The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 12, 2023FAMILY INCOME AND INDIVIDUAL INCOME, T1 FAMILY FILE, 2021 Statistics Canada has released estimates of family and individual income generated from 2021 T1 personal income tax returns (collected mostly in spring 2022). This data shows how income is changing over time for particular types of families as well as how it compares by type of income and geography.

During the initial waves of the COVID-19 pandemic, income data were distorted by large job losses as well as by extraordinary Federal income support programs. Some results from 2020 were transitory deviations from previous trends and results in 2021 show reversion to these trends.

The data shows median incomes for families (which often include more than one earner) as well as for persons within families (which allows for comparison with those who are not in census families). There are data available for provinces, for Census Metropolitan Areas (CMA), Census Agglomerations (CA) and areas outside CMA and CA communities. Within Statistics Canada’s estimates, there are income results for those who are in census families (couples and lone-parent families) as well as for those who are not in census families.

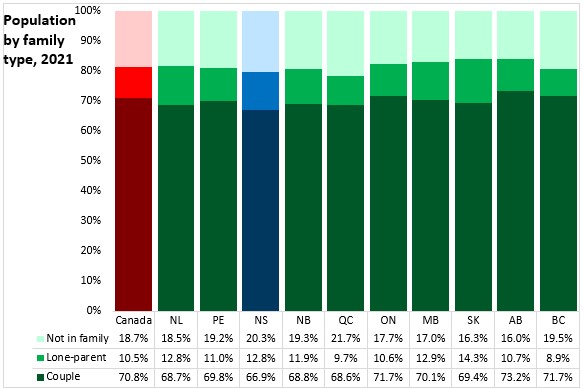

For Nova Scotia, the T1 records indicate a total of 957,300 persons (totals will not align with official population estimates). Of these, 66.9% were in couple families – the lowest such proportion among the provinces while there were 12.8% in lone-parent families (second highest among provinces) and 20.3% not in any form of census family (second highest among provinces).

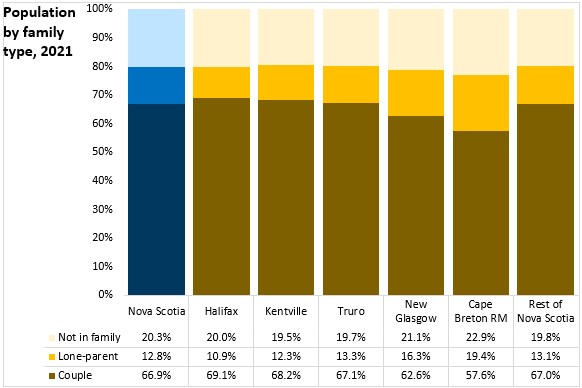

Within Nova Scotia, the portion of couple families is lower in New Glasgow and the Cape Breton Regional Municipality, where there are larger portions of lone-parent families as well as persons not in a census family.

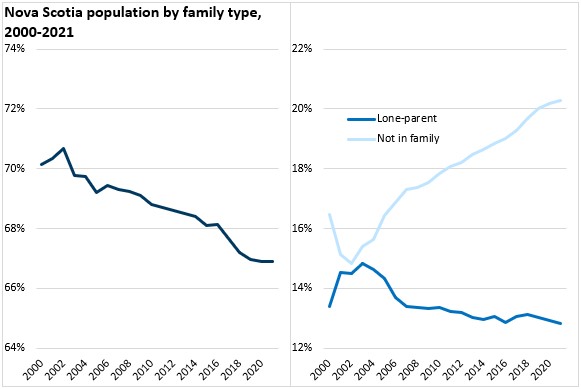

Over time, the share of Nova Scotia's population in census families has declined as has the share in lone-parent families. The population's share of persons not in a census family is rising (concentrated among older residents).

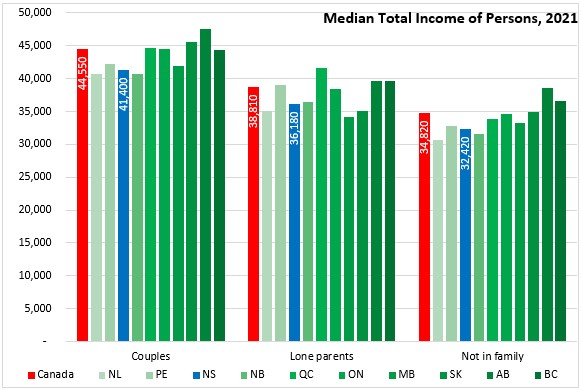

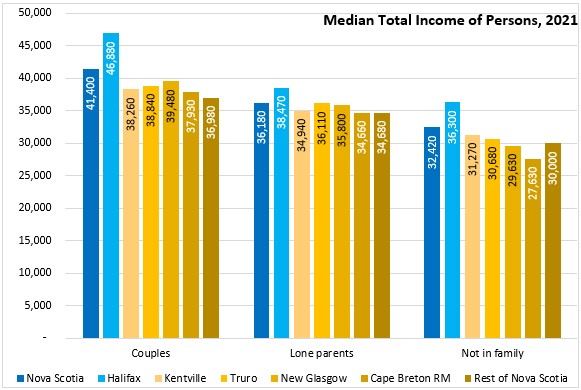

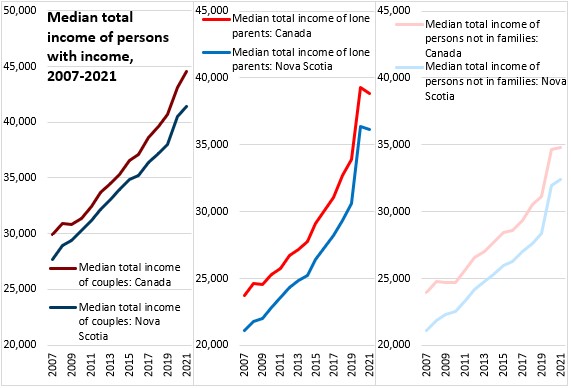

Median total income (among those who had income) for persons in couple families was $41,400 in Nova Scotia in 2021, which was 92.9% of the national average ($44,550).

Median income from all sources among persons in lone-parent families who had income in Nova Scotia during 2021 was $36,180, 93.2% of the national median ($38,810).

Median income from all sources among persons not in census families who had income was $32,420 or 93.1% of the national median ($34,820).

Note: median income of persons in couple families treats each person with income separately.

Within Nova Scotia, the Halifax CMA had higher median total income among couple families, lone-parent families, and persons not in families while areas outside of Halifax had lower median incomes across all family types. Median incomes were lowest for couple and lone-parent families in rural areas. Median incomes for persons not in a census family were lowest in the Cape Breton Regional Municipality.

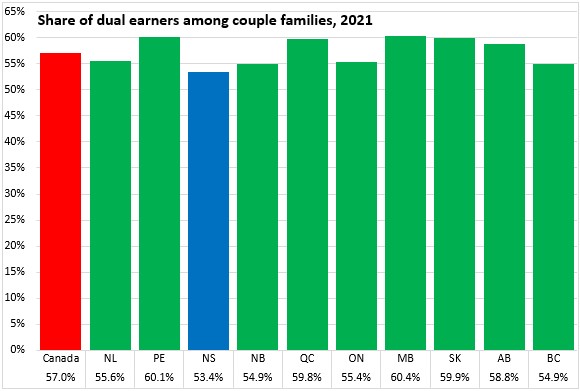

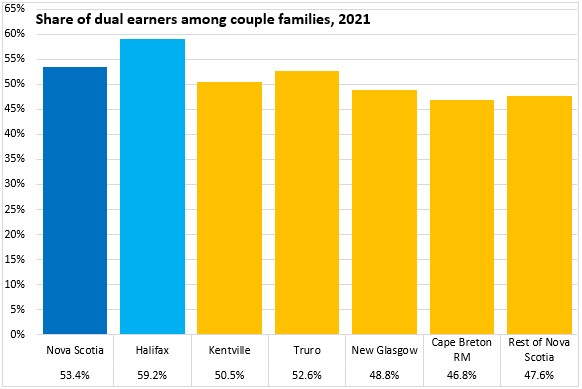

Couple families typically report higher incomes, particularly for those that have two persons earning employment income. Nova Scotia reports the lowest proportion of dual earners among couple families at 53.4%.

The share of dual earners among couple families is under 50% in New Glasgow, Cape Breton Regional Municipality and rural Nova Scotia outside of Halifax and the Census Agglomeration areas.

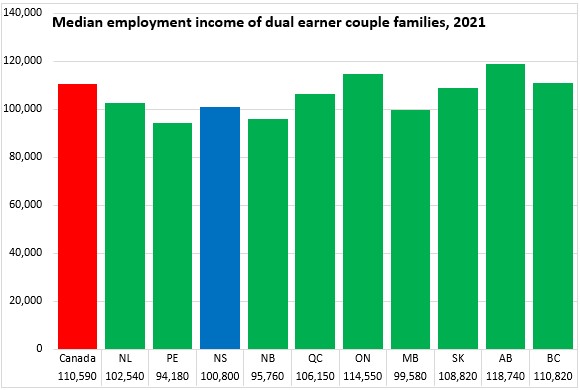

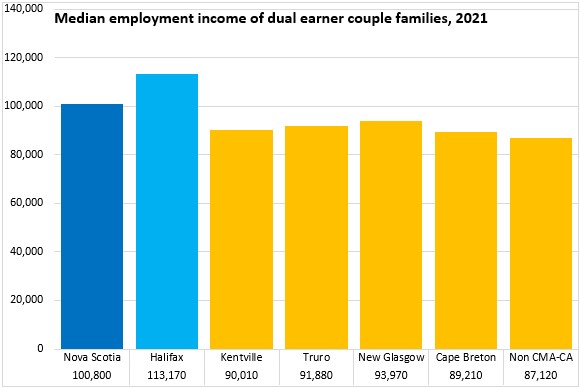

Among dual earner couples, Nova Scotia's median employment earnings (combining the incomes of both earners) were $100,800 in 2021 (91.1% of the national median).

Dual earner couples' income was notably higher in Halifax ($113,700) than across the rest of the province.

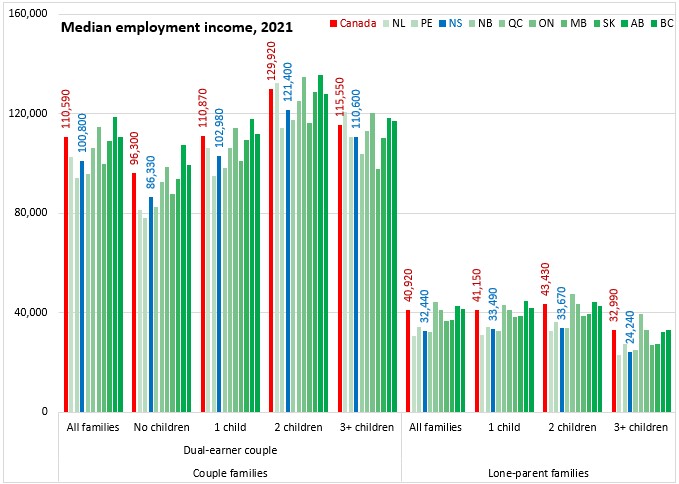

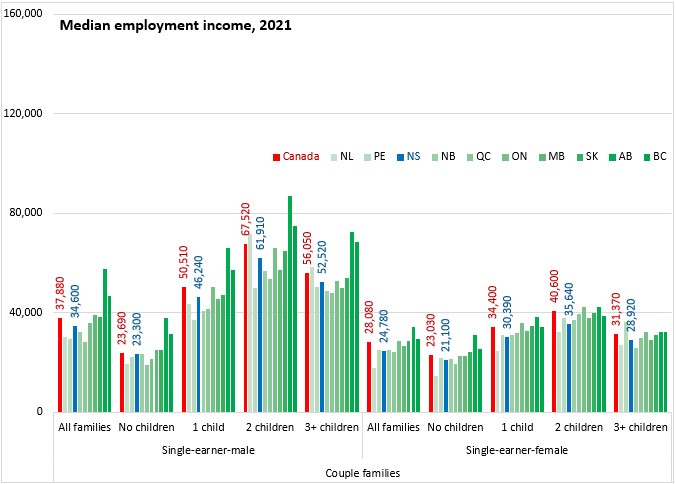

When looking at median incomes by family (including all earners in the family), couple families have higher median incomes, particularly for those with 2 children. In comparison, lone-parent families have substantially lower median incomes (less than one-third of earnings of dual earner couples). Among couple families with only one earner, median incomes were notably higher for those families where the single earner is male as opposed to female.

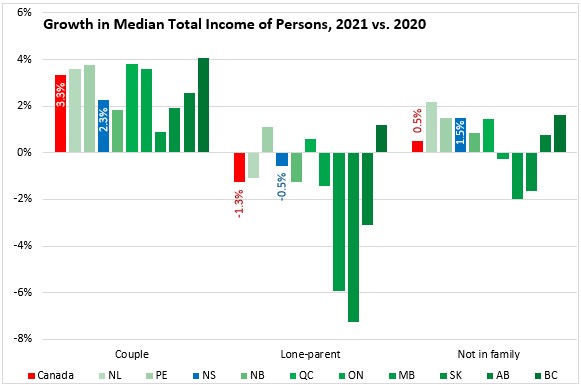

Median incomes in 2020 were notably distorted by extraordinary government transfers. As these transfers were largely withdrawn in 2021, this distortion was removed and incomes returned to previous trends.

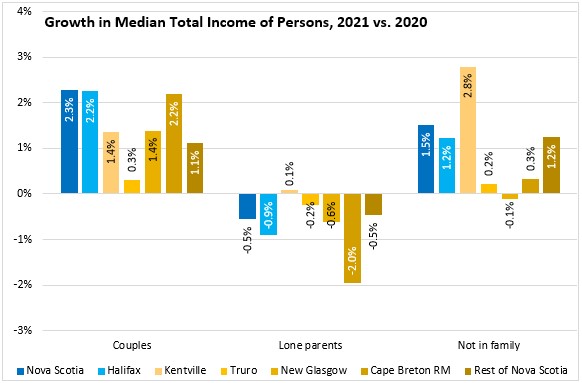

Nova Scotia's median income of persons in couple families grew by 2.3% from 2020 to 2021, slower than the national pace of 3.3%.

Incomes for Nova Scotia lone-parent families declined 0.5% in 2021, a more modest decline than the national average (-1.3%).

Among Nova Scotia's persons not in a census family, 2021 median income was 1.5% higher than in 2020, faster than the national median for this group (0.2%).

Median income growth was notably faster among couple families and persons not in a census family (except New Glasgow). Income for lone parents was down for most communities (except Kentville).

In 2020, there were notably sharp increases in incomes for lone-parent families and persons not in a census family. For lone parent families, these increases were partially reversed by a decline in 2021. For persons not in a census family, growth slowed considerably from 2020 to 2021. Couple families continued to report a steady pace of income growth.

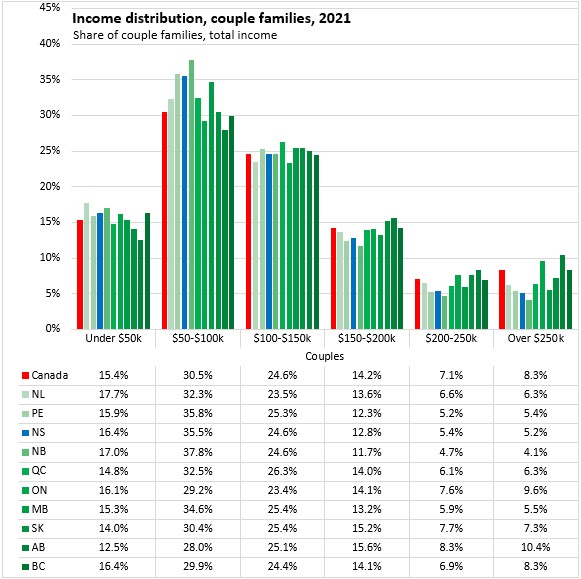

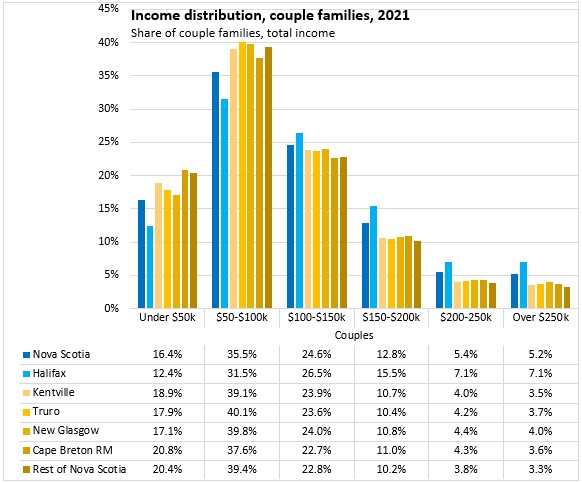

The Annual T1 Family File provides breakdowns of family income by income range.

Among couple families in 2021, there was a higher share of Nova Scotia families reporting less than $100,000 in income than the national average. The share of Nova Scotia couple families reporting incomes between $100,000 and $150,000 was the same as the national share, while there were smaller portions of Nova Scotians with incomes above $150,000.

Across Nova Scotia, the share of couple families with total income over $100,000 was higher in Halifax than in the rest of the province.

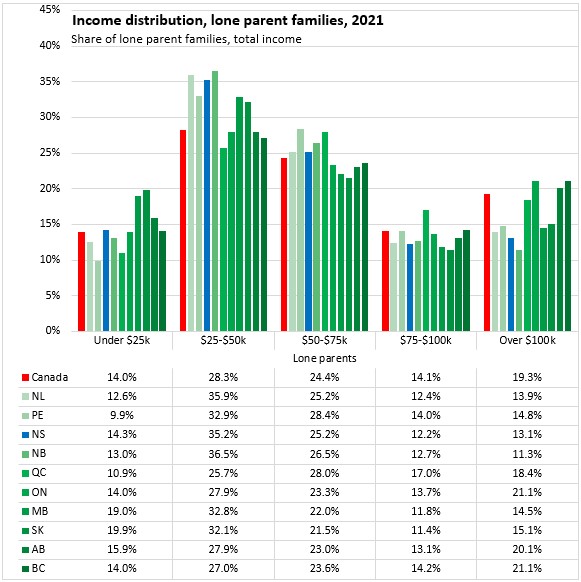

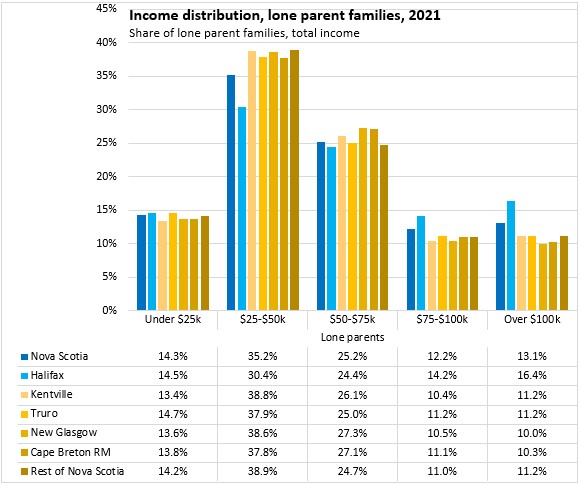

A larger portion of Nova Scotia lone parent families have total income under $75,000, compared with the national average. A smaller portion of Nova Scotia lone parent families report incomes in excess of $75,000, when compared to the national average.

Across the province, a larger portion of lone parent families report income over $75,000 in Halifax (compared to the provincial average). Outside the city a larger portion of lone parent families report incomes under $75,000.

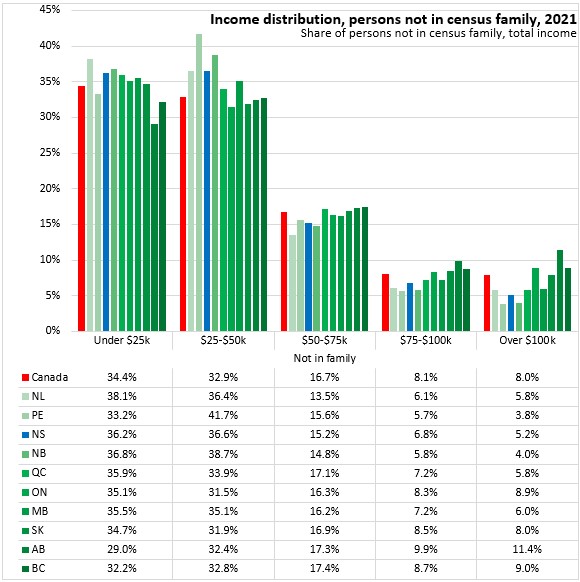

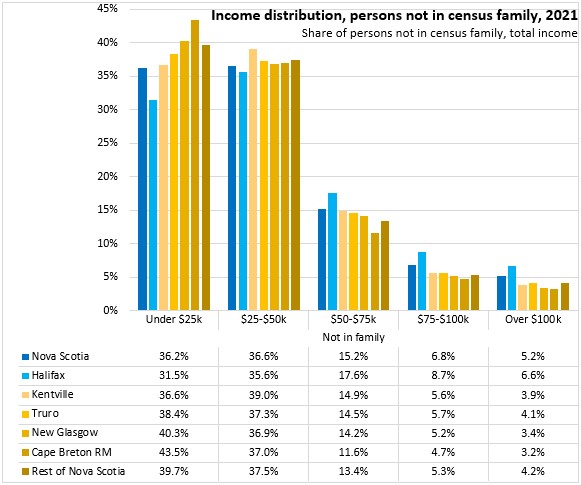

A higher portion of Nova Scotians not in a census family report incomes less than $50,000 (compared to the national average) while a lower portion report incomes in excess of $50,000.

Across the province, a higher portion of Halifax's persons not in a census family report incomes in excess of $50,000 (compared to the provincial average) while a higher portion of persons not in a census family outside the city report incomes under $50,000.

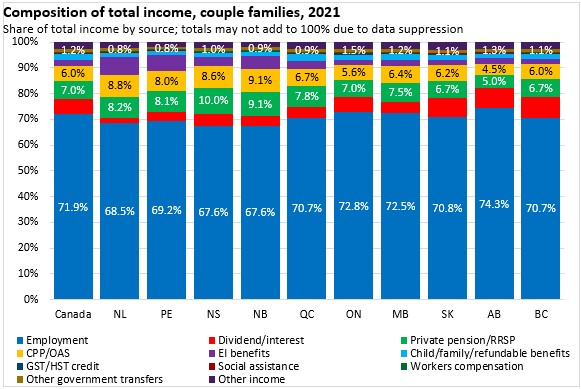

Nova Scotia couple families had the smallest share of total income from employment income in 2021 at 67.6% (tied with New Brunswick). Nationally, 71.9% of total income reported by couples was derived from employment income with the highest share in Alberta (74.3%).

Nova Scotia couples reported the highest share of income from pension sources (private pensions, RRSPs, CPP and OAS). Incomes from interest and dividends were higher in British Columbia, Alberta and Saskatchewan.

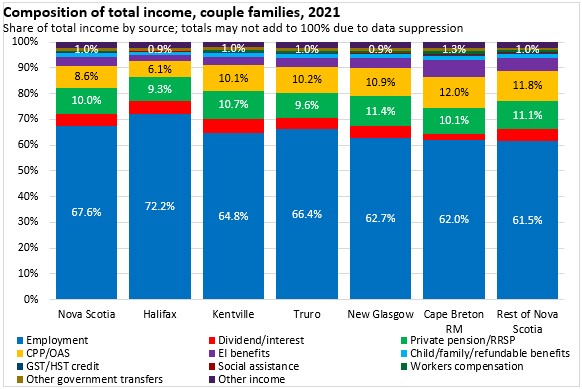

Across Nova Scotia, employment made up a larger share of couple family income in Halifax (72.2%). CPP/OAS/pensions made up a larger share of income for couples outside Halifax.

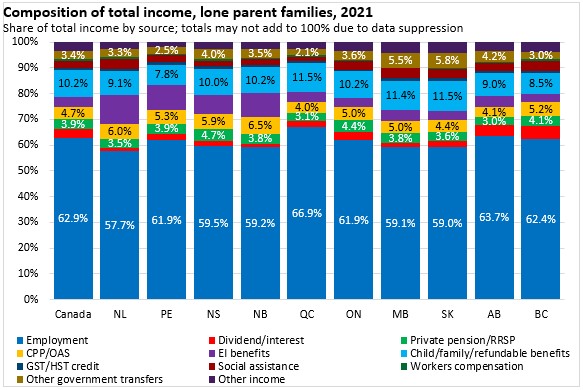

Employment income was 59.5% of the income for Nova Scotia's lone parent families in 2021 (62.9% nationally). Child, family and other refundable benefits accounted for 10.0% of the income of lone-parent families in Nova Scotia (vs 1.5% of income for Nova Scotia couple families). Other government transfers made up 4.0% of Nova Scotia lone parent family incomes in 2021 (3.4% nationally), which was down considerably from the portion of other government transfers in income for 2020.

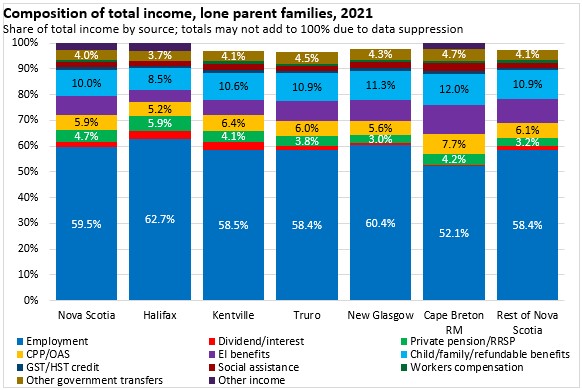

Within Nova Scotia, lone parents in Halifax reported a higher share of income from employment (62.7%) and a lower share from government transfers. Lone parents in the Cape Breton Regional Municipality reported a lower portion of income from employment (52.1%) and higher portions from child benefits, Employment Insurance and other government transfers.

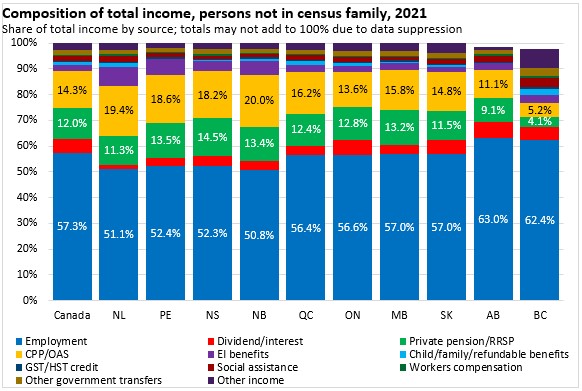

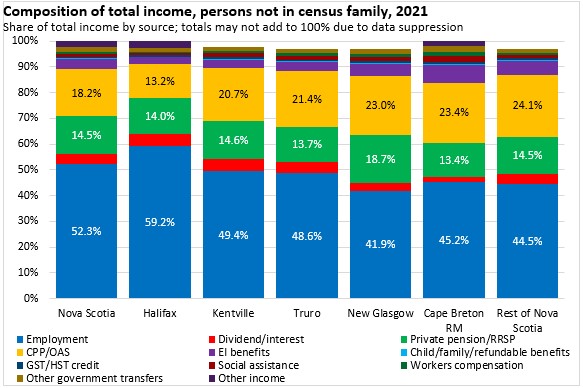

Persons not in a census family draw a much larger portion of their income from pension sources: private pensions, RRSPs, CPP and OAS. This is particularly the case in Atlantic Canada, where older populations reduce the share of the population generating income from employment.

Pension income is particularly important as a source of income in communities outside of Halifax.

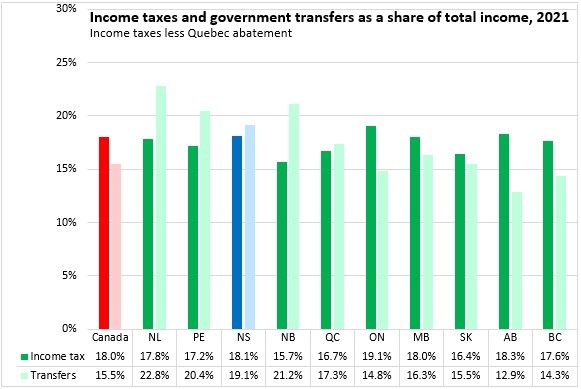

Measuring total income taxes paid to Provincial and Federal governments (and removing the Quebec abatement on Federal income taxes), the average national income tax rate was 18.0% of total national income in 2021. In the same year, government transfers made up 15.5% of total incomes.

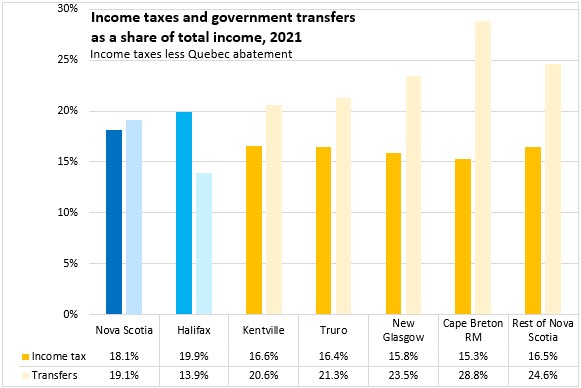

Nova Scotia's average income tax rate was 18.1% of total income in 2021 while transfers made up 19.1% of total incomes.

The highest average income tax rates were in Ontario and Alberta while the lowest were in New Brunswick. The highest average transfer shares of income were in Newfoundland and Labrador while the lowest were in Alberta.

Average income tax rates were higher in Halifax than across the rest of the province. The lowest average income tax rates were in Cape Breton Regional Municipality. The pattern is reversed for transfer share of income (lower in Halifax, highest in Cape Breton Regional Municipality).

Statistics Canada Notes:

Total income includes employment income, dividend and interest income, government transfers, pension income and other income. In accordance with international standards, capital gains are excluded from total income.

This release uses the census family concept. A census family refers to a married or a common-law couple, with or without children at home, or a lone-parent family. Results also include persons not in a census family.

Statistics Canada. Table 11-10-0009-01 Selected income characteristics of census families by family type ; Table 11-10-0014-01 Sources of income by census family type ; Table 11-10-0034-01 Tax filers and dependants with income by sex, income taxes, selected deductions and benefits

<--- Return to Archive