The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

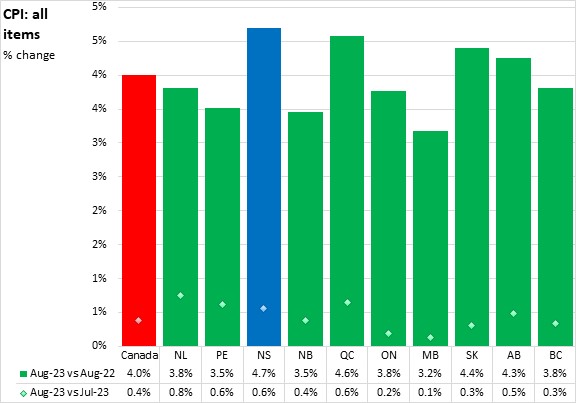

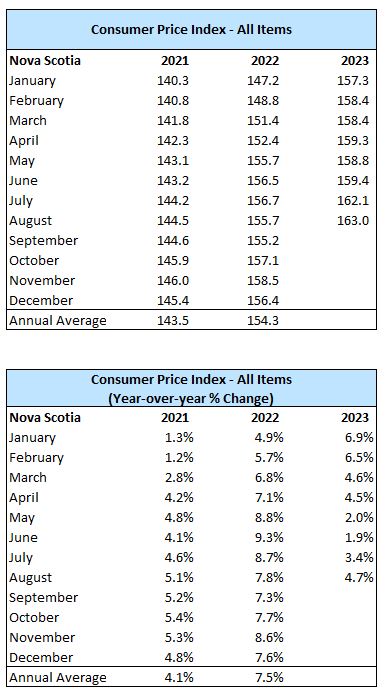

September 19, 2023ANALYSIS OF CONSUMER PRICE INDEX FOR AUGUST 2023 Nova Scotia’s all items Consumer Price Index (CPI) increased 4.7% year-over-year in August 2023. Nova Scotia's inflation had been slowing after peaking at 9.3% in June 2022 but spiked in July 2023 due to base year effects in gasoline prices, as a large monthly drop in July 2022 is no longer included in the 12-month calculations. August continued period of rerising inflation.

Nationally, consumer prices increased 4.0% year-over-year in August 2023, following a 3.3% increase in July. Inflation was highest in Nova Scotia and Quebec. Manitoba reported the slowest inflation.

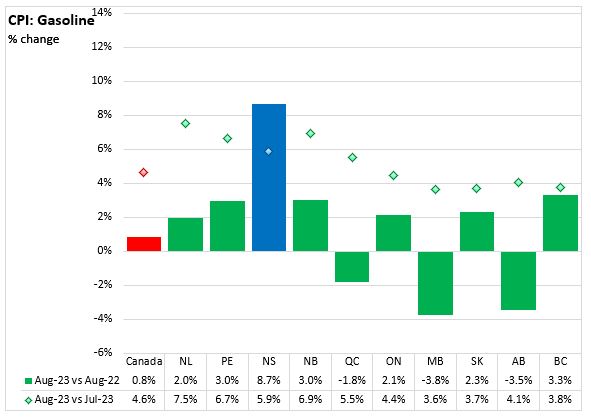

The most significant upward contributors (combining price increase as well as share of the consumption basket) to Nova Scotia's 4.7% year-over-year inflation were: rent, mortgage interest costs, gasoline, food purchased from restaurants, and purchase/leasing of passenger vehicles. These were offset by downward year-over-year contributions from: telephone services, internet access services, furniture, fuel oil and other fuels, and child care and housekeeping services.

On a monthly basis, Nova Scotia's all items CPI was up 0.6% from July to August 2023. National prices were up 0.4% with increases in all provinces. Newfoundland and Labrador reported the highest percentage gain while Manitoba posted the lowest monthly gain.

Nova Scotia's monthly inflation was influenced by upward contributions from: gasoline, fuel oil, clothing accessories/watches/jewellery, mortgage interest costs, and traveller accommodations. These upward contributors to Nova Scotia's monthly CPI were offset by some notable downward contributors: travel tours, inter-city transportation, dairy products, pork, and fresh fruit.

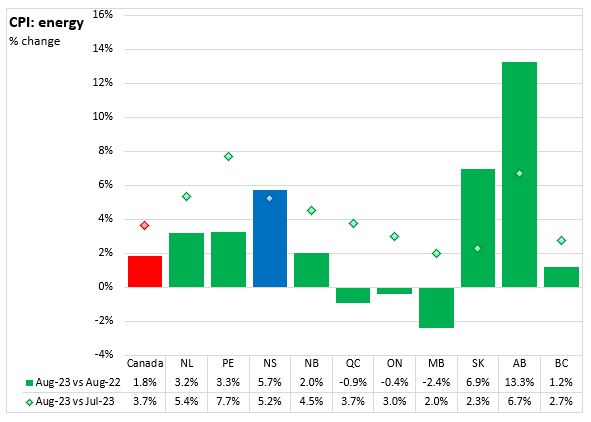

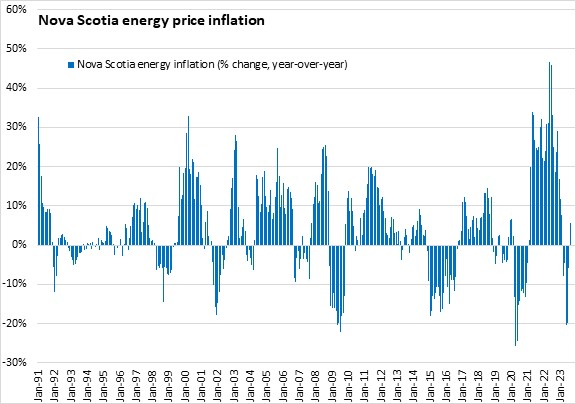

Energy prices play a significant role in inflation rates. Nova Scotia's energy prices were up 5.7% from August 2022 to August 2023. Year-over-year energy prices were up 1.8% nationally with increases in seven provinces. Alberta reported the largest increased and Manitoba reported the largest decline.

On a monthly basis, Nova Scotia's energy prices increased 5.2% from July to August 2023. National energy prices were up 3.7% with gains in all provinces. Prince Edward Island reported the largest monthly increase in energy prices while Manitoba posted the smallest monthly increase.

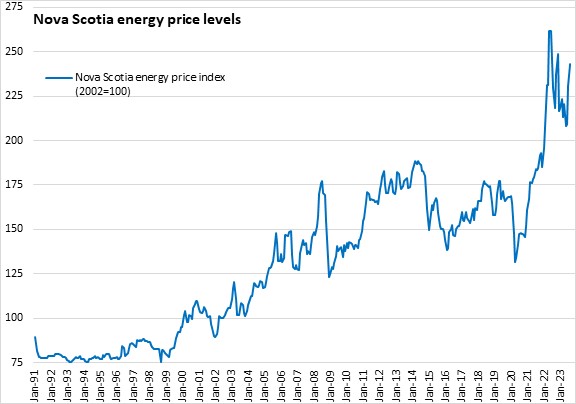

Because fuel oil for home heating is a larger component of Nova Scotia's consumption basket than in other provinces, Nova Scotia's energy prices (and overall inflation) are more sensitive to fluctuations in the global price of crude oil. Nova Scotia's energy prices accelerated dramatically after Russia's invasion of Ukraine in March 2022. Nova Scotia energy prices peaked in June 2022 and have since been trending down, though there was a substantial increase in October and November 2022. Energy prices in Nova Scotia rose in July 2023 with the introduction of federal carbon levy. Nova Scotia year-over-year energy inflation, particularly gasoline and fuel oil, continued to be impacted by the federal carbon levy in August 2023.

Nova Scotia's year-over-year energy prices (+5.7%) were up following six months of decline.

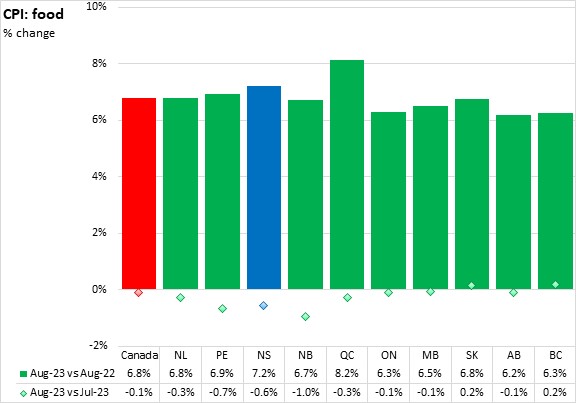

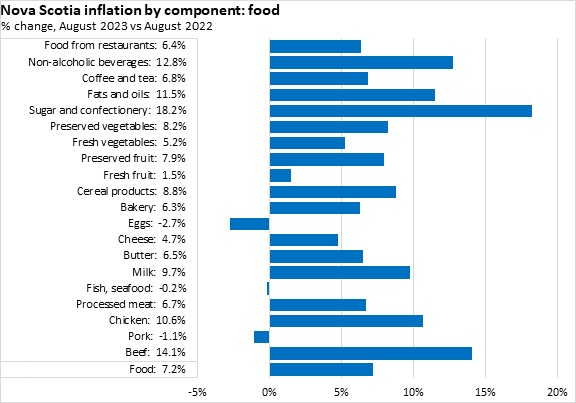

Food price inflation was 7.2% in Nova Scotia (August 2023 vs August 2022). National food prices increased 6.8% in August, down from the 7.8% gain reported in July. Food prices were up in all provinces; Quebec reported the highest food price inflation while Alberta reported the least food price growth (though it was still 6.2%).

On a monthly basis, Nova Scotia's food prices were down 0.6% from July to August. National growth in food prices was down 0.1% with declines in all provinces except Saskatchewan and British Columbia.

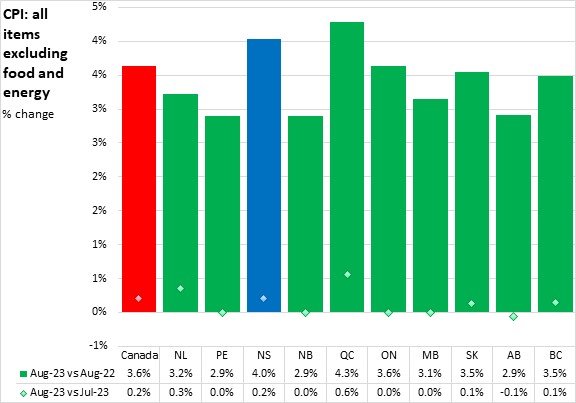

Food and energy prices are heavily influenced by volatile global commodity markets. Nova Scotia's underlying inflation rate excluding food and energy was 4.0% from August 2022 to August 2023. This was the second fastest among provinces (after Quebec). Nationally, inflation excluding food and energy was 3.6%. Prince Edward Island, New Brunswick and Alberta (all +2.9%) reported the slowest growth in inflation excluding food and energy prices.

On a monthly basis, Nova Scotia's inflation for all items excluding food and energy was 0.2% from July to August 2023. Prices for all items excluding food and energy were up 0.2% with largest increase in Quebec. Alberta reported the only monthly decline.

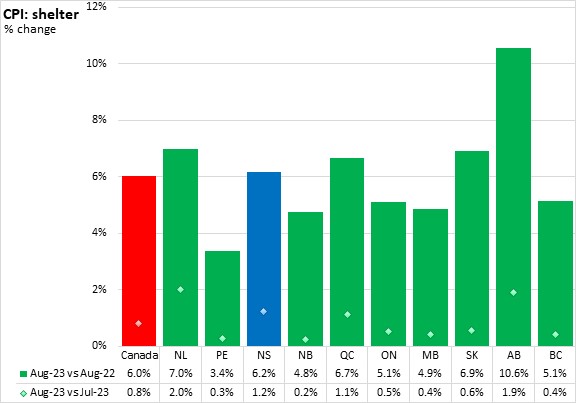

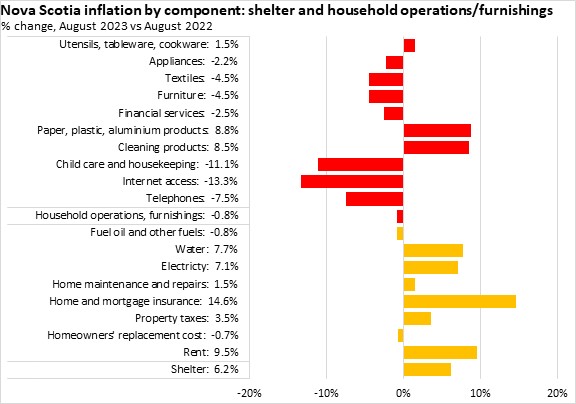

Shelter cost inflation increased to 6.2% in Nova Scotia from August 2022 to August 2023, accelerating from 4.0% year-over-year increases reported in July. National shelter prices were up 6.0% with gains in all provinces. Alberta reported the largest year-over-year increase in shelter prices while Prince Edward Island reported the smallest.

Monthly shelter costs were up 1.2% in Nova Scotia from July to August 2023. Nationally, shelter costs were up 0.8% with gains in all provinces.

Among detailed food products with available data, Nova Scotia's year-over-year inflation was fastest for sugar and confectionery while many food products reported year-over-year inflation in excess of 5% in August. Lower prices were in eggs, fish/seafood, and pork compared to August 2022.

In detailed shelter cost components, home and mortgage insurance reported the fastest year-over-year price increases, followed by rent. Fuel oil and homeowners' replacement costs reported declines.

Household operations/furnishings costs were down 0.8% overall. Prices were down for all components except utensils/tableware/cookware, paper/plastic/aluminum products, and cleaning products. The largest decline was in internet access.

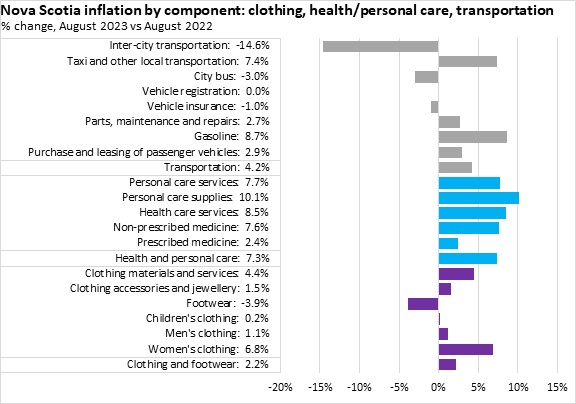

Overall transportations costs were up 4.2% year-over-year in August with higher prices for gasoline and taxi/local transportation. Inter-city transportation had the largest decline.

Health and personal care costs were up 7.3% year-over-year on gains in all sub-components led by personal care supplies.

Clothing and footwear prices were up 2.2% year-over-year with gains in women's clothing and clothing materials and services. Footwear posted a year-over-year decline in August.

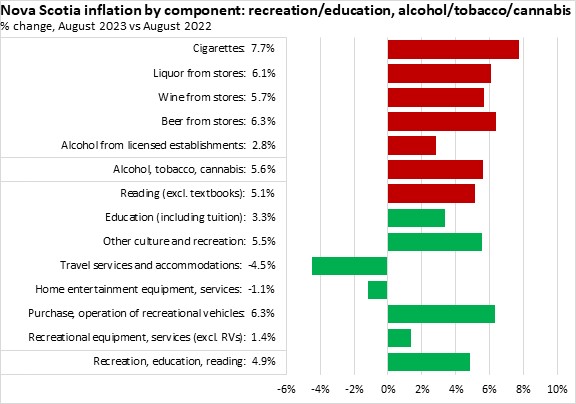

Nova Scotia's overall prices for recreation, education and reading were up 4.9% from August 2022 to August 2023 with faster increases for recreational vehicles and other culture/recreation. Prices declined in travel services/accommodations and home entertainment equipment/services from the previous year.

Nova Scotia's prices for alcohol, tobacco and recreational cannabis were up 5.6% year-over-year with the fastest growth in the price for cigarettes.

Trends

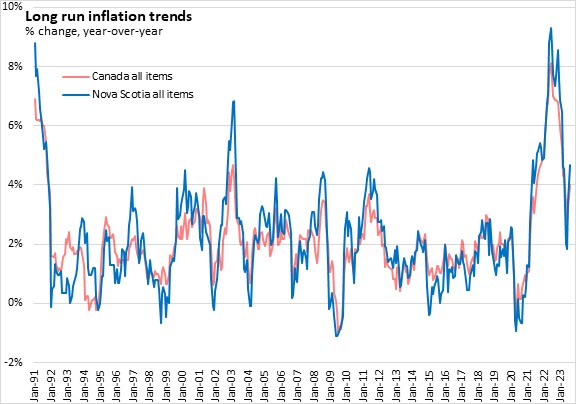

Since the start of the Bank of Canada's inflation-targeting monetary policy regime, inflation for all items has generally been in the 0-4% range. Period of above target inflation are typically followed by periods of slow price growth or even negative price changes. The most recent acceleration in inflation was the strongest since the inflation-targeting era began.

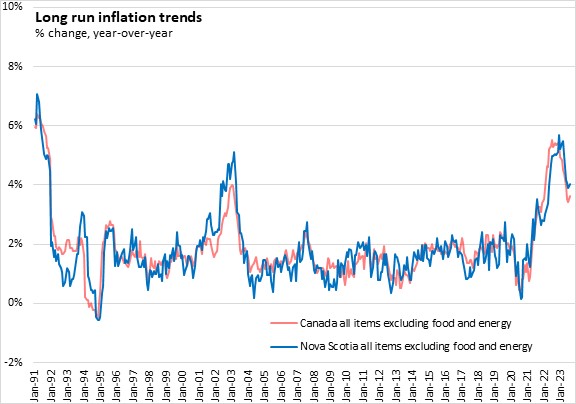

Many of these periods of accelerated and slowed inflation are attributable to volatile commodity prices, especially energy prices. Once the more volatile commodity prices are excluded, inflation in Nova Scotia has largely been below 2% for much of the last 20 years. However, the recent rise in inflation in 2021-2023 spread beyond commodity prices and has been longest period of CPI excluding food and energy above 3%.

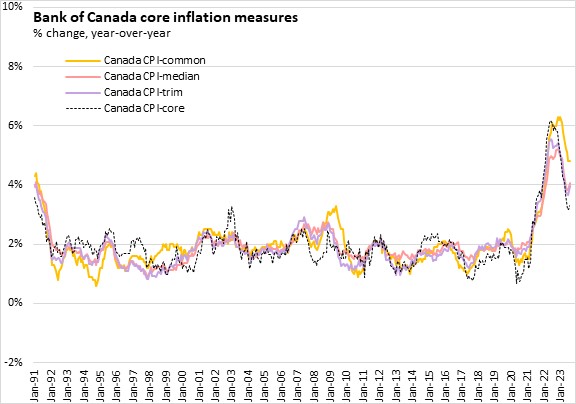

The Bank of Canada examines 'core' measures of inflation that are intended to remove the effects of volatile components and capture underlying inflation trends that are more connected to capacity in the Canadian economy. Core measures of inflation may also indicate where all items inflation is headed.

Canada's core measures of inflation remained mostly at or below the Bank's target of 2% for over a decade prior to 2021. However, after prices accelerated in 2022, core inflation measures also started to rise, peaking at over 6% for the CPI-common measure before declining for a period. For August 2023, the year-over-year core inflatoin measures were up for CPI-median (4.1%) and CPI-trim (4.0%) and unchanged for CPI-common (4.8%).

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics - Bank of Canada definitions

<--- Return to Archive