The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 01, 2023ALBERTA BUDGET 2023-24 British Columbia and Alberta released their 2023-24 Budgets on February 28 - the first of Canada's Provincial Budgets.

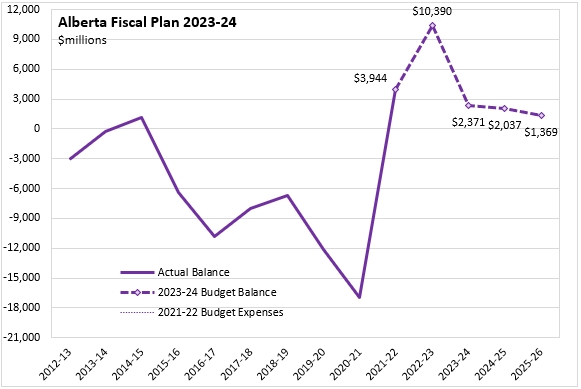

Alberta's budget delivered a $10.39 billion surplus in 2022-23. Surpluses are projected to continue at $2.37 billion in 2023-24, $2.04 billion in 2024-25 and $1.37 billion in 2025-26.

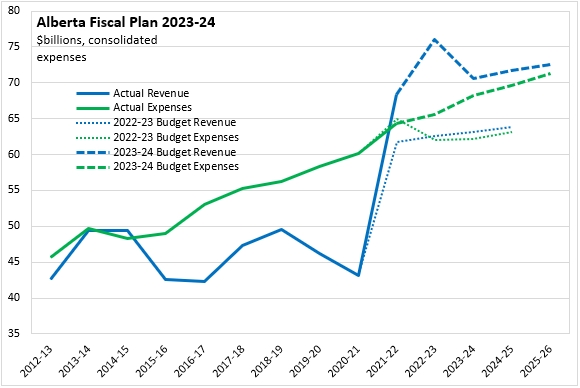

Alberta's 2022-23 fiscal plan had already anticipated a recovery in revenues. However, the $33.9 billion increase in revenues from 2020-21 to 2022-23 (+76.3%) exceeded these expectations. Revenues are expected to have peaked in 2022-23 and are projected to contract in 2023-24 (-$5.37 billion). The planned reduction and stabilization in expenditures has been altered to a plan with steady expenditure increases.

Alberta's surplus of $10.39 billion in 2022-23 is expected to be an extraordinary event as surpluses diminish in 2023-24 and subsequent fiscal years.

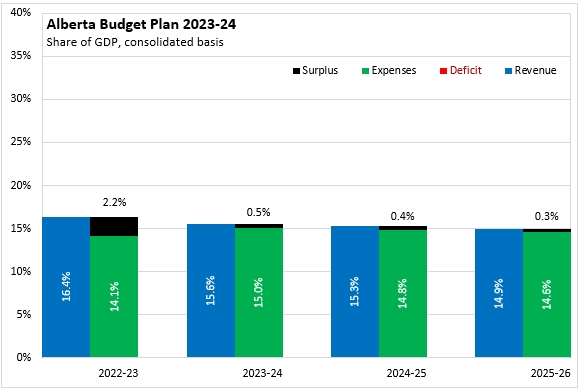

Alberta's surplus for 2022-23 amounted to 2.2% of provincial GDP. Subsequent surpluses are projected to be 0.5% of GDP or smaller.

With very high values of nominal GDP, the footprint of the Alberta provincial government in the economy is more modest than in other provinces. Alberta's government amounted to 16.4% of GDP in 2022-23. This is projected to fall to 15.6% of GDP in 2023-24 and to 14.9% of GDP by 2025-26.

Alberta's net financial debt amounted to 10.2% of GDP in 2022-23. This is projected to remain stable in 2023-24 before falling to 9.1% of GDP by 2025-26.

On a per capita basis, the Alberta budget spent a forecasted $14,447 per resident in 2022-23. This is projected to rise to $14,606 per resident in 2023-24 and to remain stable through the rest of the planning horizon. The provincial government's surplus amounted to $2,287 per capita in 2022-23. The surplus is projected to be $507 per capita in 2023-24, falling to $281 per capita by 2025-26.

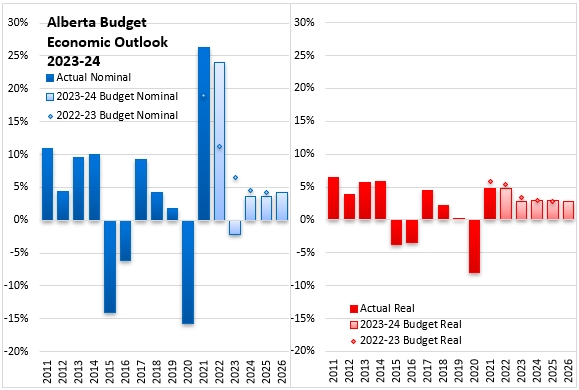

The rise in commodity prices in 2022 generated a 24.0% increase in Alberta's nominal GDP. This followed a 26.2% rise in 2021. For 2023, contracting prices are projected to reduce Alberta's nominal GDP by 2.2%, while real GDP increases by 2.8%. Alberta's Budget assumes that oil prices ($USD/bbl, WTI) fall from $90.5 for 2022-23 to $79.0 for 2023-24, to $76.0 for 2024-25 and to $73.5 for 2025-26. Alberta's economic outlook assumes that strong cash positions generated by high commodity prices in 2022 will lead to more drilling and investment activity in oil and gas during 2023 and 2024. Although higher interest rates may slow investment in the near-term, Alberta's population growth and economic diversification are expected to contribute to broad-based economic growth in the medium term.

Key Measures and Initiatives

The Alberta Budget for 2023-24 prioritizes:

- Securing Alberta's future: a new fiscal framework requiring balanced budgets, limiting growth in operating expenses, setting rules for paying maturing debt, requiring the Heritage Savings Trust Fund to retain 100% of net income

- Boosting Alberta's advantage: targeted investments in areas with critical labour market shortages, such as health care, non-trade construction, energy, technology and aviation.

- Strengthening health care: investments to strengthen Emergency Medical Services and reduce surgical and emergency room wait times, funding to enhance recruiting and retaining health workers (particularly in rural/remote areas), additional physician training seats, recruitment of internationally educated nurses

- Supporting Albertans: capping tuition growth at 2%, reducing interest on student loans, supporting student loan repayment

- Keeping communities safe: funding for community policing, correctional services, custody operations, victims' services and sheriffs

- Fiscal management: bringing per capita spending in line with averages in Ontario, Quebec and British Columbia

Alberta Budget 2023-24

<--- Return to Archive