The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

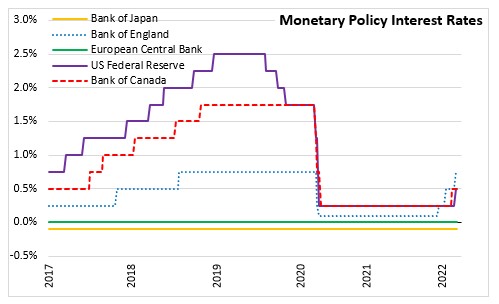

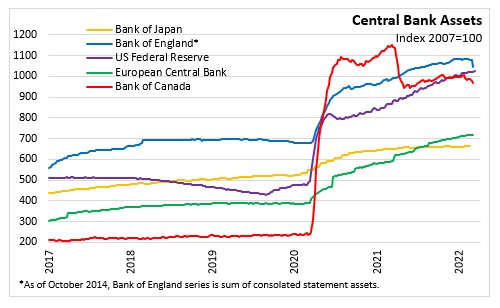

March 18, 2022BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan decided to maintain a negative interest rate of 0.1% for the Policy-Rate Balances in current accounts held by financial institutions at the Bank. The Bank of Japan will also purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit in order to keep the 10-year JGB yields at around zero per cent.

In addition, the Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces with upper limits of about 12 trillion yen and about 180 billion yen, respectively. The Bank will continue purchases of Commercial paper and corporate bonds with an upper limit on the amount outstanding of about 20 trillion yen in total until the end of March 2022.

The Bank will continue with "Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control," aiming to achieve the price stability target of 2 per cent, as long as it is necessary for maintaining that target in a stable manner. The Bank also noted that it will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 per cent and stays above the target in a stable manner.

Japan's economic activity continued to increase despite some continued weakneed due to COVID-19. Exports and industrial production continue to increase as a trend. Corporate profits and business sentiment also continued to improve. The employment and income situation has remained relatively week despite improvements in some sectors. Housing investment has been flat.

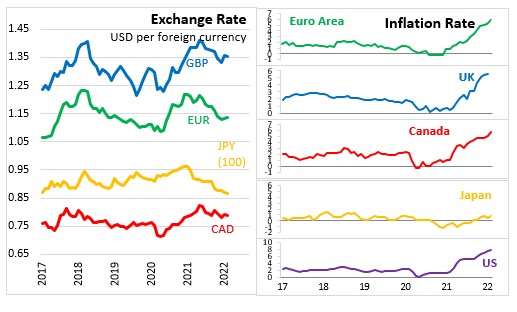

Russia's invasion of Ukraine has created volatiliry in global financial and capital markets, and pushed up energy and commodity prices. How future developments surrounding the situation in Ukraine will affect Japan's economic activity and prices are highly uncertain.

The year-on-year rate in the consumer price index (CPI, all items) was 0.9% in February 2022. Despite the reduction in mobile phone charges, the year-over-year rate of change in the CPI has been slightly positive, reflecting the increase in energy prices. Inflation expectations have also increased moderately. The CPI is expected to increase and be in positive territory over the short-term due to a rise in energy prices, the moderate pass-through of raw material cost increases on the back of improvement in the output gap, and dissipation of the effects of last year's reduction in mobile phone charges. As economic activity continues to improve, the annual change in the CPI is expected to increase gradually as a trend mainly due to improvements in the output gap and a rise in medium- to long-term inflation expectations.

The Bank of Japan noted that it will continue to closely monitor the impacts of the COVID-19 and will take additional easing measures if needed. The Bank expects short- and long-term policy interest rates to remain at their present or lower levels.

Source: Bank of Japan, Statement on Monetary Policy (Mar 18, 2022)

<--- Return to Archive