The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 28, 2023MULTIFACTOR PRODUCTIVITY GROWTH, 2021 Statistics Canada has released provincial results for multifactor productivity and related variables for the business sector for 2021.

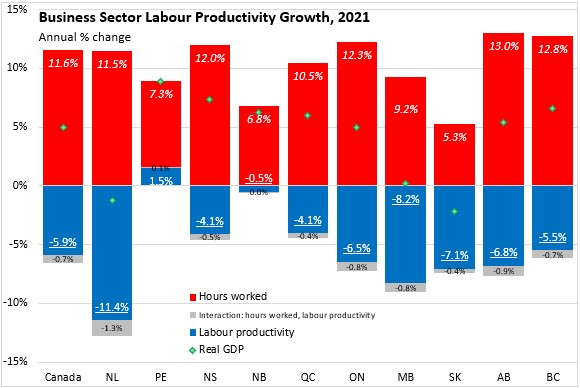

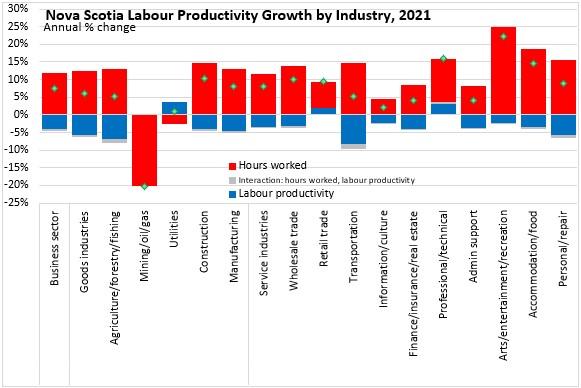

Growth in Real GDP can be decomposed into growth in hours worked and growth in labour productivity. In most years, the interaction between changes in both labour productivity and hours worked is negligible, but with larger movements in productivity and hours worked, this interaction offset some of the labour productivity gain.

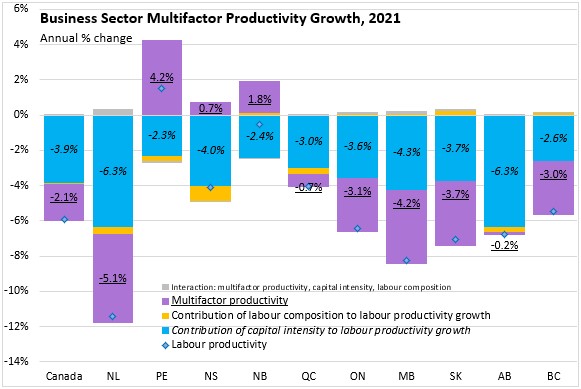

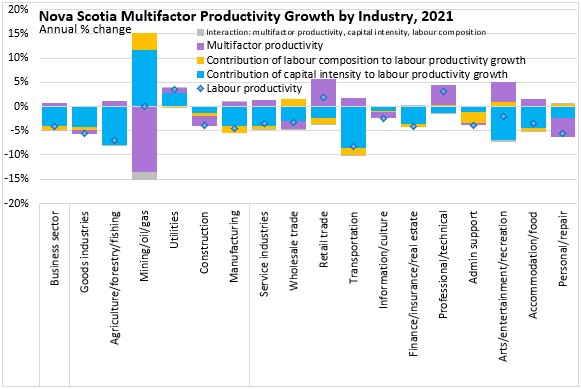

Growth in labour productivity can be further decomposed into growth in capital intensity (ie: the amount of capital used in production), labour composition (ie: skills upgrading) and multifactor productivity. Multifactor productivity is the residual of economic growth that cannot otherwise be accounted for and is meant to reflect intangible contributions to economic growth from unobserved variables such as branding, economies of scale, technology, management practice or entrepreneurship.

Extraordinary job losses during the first wave of the pandemic distorted productivity results for 2020. Previously released data for labour productivity in 2021 showed how a large rebound in hours worked (12.0%) was partially offset by a 4.1% decline in labour productivity. Much of the volatility in productivity over the past two years has been associated with specific industries. In the first waves of the pandemic in 2020, employment loss was concentrated in labour-intensive and high-contact service industries that generally have lower productivity. The remaining employment that continued was in higher productivity industries. Likewise, the employment rebound in 2021 was concentrated in these labour-intensive, high-contact (and lower productivity) industries. All provinces reported strong gains in hours worked and most provinces reported large declines in productivity. Prince Edward Island was the only province to report a labour productivity increase in 2021.

Multifactor productivity estimates further decompose the sources of provincial labour productivity changes in 2021. Much of the decline in productivity is attributable to falling capital intensity of production as employment gains were concentrated in labour-intensive industries. This was observed in every province. Labour composition made small contributions to labour productivity changes in each province.

Nova Scotia reported multifactor productivity growth of 0.7% in 2021. Only the Maritime provinces reported positive contributions to growth from multifactor productivity (led by Prince Edward Island). Across Canada, multifactor productivity was a drag on labour productivity, with largest negative contribution in Newfoundland and Labrador.

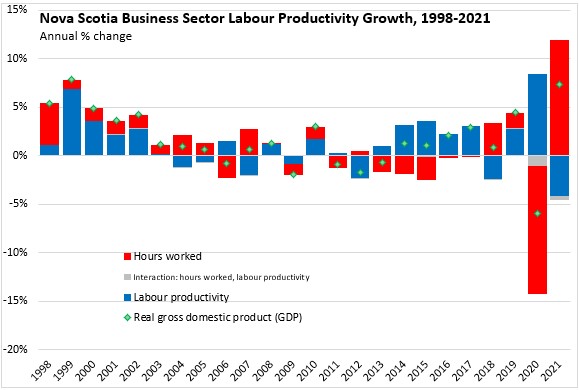

After strong productivity and real GDP growth from 1998-2003, during which natural gas production facilities were constructed and reached peak production, Nova Scotia's reported very little labour productivity growth from 2003 to 2013. Over this period, output from the province's natural gas fields was declining, which is typical of production patterns after peaking early in their life cycle. From 2013 to 2017, Nova Scotia's labour productivity made significant contributions to overall business sector real GDP growth even when labour's contribution from hours worked was flat or negative during substantial declines in the province's labour force. In 2018, there was an extraordinary increase in contribution to real GDP growth from labour hours worked and an offsetting decline in labour productivity. In 2019, Nova Scotia's business sector real GDP growth reached its fastest pace since 2002 on another strong increase in labour productivity.

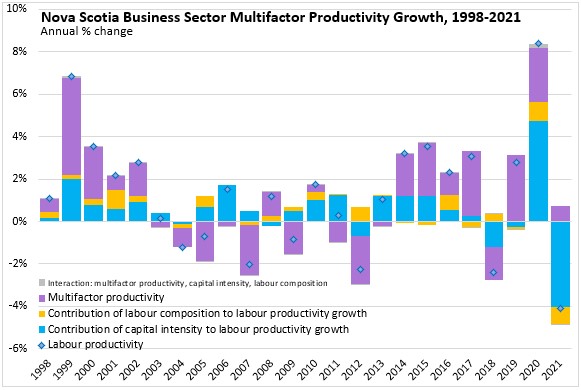

In the period from 1998-2003, labour productivity gains were driven mostly by capital intensity as well as multifactor productivity (which includes effects from bringing new natural resources into production). From 2003-2013, multifactor productivity growth was generally negative as natural gas output slowed - though capital intensity continued to grow through much of this period. Starting in 2014, multifactor productivity growth made significant contributions to business sector labour productivity gains and therefore to real GDP growth.

Among industries, Nova Scotia's 2021 productivity declines were spread across most business sector industries - as were gains in hours worked (only mining and utilities reported declining hours worked). Only utilities, retail trade and professional/technical services reported productivity improvements.

Most industries reported a drag on productivity from capital intensity (exceptions: mining, utilities). Labour composition generally made small contributions to productivity change, with the exceptions of mining and wholesale trade (positive contributions) as well as administrative/support (negative contribution).

Multifactor productivity contributed to labour productivity improvements for many industries (exceptions: mining, construction, wholesale trade, information/culture, administrative/support and personal/repair). The strongest contributions from multifactor productivity growth were reported in retail trade, professional/technical services and arts/entertainment/recreation.

Statistics Canada. Table 36-10-0208-01 Multifactor productivity, value-added, capital input and labour input in the aggregate business sector and major sub-sectors, by industry; Table 36-10-0211-01 Multifactor productivity and related variables in the aggregate business sector and major sub-sectors, by industry

<--- Return to Archive