The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

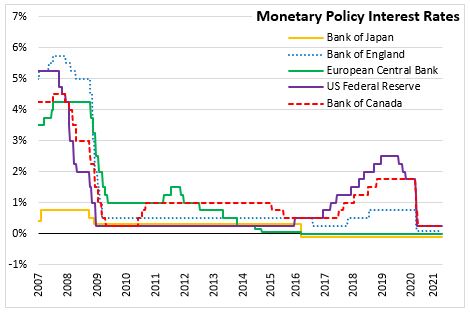

June 24, 2021BANK OF ENGLAND MONETARY POLICY The Bank of England announced that it would maintain Bank Rate at 0.1% at its Monetary Policy Committee (MPC) meeting.

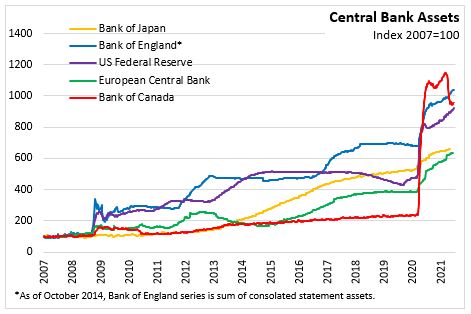

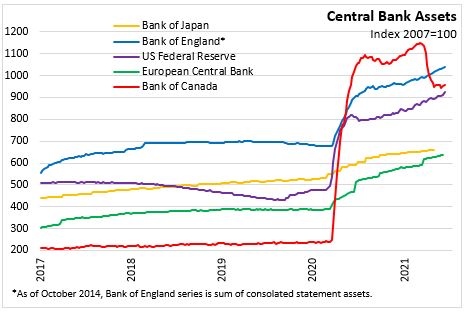

Also unchanged, the MPC decided to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion and the target for the stock of government bond purchases at £875 billion. The total target stock of asset purchases will be maintained at £895 billion.

Developments since May have been stronger than anticipated growth in global GDP, particularly among advanced economies. The recovery in activity has been better than expected in consumer-facing services after restriction were loosened. The Bank of England noted that the housing market remains strong and consumer confidence has increased. With the demand recovery, the labour market has seen reduced furloughed jobs, vacancies rising above pre-COVID levels, and hiring challenges in some location and sectors.

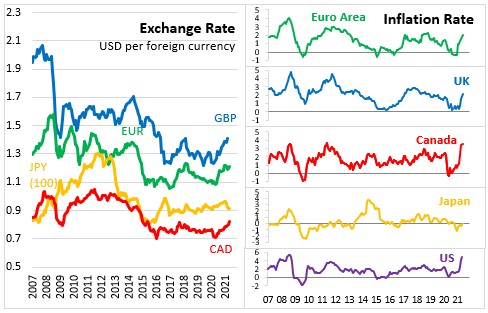

Global prices pressures have picked up and been reflected in consumer prices in advanced economies due to strong demand for goods, rising commodity prices, supply-side constraints, and transportation bottlenecks. Inflation expectations from financial market measures suggest current spike will be transitory. UK CPI inflation increased form 1.5% in April to 2.1%. core inflation rose to 2.0%. Input cost pressures have increasingly been based into output prices and import prices. The Bank of England expects CPI inflation to pick up further and temporarily exceed 3% with recent development in energy and commodity prices; however, "...the direct impact of rises in commodity prices on CPI inflation will be transitory."

The Committee notes that it will continue to monitor the situation carefully and stands ready to take whatever additional action is ready to achieve its target. The Committee does not intend to tighten monetary policy until their is clear evidence that significant progress is being made in eliminating spare capacity and achieving 2% inflation target sustainably. The Committee focus will be on medium-term prospects for inflation, balancing demand and supply and medium-term expectations rather than factors than are likely to be temporary. The next scheduled date for MPC announcement on bank rate is August. The Bank’s May Monetary Policy Report will be published at the same time.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive