The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

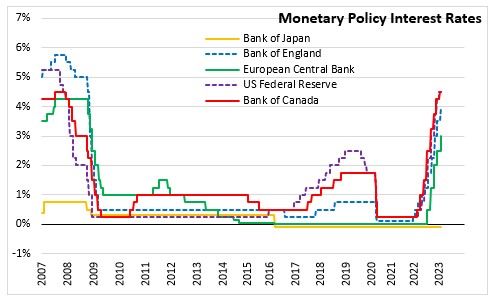

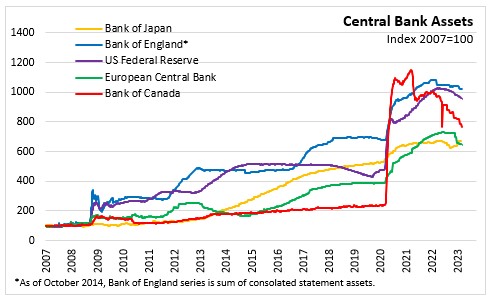

March 08, 2023BANK OF CANADA MONETARY POLICY The Bank of Canada kept its target for the overnight rate unchanged at 4.50%, with the Bank rate at 4.75% and the deposit rate at 4.50%. The Bank is continuing its policy of quantitative tightening.

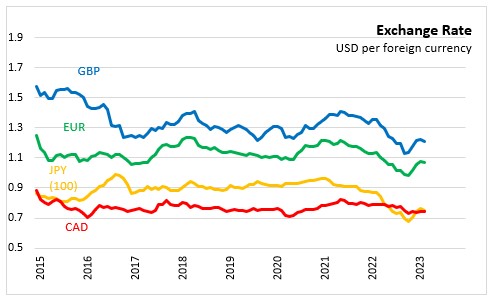

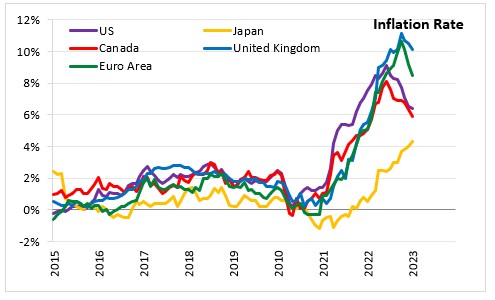

Global growth continues to slow down. Inflation is also slowing due to lower energy prices, but still remains elevated. With tight labour markets and high core inflation, near-term outlooks for economic growth are a bit higher than expected in the January Monetary Policy Report (MPR), especially for the United States and Europe.

In Canada, real GDP was flat in the last quarter of 2022, lower than the Bank's January MPR projections. This was mostly a result of slowdown in inventory investment while consumption, government spending and net exports all increased. Monetary tightening continues to weigh on household spending with business investment also weakened.

Inflation slowed down to 5.9% in January 2023 reflecting lower price increases for energy, durable goods and some services. Price increases for food and shelter remain high. The Bank noted that pressure in product labour markets are expected to ease.

Against the backdrop of recent economic developments, the Governing Council decided to maintain the policy rate at its current level with quantitative tightening complementing this restrictive stance. Governing Council will continue to assess economic developments and the impact of past interest rate increases, and is prepared to increase the policy rate further if needed to return inflation to the 2% target.

The next scheduled date for announcing the overnight rate target is April 12, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection at the same meeting.

Bank of Canada: Rate Announcement

<--- Return to Archive