The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

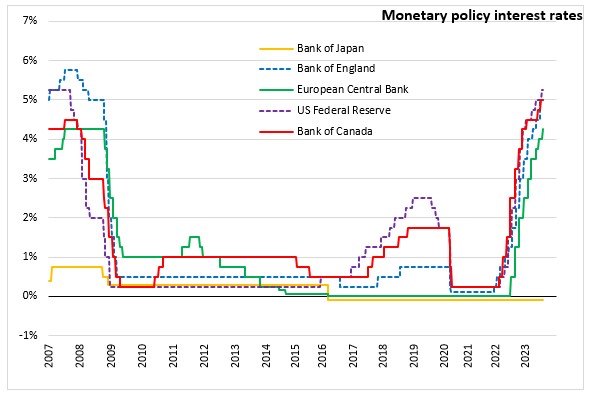

July 27, 2023EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) raised the three key ECB interest rates by 25 basis points as the inflation outlook continues to be too high for too long. The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility will be increased to 4.25%, 4.50% and 3.75% respectively, effective 2 August 2023.

The Governing Council also decided to set the remuneration of minimum reserves at 0%. This is expected to improve the efficiency of monetary policy by reducing the overall amount of interest that needs to be paid on reserve and ensuring rhe full pass-through of the interest rate decisions to money markets.

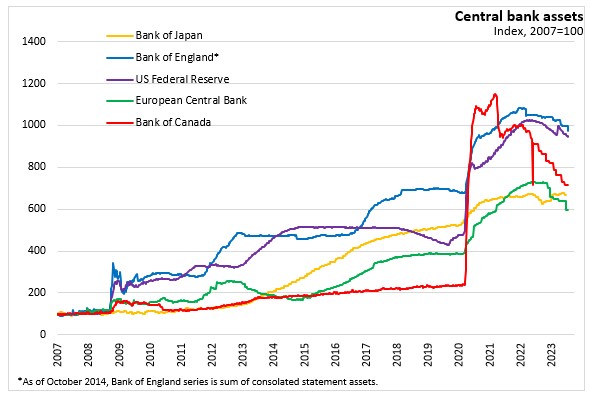

As announced in the February Monetary Policy Meeting, the asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities.

The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) until at least the end of 2024. The Governing Council noted that the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Economic activity in the euro area has stagnated in recent months and contracted by 0.4% in the first quarter of 2023 due to a drop in private and public consumption. As higher inflation and tighter financial conditions dampen domestic spending, the near-term economic outlook remains weak for the euro area. While services sector remain strong, housing and business investment have started show signs of weakness. As inflation continues to come down, improved supply chain conditions and incresed incomes are expected to support economic recovery over the long-term.

The labour market remains strong as almost a million new jobs were added in Q1 2013 and the unemployment rate is still at its historical low of 6.5% as of May 2023.

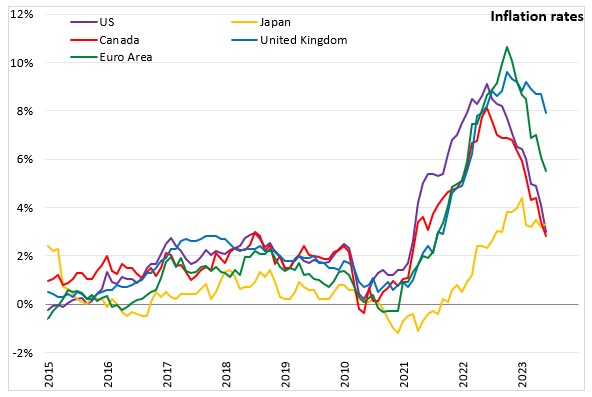

According to Eurostat’s flash estimate, inflation dropped further to 5.5% in June from 6.1% in May 2023. While external sources of inflation are easing, domestic pressures including increasing wages and robust profit margins are becoming an important driver of inflation. Underlying inflation remains high reflecting the persistent impact of past energy price increases on economy-wide prices. The Governing Council noted that as the energy crisis fades, governments should roll back the related support measures promptly and in a concerted manner to avoid driving up medium-term inflationary pressures, which would call for a stronger monetary policy response.

According to the June macroeconomic projections, Eurosystem staff expect headline inflation to average 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025. Tighter financing conditions driven by higher interest rate are a key reason behind the projected decline in inflation as they are expected to increasingly lower demand.

The euro area economy is expected to grow 0.9% in 2023, 1.5% in 2024 and 1.6% in 2025, representing a slight downgrade for the next two years compared to March projections.

The Governing Council noted that future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary. Future policy rate decisions will be based on a data-dependent approach and its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on September 14, 2023. An updated summary of economic projections is expected to be published on September 2023.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive