The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 29, 2023FEDERAL BUDGET 2023-24 Canada's Federal government released its 2023-24 Budget on March 28.

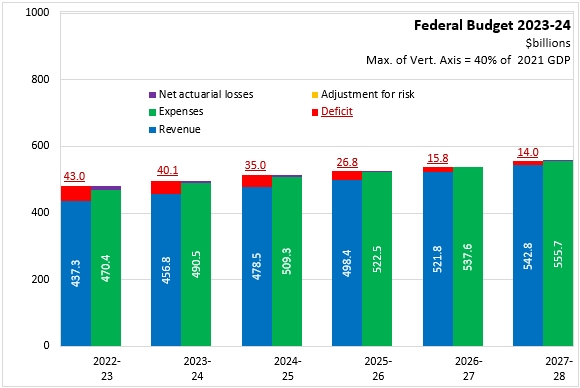

The 2023-24 Federal Budget deficit is estimated at $40.1 billion, which is down from the forecasted deficit of $43.1 billion in 2022-23. In 2023-24, Canada's Federal revenue growth of 4.5% is expected to outpace expenditure increases of 4.3%.

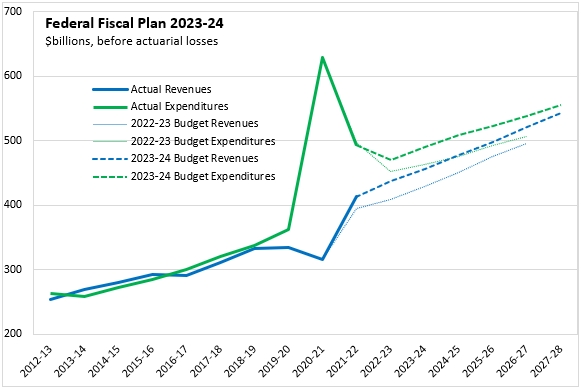

Both revenues and expenditures have been revised up since the 2022-23 Budget plan, but growth rates are similar to previous projections.

Compared to the 2022-23 Federal fiscal plan, Canada's revised fiscal plan anticipates about the same deficit for 2023-24, but slightly higher deficits in the outer years. The Federal deficit remains through to the end of the forecast horizon, though it shrinks to $14.0 billion by 2027-28.

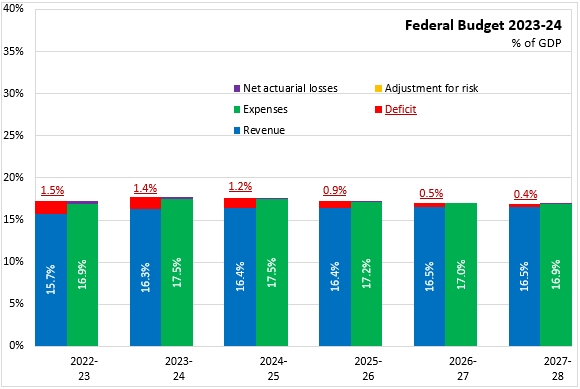

Canada's Federal deficit for 2023-24 amounts to 1.4% of GDP. By 2027-28, the shrinking deficit amounts to 0.4% of GDP. Federal revenues amount to 16.3% of GDP in 2023-34 and are expected to rise slightly to 16.5% of GDP in 2026-27 and 2027-28. Expenditures are projected to contract from 17.5% of GDP in 2023-24 to 16.9% of GDP in 2027-28. Canada's Federal Budget notes a number of measures to slow non-defence and non-transfer spending in the coming years.

Canada's net debt to GDP ratio (note: this is different from the Federal debt to GDP ratio) is projected to be 47.5% in 2023-24, falling to 43.6% of GDP by 2027-28. The Federal Budget for 2023-24 shows long-range projections in which all scenarios forecast a declining debt-to-GDP ratio. The more optimistic scenarios project elimination of the Federal debt by 2055-56.

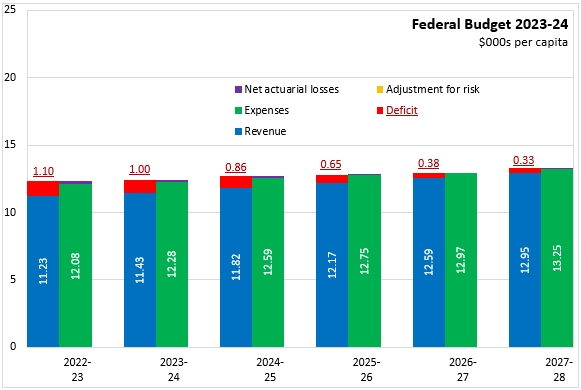

Canada's Federal expenditures are made up primarily by transfers to persons and other orders of governments. Federal expenditures are estimated to be $12,227 per capita in 2023-24. These expenditures are projected to rise to $13,253 per capita by 2027-28.

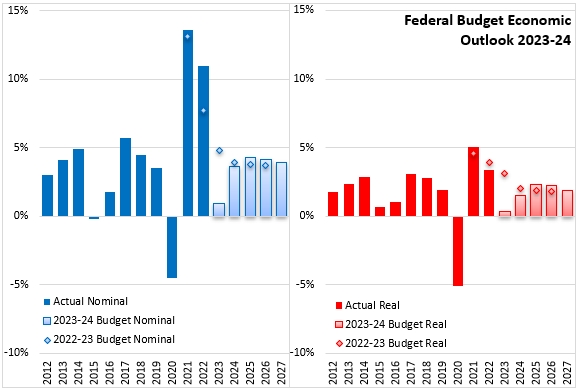

Private sector forecasters now expect tighter monetary policy to lead to a shallow recession in 2023. Real GDP is expected to decline by 0.4% from peak-to-trough. In comparison, the peak-to-trough contraction in the 2008-09 recession was 4.4%. Canada's real GDP is forecast to grow by just 0.3% in 2023, rebounding to 1.5% in 2024 and 2.3% in 2025. After rising by 11.0% in 2022, Canada’s nominal GDP is projected to grow by just 0.9% in 2023. This means that the aggregate tax base will be about $60 billion smaller than was anticipated in the Fall Economic Statement. The weaker economic outlook has led to a $4.7 billion larger deficit (prior to new policy actions) for 2023-24.

The Federal Budget assumes that higher interest rates are expected to continue until the fall, at which time inflation is projected to fall back within the Bank of Canada’s target range. By 2024, inflation is expected to be largely back to its 2% target.

Canada’s unemployment rate is projected to rise from current (relatively low) levels to peak at 6.3% by the end of 2023. Unemployment is projected to remain at this level in 2024 before contracting slowly to 5.7% by 2026.

Commodity prices have fallen since last year and are expected to remain stable. The 2023-24 Federal Budget assumes that oil prices range between $78 and $82/bbl over the next four years.

The Federal Budget contemplates upside and downside economic scenarios depending on how persistent inflationary pressures are and how long monetary policy must remain tight to contain these pressures. The Federal Budget also cautions that although Canada's financial system appears to be stable, higher interest rates are revealing vulnerabilities at financial institutions in the US and Europe. Should they emerge here, similar vulnerabilities in Canada's financial system would constitute a downside risk to the economic projections.

Canada's Federal Budget also highlighted two structural changes that may influence the country's economic future: net zero emissions and "friendshoring" trade agreements to better protect supply chains within democratic countries.

Key Measures and Initiatives

Canada's Federal Budget prioritizes affordability, housing, health care, reconciliation, infrastructure and clean energy. Key new initiatives include:

- Making life more affordable

- a "grocery rebate" through the GST credit, recipients get an amount equal to double their January 2023 quarterly payment

- a one-time cap of 2% on the alcohol excise duty

- regulations to reduce "junk" fees such as roaming charges, event/concert fees and excess baggage fees

- lowering criminal rates of interest to 35% APR (from 47%) and requiring payday lenders to charge no more than $14 per $100 borrowed

- lowering credit card fees for small businesses (while protecting rewards points for customers)

- introducing a "right to repair" framework for appliances and electronics

- exploring standardized charging ports for electronics

- extending automatic tax filing eligibility to 2 million filers in 2025

- enhancing student financial assistance and increasing student grants by 40%

- increasing withdrawal limits on RESPs

- Housing

- altering the code of conduct for federally-regulated mortgage providers to offer guidelines on relief measures for distressed borrowers

- reallocating funding from the National Housing Co-investment fund from repairs to new construction

- committing $4 billion over 7 years for an Indigenous housing strategy

- Health care

- extending the Canadian dental care program to cover adults (in addition to currently-covered children in families without insurance and incomes under $90,000

- adding a new Oral Health Access Fund to address oral health needs in vulnerable populations

- increasing forgivable student loans for doctors and nurses working in remote areas

- establishing a national suicide prevention and mental health crisis support phone number

- Reconciliation

- in addition to the Indigenous housing strategy, providing $2 billion over 10 years to address Indigenous communities' access to health care

- establishing an FPT-Indigenous table on missing and murdered Indigenous women, girls and 2SLGBTQI+ people

- Clean energy

- starting a 15% refundable Clean Electricity Investment Tax Credit

- launching a 30% Clean Technology Manufacturing Investment Tax Credit

- allocating $10 billion each through the Canada Infrastructure Bank for its Clean Power and Green Infrastructure priority streams

- $3 billion over 13 years to support clean electricity projects (including offshore wind)

- Other notable initiatives

- doubling tradespeople's tool deduction from $500 to $1,000

- restructuring the Alternative Minimum Tax for high income individuals

Federal Budget 2023-24

<--- Return to Archive