The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

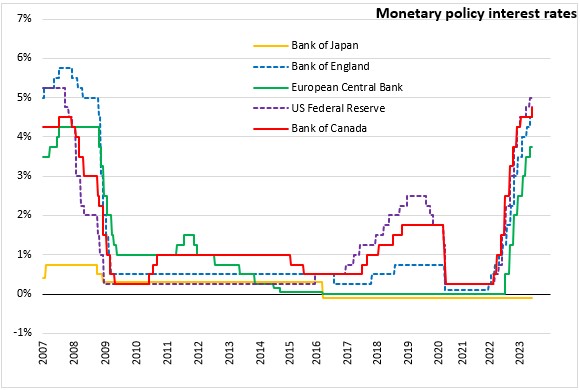

June 07, 2023BANK OF CANADA MONETARY POLICY The Bank of Canada increased its target for the overnight rate by 25 basis points to 4.75%, with the Bank rate at 5.0% and the deposit rate at 4.75%. The Bank is continuing its policy of quantitative tightening.

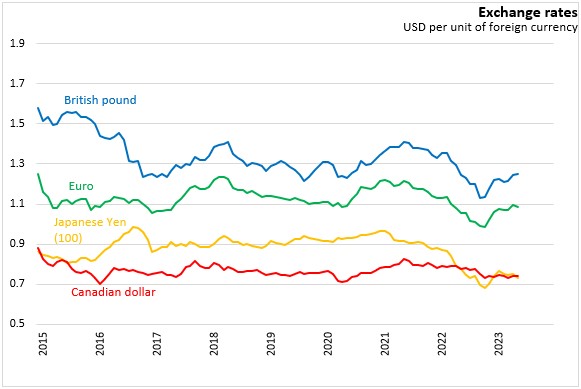

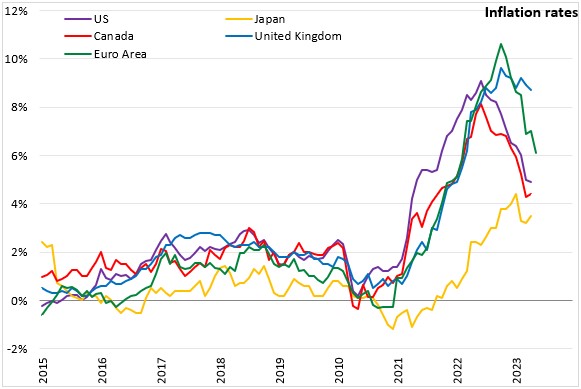

Global growth continues to slow down. Inflation is also slowing due to lower energy prices, but underlying inflation remains high. While higher interest rates are slowing the pace of economic growth, major central banks are still signaling that further interest rate hikes might be necessary to restore price stability.

In the United States, economic growth is slowing but consumer spending remains high and labour market is still tight. Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting.

In Canada, real GDP increased 3.1% in the first quarter of 2023. This pace of growth was stronger than expected. Consumer spending was strong and broad-based with demand for services continuing to rebound. Housing activity has picked up. Supported by higher immigration and participation rates, labour markets remain high. Overall, excess demand in the economy looks to be more persistent than anticipated.

Inflation increased 4.4% in April 2023, posting the first increase in the 10 months. Prices were higher than expected across a broad range of goods and services. Goods price inflation increased, despite lower energy costs. Services price inflation remained elevated, reflecting strong demand and a tight labour market. The Bank expects CPI inflation to ease to around 3% in the summer, as lower energy prices feed through and last year’s large price gains fall out of the yearly data. However, with high core inflation and persistent excess demand, concerns around inflation to get stuck materially above the 2% target have increased.

The Governing Council decided to increase the policy interest rate, reflecting their view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target. Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet. Governing Council will continue to assess economic developments and the impact of past interest rate increases, and is committed to restoring price stability.

The next scheduled date for announcing the overnight rate target is July 12, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection at the same meeting.

Bank of Canada: Rate Announcement

<--- Return to Archive