The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

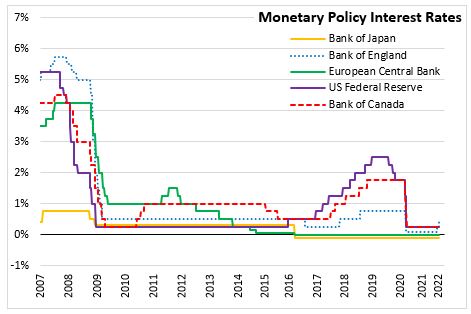

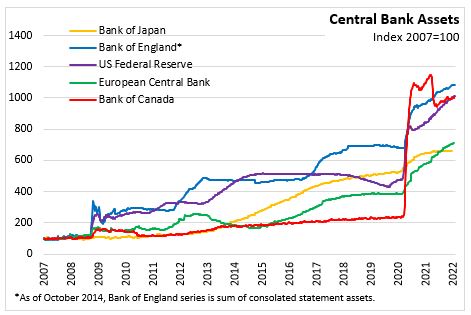

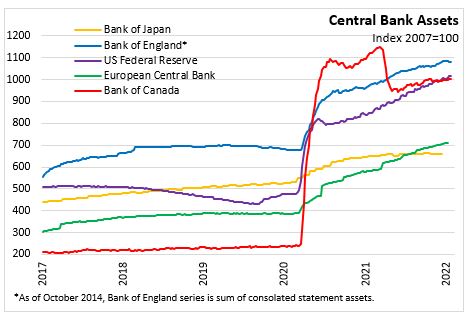

February 03, 2022BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary Policy Committee (MPC) voted by 5-4 to increase the Bank Rate by 0.25 percentage points to 0.50%. The minority in the vote preferred to increase the Bank Rate to 0.75%. The MPC will reduce the stock of UK government bond purchases, financed by issuing central bank reserves, by no longer reinvesting maturing assets. Additionally, the stock of investment-grade corporate bond purchases, financed by the issuance of central bank reserves, will be reduce by ending reinvestment of maturing assets and corporate bond sales made through 2023. Update projection have been made based on the market-implied path for Bank Rate that increases to 1.5% by middle of 2023.

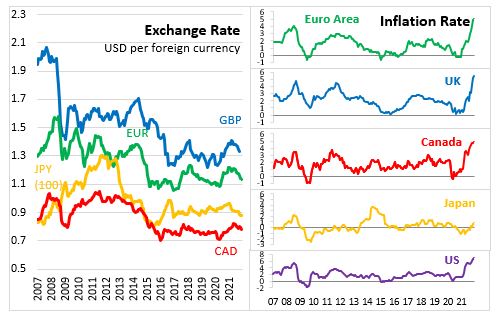

The MPC views that the Omicron variant depressed activity in December and January, but the impacts are limited. UK GDP is expected to return to growing and output will return to being above pre-pandemic levels. The unemployment rate is expected to decline further in Q1 2022 to 3.8%. The UK is expected to grow at subdued rates due to the adverse impact of higher global energy and goods prices on real income and spending. Labour income growth is expected to strengthen this year, consistent with tight labour market and temporary upward pressure on wage settlements from price inflation. Unemployment rate is expected to rise to around 5% as excess supply builds to around 1% by end of the forecast. Real GDP is expected to grow 3.75% in 2022, 1.75% in 2023, and 1% in 2024.

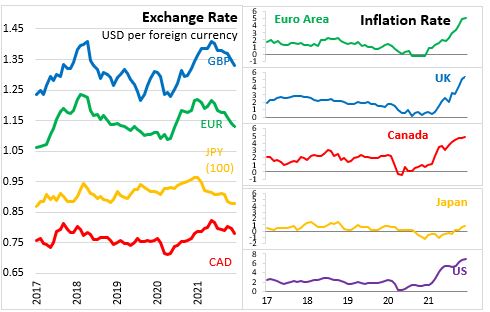

CPI inflation rose to 5.4% in December, nearly 1 percentage point higher than forecasted in November. The MPC expected inflation to rise further and peak at around 7.25% in April 2022. The overshooting of inflation relative to the 2% target is noted as being primarily due to global energy and good prices. Upward pressure on CPI inflation is expected to dissipate over time due to projections assuming global energy prices will be constant after six months, bottlenecks ease and tradeable goods prices fall back a little. Wage growth is expected to ease in 2023 as labour market loosens and price inflation declines. Based on the market-implied path for the Bank Rate and future energy price assumptions, CPI inflation is projected to decline towards the 2% target in two years and be below target in three years. Inflation is projected to be 5.75% in 2022, 2.5% in 2023, and 1.75% in 2024.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive