The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

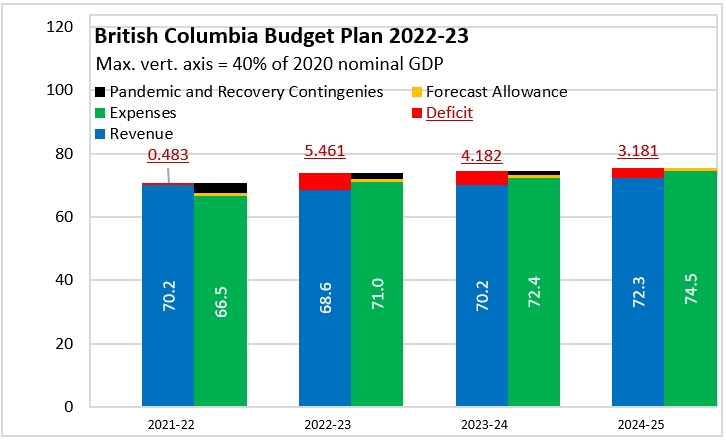

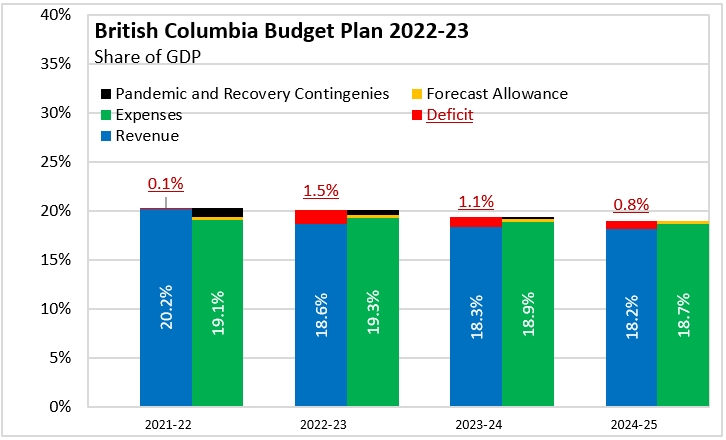

February 23, 2022BRITISH COLUMBIA BUDGET 2022-23 British Columbia has tabled its 2022-23 Budget, with a deficit estimated at $5.461 billion (1.5% of GDP), up from $0.483 billion (0.1% of GDP) estimated for the 2021-22 fiscal year. For 2022-23, the British Columbia government steps back from the $3.25 billion in pandemic and recovery contingencies assumed for 2021-22 to just $2 billion for pandemic and recovery contingency and $1 billion for forecast allowance. British Columbia's projected deficit narrows to $4.182 billion (1.1% of GDP) in 2023-24 and to $3.181 billion (0.8% of GDP) in 2024-25.

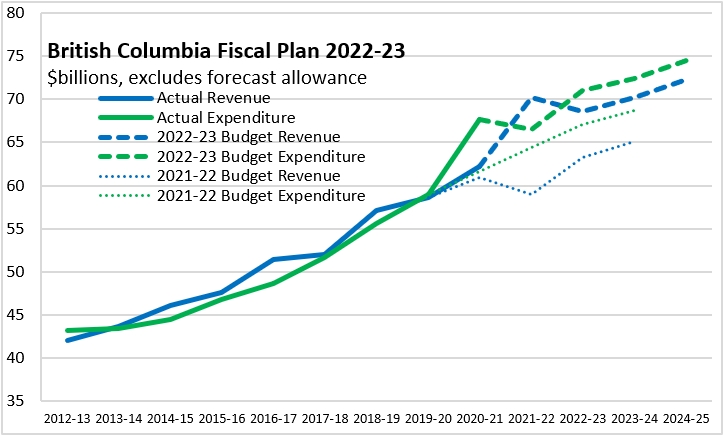

The fiscal impacts of COVID-19 estimated in the 2021-22 Budget Plan did not materialize as anticipated. Revenues actually increased in 2021-22 rather than declining while expenses (not including the forecast and pandemic contingencies) grew more rapidly than previously projected.

Although British Columbia anticipated a deficit of almost $10 billion in 2021-22, the latest deficit estimated is less than $0.5 billion (and this still includes pandemic and forecast contingencies). For 2022-23 and beyond, the path of deficits is similar to what was projected in the 2021-22 Budget plan.

The size of the British Columbia government in the provincial economy is projected to peak at 20.3% of GDP in 2021-22. This is projected to remain steady in 2022-23 before falling to 19.4% of GDP in 2023-24 and 19.0% of GDP in 2024-25.

British Columbia's 'taxpayer-supported' debt was 14.9% of GDP at the end of 2019-20. In 2020-21, this increased to 19.3% of GDP. For 2021-22, taxpayer-supported debt is projected to fall to 17.8% of GDP. For 2022-23, taxpayer supported debt is projected to rise again to 20.0% of British Columbia's GDP. It is projected to continue rising in the next two years, reaching 22.8% of GDP by 2024-25.

For 2022-23, British Columbia plans to collect $12,895 in revenues per capita, supporting expenditures of $13,358. The deficit is projected to amount to just over $1,000 per capita.

Although there has been weaker than expected growth among trading partners, the British Columbia economy is projected to expand rapidly, overcoming the declines during the initial waves of the pandemic. The nominal value British Columbia's GDP grew by an estimated 12.4% in 2021 (5.0% in real terms). In the next two calendar years, British Columbia's economy is expected to grow at a more moderate pace 5.8% nominal in 2022 (4.0% real) and 4.1% nominal in 2023 (2.5% real). British Columbia's return to previous trends depends on ongoing efforts to clean up after unprecedented floods as well as strong labour market that underpins residential investment and retail sales. British Columbia's consumer price index inflation is projected to be 2.9% in 2022, followed by 2.2% in 2023.

Key Measures and Initiatives

- housing more than 3,000 people through new rent supplements and supports as well as supporting 3,000 people who were temporarily housed in leased/purchased hotel accommodations during COVID-19 through a transition to permanent housing.

- removing Provincial Sales Tax on zero emission vehicles and providing rebates for charging infrastructure

- grants for community-built bike lanes

- motor fuel tax exemption for hydrogen in combustion engines

- Provincial Sales Tax exemption for heat pumps and increase tax on fossil fuel heating equipment

- Clean buildings tax credit for residential and commercial buildings

British Columbia Budget 2022-23

<--- Return to Archive