The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 25, 2022SURVEY ON BUSINESS CONDITIONS: Q1 2022 Statistics Canada has conducted an eighth iteration of the Canadian Survey on Business Conditions. In January and early February, Statistics Canada surveyed businesses to collect information on businesses' expectations, obstacles, financing and practices as the economy continues to move beyond COVID-19.

The results reported here are a selection of the impacts found for Nova Scotia businesses, by industry, by size of business (measured by number of employees), by age of business and by urban or rural location. There are comparisons of the Nova Scotia average (all industries, ages, sizes, locations) with the national and provincial averages. The horizontal axis in all charts measures the share of businesses reporting each outcome. The total for many outcomes does not add to 100% of respondent businesses as many replied that the outcome was not applicable in their circumstances.

Business expectations

Looking forward over the next 12 months, 73.2% of Nova Scotia business respondents felt very or somewhat optimistic about business conditions while 14.1% were not optimistic. Across Canada, optimism was strongest in Prince Edward Island and Quebec. Optimism was lowest in Alberta and Ontario.

Nova Scotia business optimism was stronger in finance/insurance, real estate/rentals and health care/social assistance (including daycare). Pessimism among Nova Scotia businesses was more prevalent in accommodation/food service, arts/recreation and professional/technical services industries.

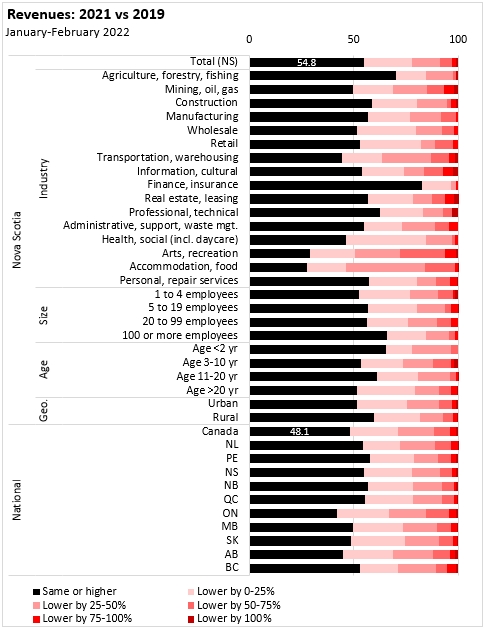

Sales comparison: 2021 vs 2019

Among Nova Scotia's busineses, 54.8% reported revenues in 2021 that were the same as or higher than in 2019 (before the pandemic). Nationally, 48.1% of businesses reported same or higher revenues. Businesses in Nova Scotia's arts/recreation and accommodation/food industries reported the largest share with revenue declines from 2019 to 2021.

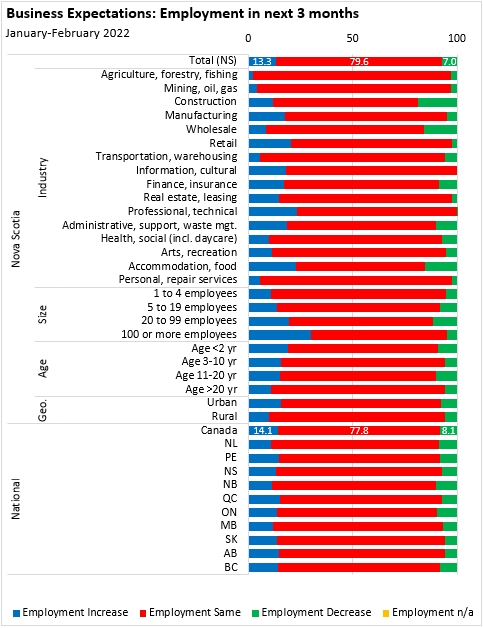

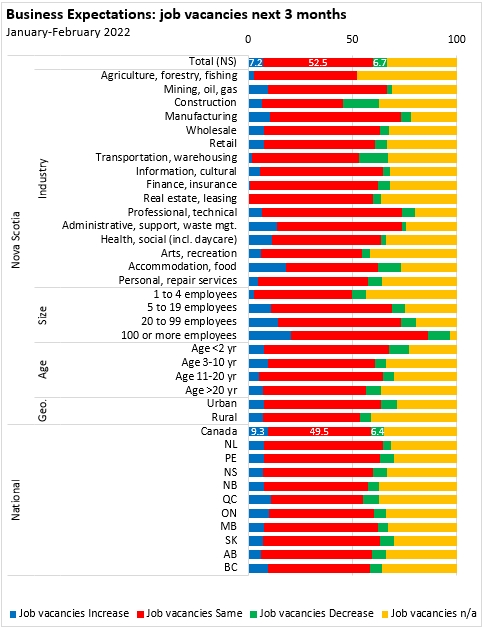

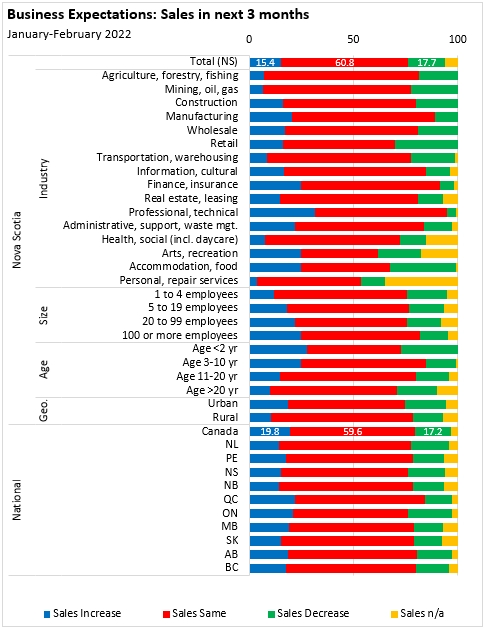

Business expectations for the next three months

The outlook for employment was stable for 79.6% of Nova Scotia businesses in the next three months. Rising employment is expected among 13.3% of Nova Scotia businesses while declining employment is expected by 7.0% of Nova Scotia businesses.

52.5% of Nova Scotia businesses expect stable job vacancies (49.5% nationally) while 7.2% expect rising job vacancies and 6.7% expect falling vacancies. Across Canada, 9.3% of businesses expect rising job vacancies and 6.4% expect falling vacancies.

76.2% of Nova Scotia businesses expect stable or rising sales while 17.7% expect a decline.

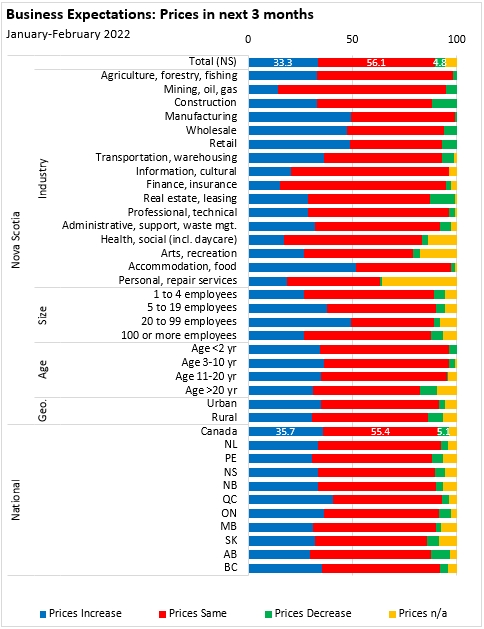

Rising prices were expected by one third of Nova Scotia businesses while 56.1% expected stable prices. Only 4.8% expected price declines.

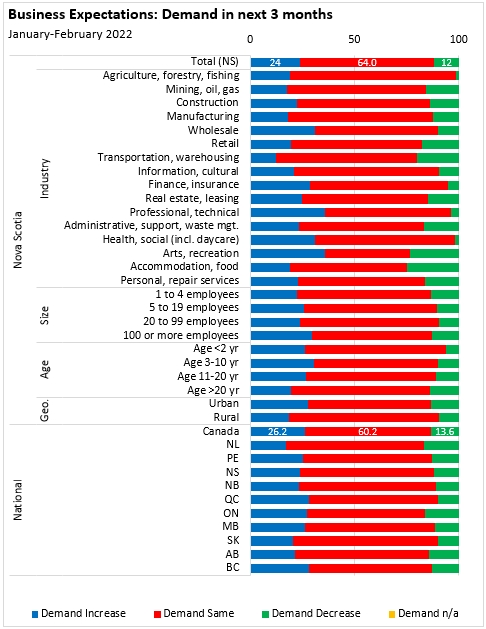

Almost two thirds (64%) of Nova Scotia businesses expected stable demand while 24% expected a rise in demand and 12% expected a fall in demand.

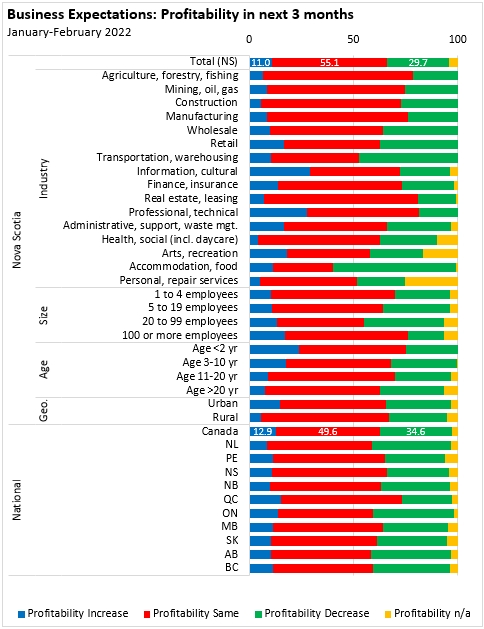

Business profitability is expected to remain the same for 55.1% of Nova Scotia businesses in the next three months while 11.0% expect rising profitability and 29.7% expect decreasing profitability. Rising profitability is expected more in Nova Scotia's professional/technical services and information/culture businesses. Decreasing profitability expectations were more prevalent in Nova Scotia's accommodation/food and transportation businesses.

Obstacles for businesses

As part of the Survey of Business Conditions, businesses were asked about their obstacles. 20.9% of Nova Scotia businesses reported no substantial obstacles expected in the next three months. Businesses in Nova Scotia's finance/insurance industry were more likely to report no substantial obstacles. Across Canada, 16.3% of businesses reported no obstacles with higher shares in Atlantic Canada and Manitoba.

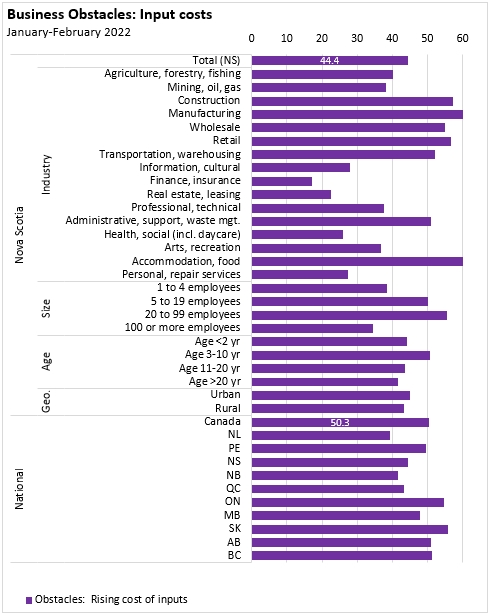

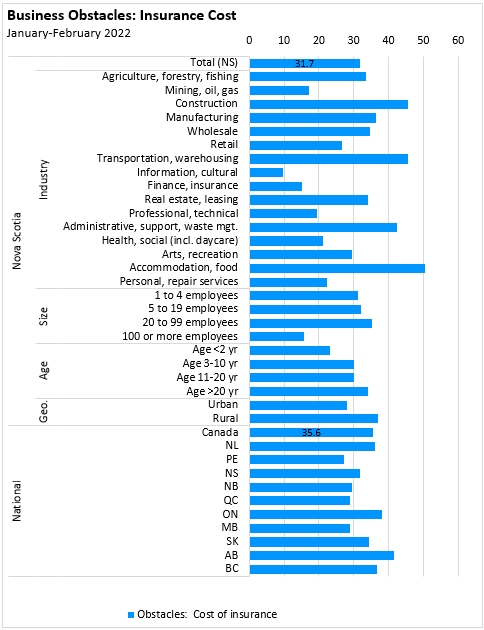

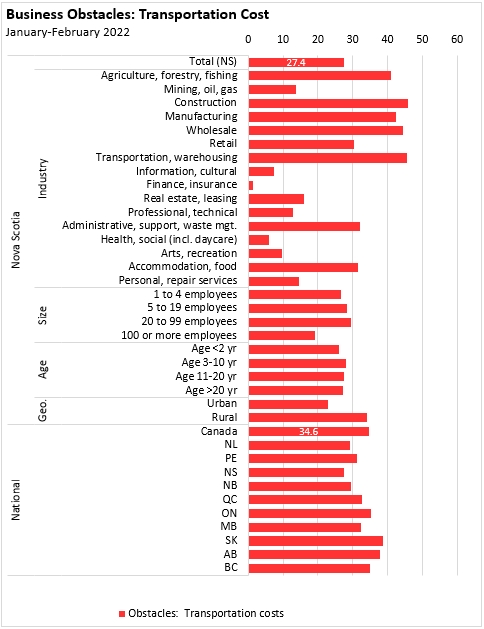

Cost factors were among the most commonly cited obstacles by Nova Scotia businesses, including rising input costs (44.4%), insurance costs (31.7%) and transportation costs (27.4%).

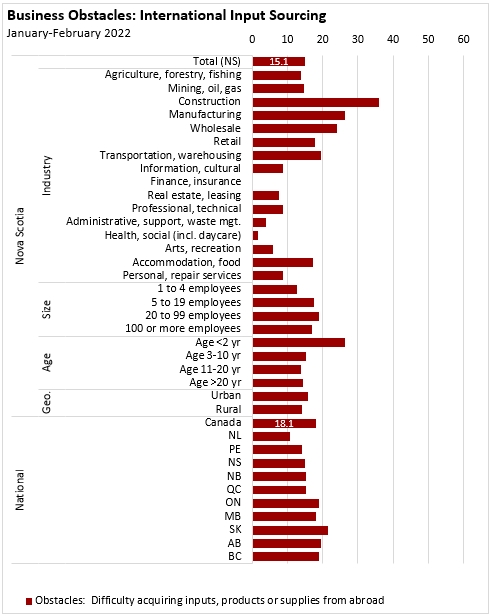

Domestic input sourcing was noted as a challenge for 30.8% of Nova Scotia businesses while international input sourcing was an obstacle for 15.1%. Maintaining inventory levels was an obstacle for 17.3% of Nova Scotia businesses (notably retail).

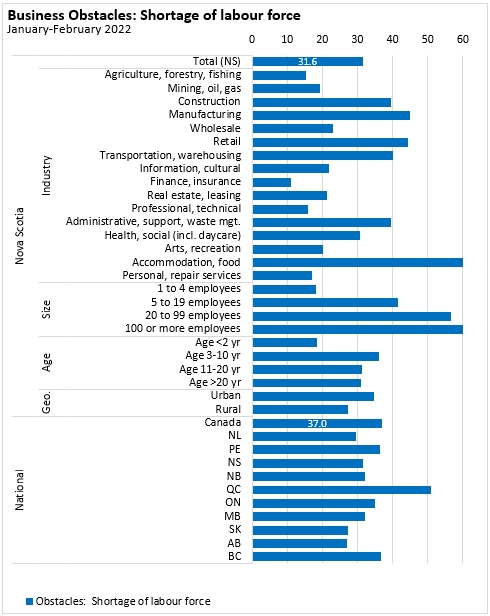

Labour shortages were noted as obstacles for 31.6% of Nova Scotia businesses. Recruiting skilled employees (32.9%) was a more commonly-noted obstacle than retaining skilled employees (25.4%).

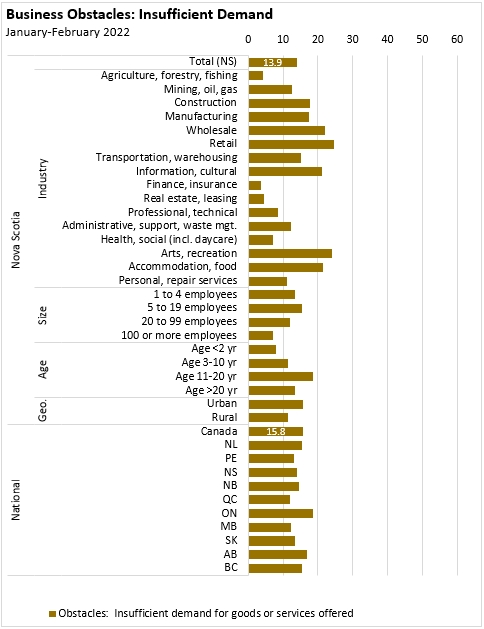

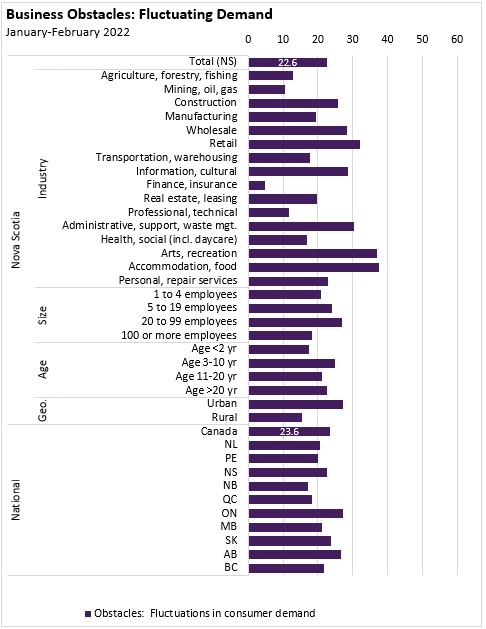

Insufficient demand (13.9%) and increasing competition (13.5%) were less commonly cited as obstacles for Nova Scotia businesses than fluctuating demand (22.6%).

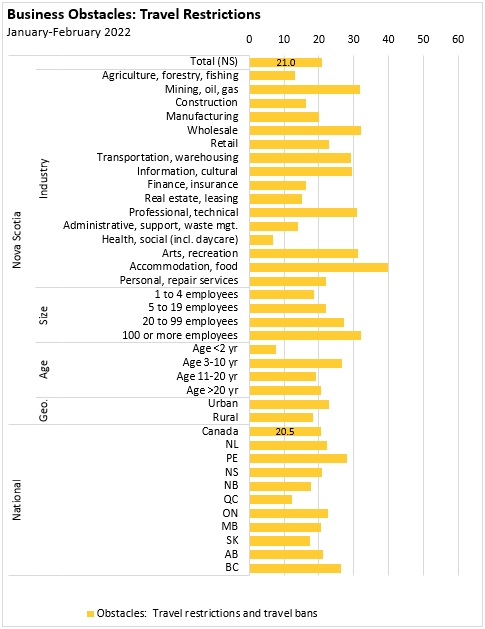

Travel restrictions remain a notable business obstacle - cited by 21.0% of Nova Scotia respondents.

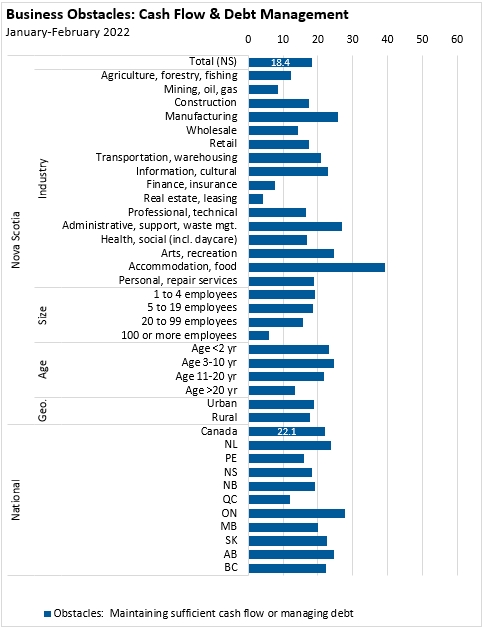

Managing cash flow and debt management (18.4%) were more substantial obstacles for Nova Scotia businesses compared with financing (8.1%).

Supply chain challenges

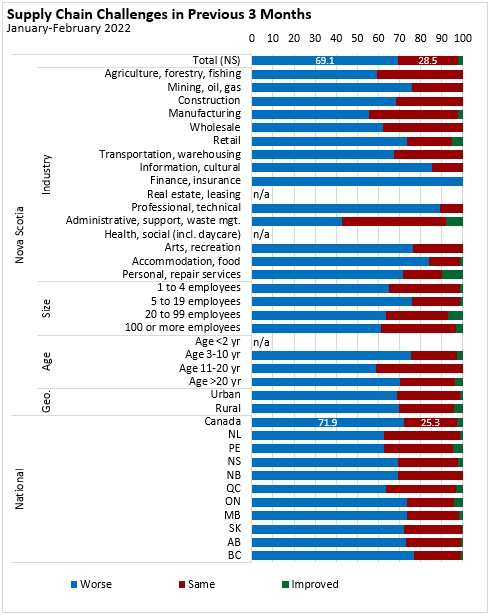

In the last 3 months, 69.1% of Nova Scotia businesses reported worsening supply chain conditions.

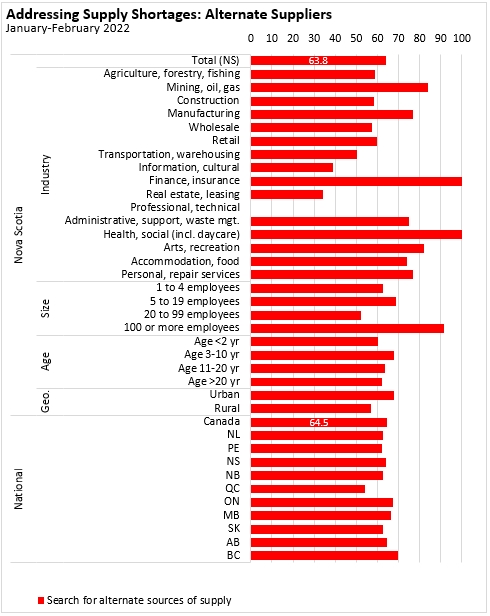

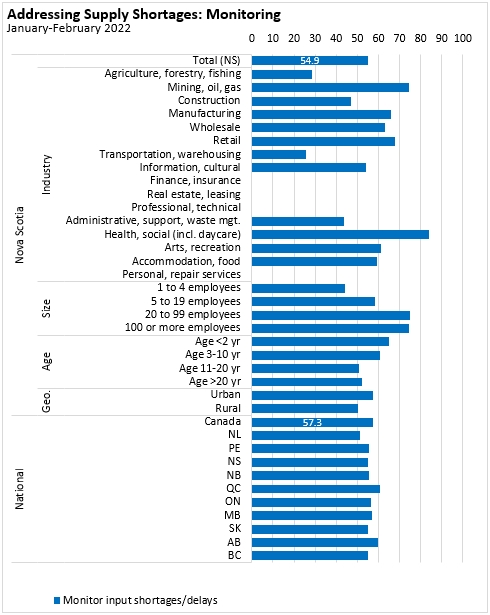

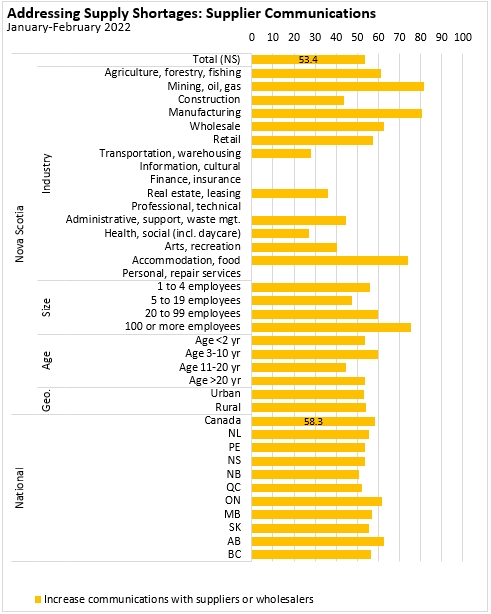

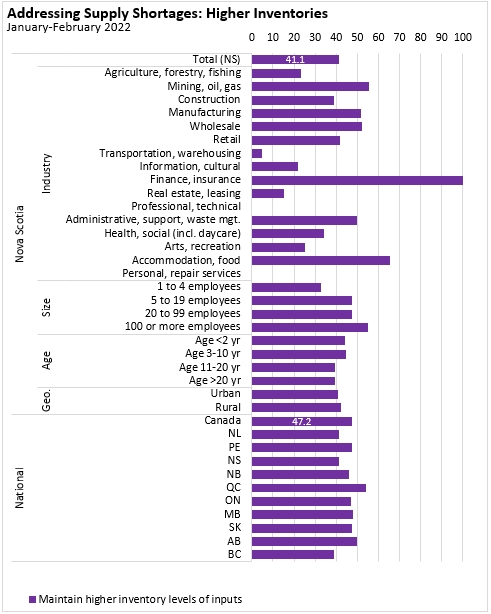

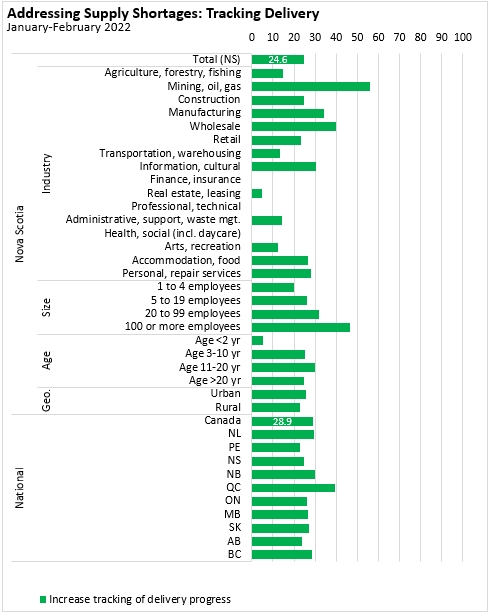

Among the more commonly-noted approaches to managing supply shortages were: seeking alternate suppliers (63.8% of Nova Scotia businesses), monitoring (54.9%), communicating with suppliers (53.4%), maintaining higher inventories (41.1%) and increasing tracking of deliveries (24.6%).

Plans to address labour recruitment and retention obstacles

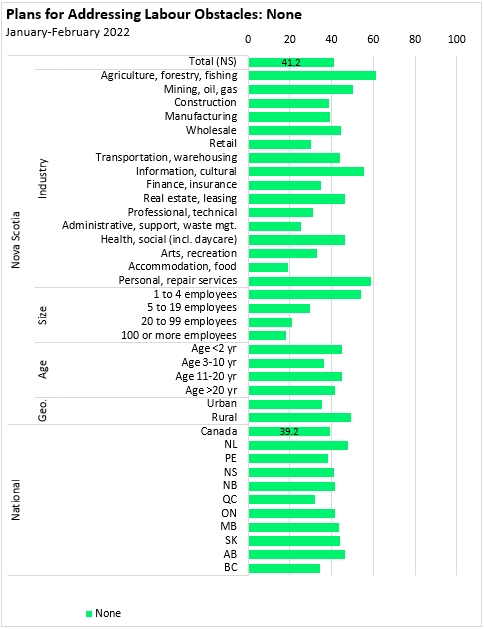

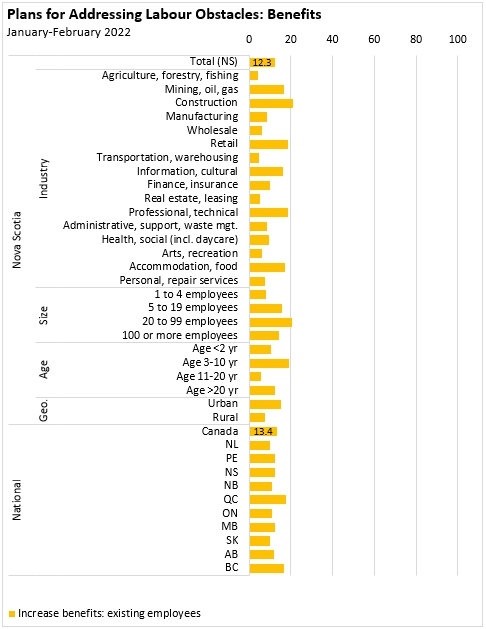

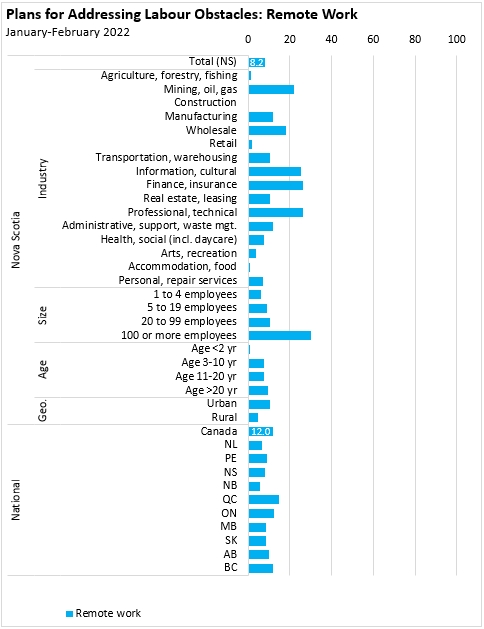

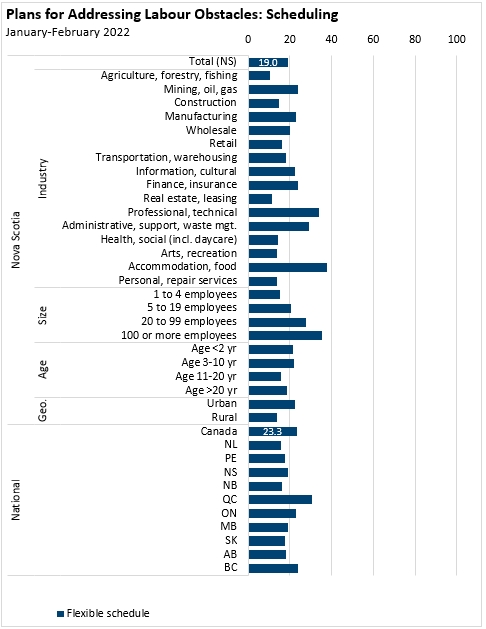

Apart from rising input costs, labour shortages, recruitment and retention were the some of the most widely-reported business obstacles expected in the next three months. Statistics Canada asked for specific plans to address labour-related obstacles. However, 41.2% of responding businesses had no plans to address labour-related obstacles.

Increasing wages (for both new and existing employees) were the most commonly cited approaches to addressing labour issues.

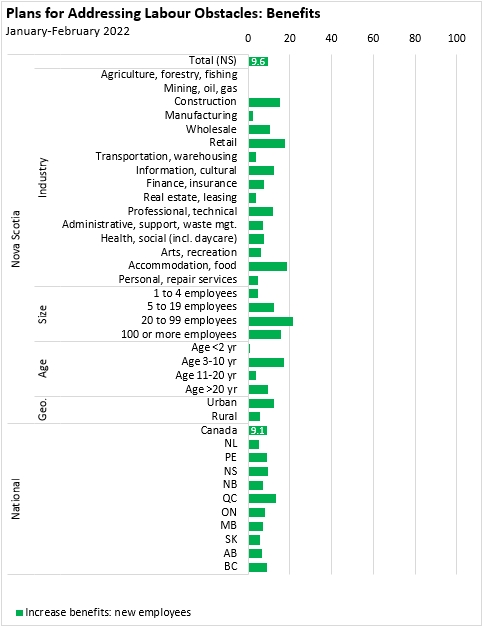

Increasing benefits and work flexibility (including remote work) were less commonly-cited approaches to addressing labour obstacles.

On-site and remote work

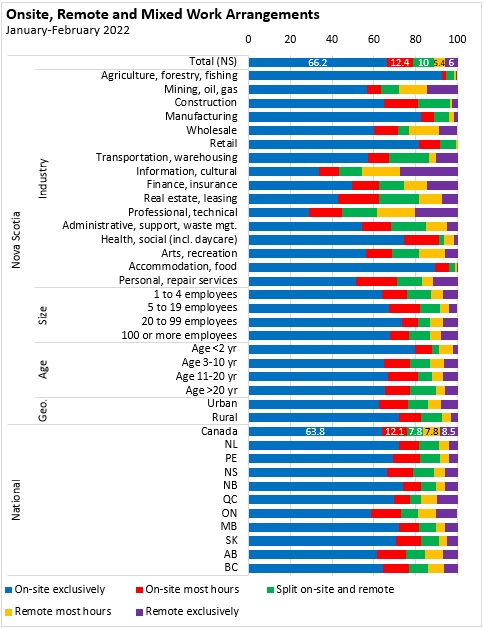

Greater use of remote and work-from-home labour may also play a role in addressing labour obstacles.

Nova Scotia businesses report that 78.6% of workers will be exclusively or mostly on-site while 11.4% will carry out mostly or exclusively remote work and 10% of workers will be split between on-site and remote work.

Rising costs and prices

On average, businesses in Nova Scotia that expect wage growth anticipate an average increase of 7.7%. Wage growth expectations were notably higher in real estate, rentals and leasing as well as in health care and social assistance (which includes daycares).

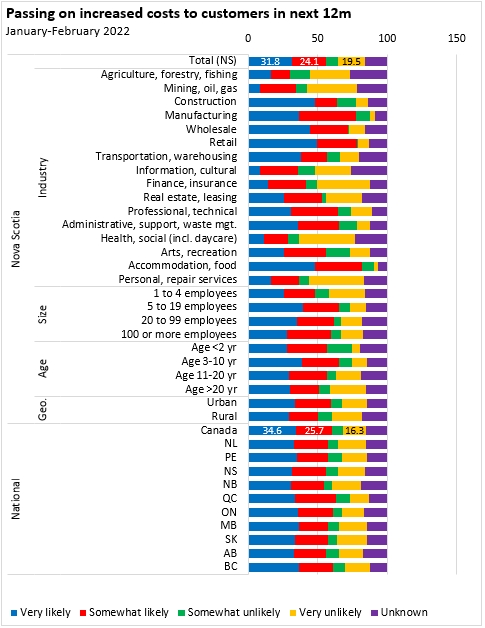

Because of rising wage, input and other costs, many businesses expect to increase output prices. Over next 12 months, 55.9% of Nova Scotia businesses reported that they were somewhat or very likely to pass on higher costs to customers.

Plans for sale/closure, expansion, restructuring

76.6% of Nova Scotia businesses have no plans to sell, transfer or close their business in the next 12 months while 6.4% plan to sell, transfer or close the business (17.0% have unknown plans about sale/transfer/closure).

65.1% of Nova Scotia businesses have no plans to expand, restructure or change the business through merger with, acquisition of or investment in another business.

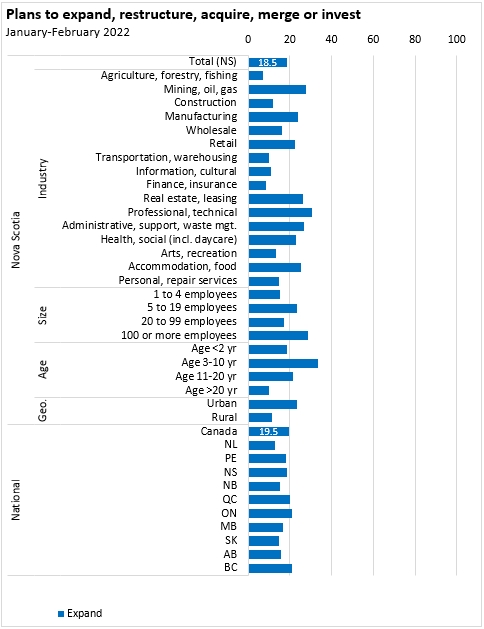

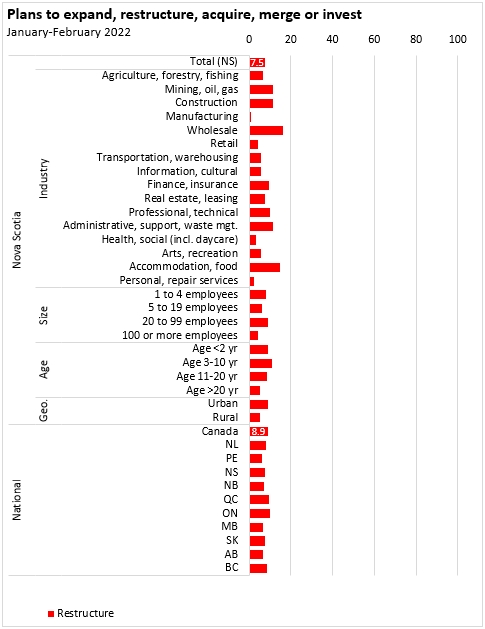

18.5% of Nova Scotia businesses have plans for expansion while 7.5% plan to restructure and 6.0% plan to merge with, invest in or acquire another business.

Cash for operations and availability of credit

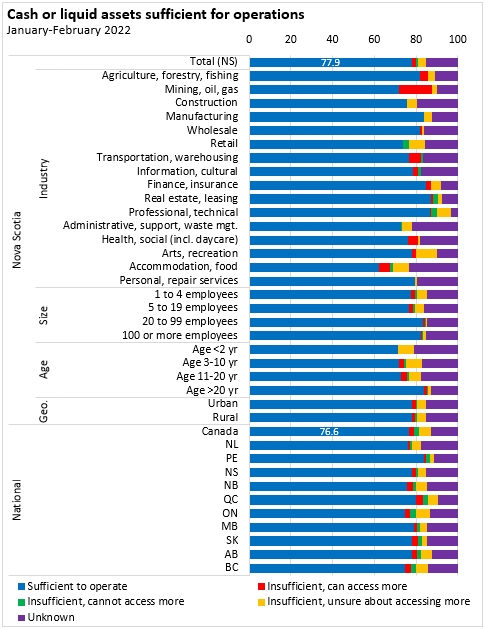

77.9% of Nova Scotia businesses report having sufficient cash or liquid assets for operations.

53.5% of Nova Scotia businesses report being able to take on more debt while 25.4% report being unable to take on more debt.

Source: Statistics Canada. Table 33-10-0468-01 Business or organization expectations over the next three months, first quarter of 2022; Table 33-10-0469-01 Business or organization obstacles over the next three months, first quarter of 2022; Table 33-10-0471-01 Business or organization change in supply chain challenges over the last three months, first quarter of 2022; Table 33-10-0474-01 Strategies business or organization uses to address supply chain challenges, first quarter of 2022; Table 33-10-0476-01 Plans to expand or restructure business or organization or acquire other businesses or organizations over the next 12 months, first quarter of 2022; Table 33-10-0477-01 Plans to transfer, sell, or close business over the next 12 months, first quarter of 2022; Table 33-10-0478-01 Likelihood of business or organization to pass on any increases in its costs to customers over the next 12 months, first quarter of 2022; Table 33-10-0480-01 Average change in average wages expected over the next 12 months, first quarter of 2022; Table 33-10-0481-01 Plans regarding recruitment, retention and training over the next 12 months, first quarter of 2022; Table 33-10-0482-01 Liquidity and access to liquidity over the next three months, first quarter of 2022; Table 33-10-0483-01 Ability for the business or organization to take on more debt, first quarter of 2022; Table 33-10-0485-01 Average percentage of workforce anticipated to work on-site or remotely over the next three months, first quarter of 2022; Table 33-10-0488-01 Future outlook for the business or organization over the next 12 months, first quarter of 2022; Table 33-10-0489-01 Revenues from 2021 compared with 2019

<--- Return to Archive