The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

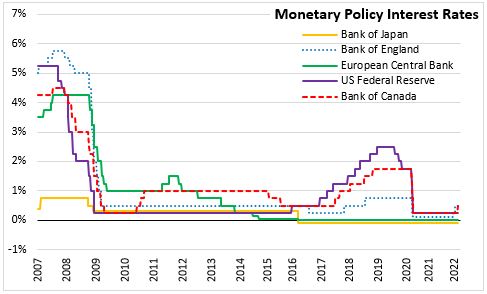

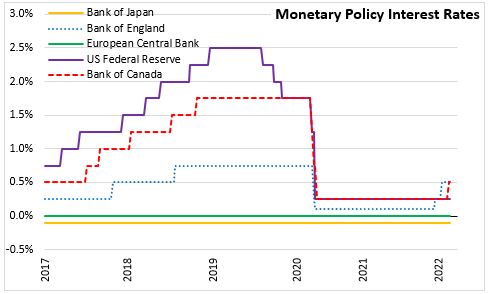

March 10, 2022EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced that key interest rates would remain unchanged at their current levels. The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively.

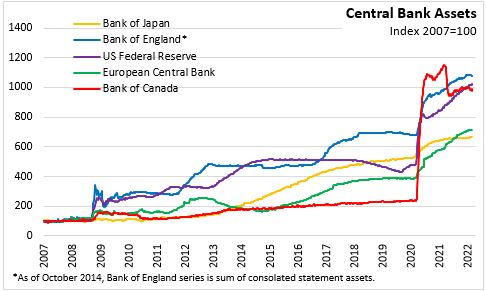

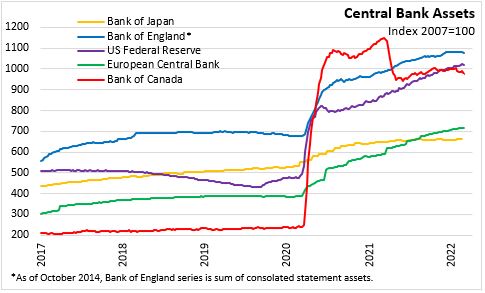

The Russian invasion of Ukraine has created a more uncertain environment. The ECB will ensure smooth liquidity conditions and implement the sanctions decided by the EU and European governments. Taking this into account, the Governing Council revised the purchase schedule for its Asset purchase programme (AAP) to wind down faster. Monthly net purchases will amount to €40 billion in April, €30 billion in May and €20 billion in June. Net purchases for the third quarter will be data-dependent and reflect the changing assessment of the outlook. The Governing Council also intends to continue reinvesting principal payments from maturing securities purchased under the APP for as long as necessary to maintain favourable liquidity conditions. The Governing Council will discontinue net asset purchases under the Pandemic emergency purchase programme (PEPP) at the end of the month, and principal payments will be reinvested until at least the end of 2024.

Given the highly uncertain environment caused by the Russian invasion of Ukraine and the risk to euro area financial markets, the Eurosystem repo facility for central banks has been extended until January 15 2023. This will assist with the smooth transition of the ECB’s monetary policy to address possible liquidity needs in the event of market dysfunctions outside the euro area.

Economic growth slowed in final quarter of 2021 and is expected to remain weak in the first quarter of 2022. Economic growth will be slower than previously expected given Russian-Ukraine war. Higher energy and commodity prices, the disruption of international commerce and weaker confidence will slow economic activity. Supply chain bottlenecks have been showing signs of easing and labour markets have showed further improvement. Measures to contain the Omicron variant are now being lifted. GDP growth has been revised downward despite solid underlying economic conditions and policy support. Projections are for 3.7% growth in 2022, slowing to 2.8% in 2023 and 1.6% in 2024.

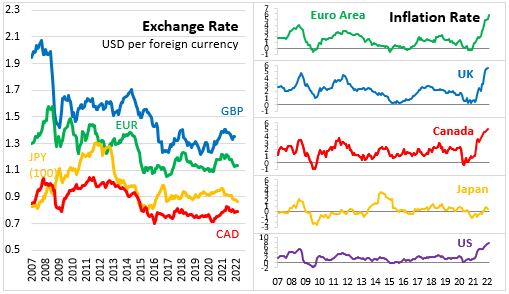

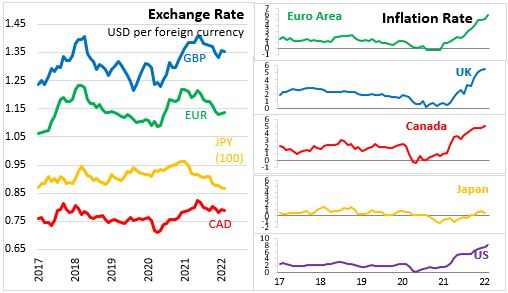

Inflation increased to 5.8% in February 2022 and further increases are expected in the near term. Energy prices remain the main reason for high inflation and have risen further in recent weeks given the impact of the war in Ukraine. However, price increases have become more broad based and projections have been revised upward significantly. Baseline staff projections show annual inflation reaching 5.1% in 2022, slowing to 2.1% in 2023 and 1.9% in 2024. Longer-term expectations have re-anchored at the inflation target and the Governing Council expects that inflation will stabilize at its 2% target over the medium term.

Source: European Central Bank: Monetary Policy Decision, Remarks, Eurosystem staff macroeconomic projection

<--- Return to Archive