The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

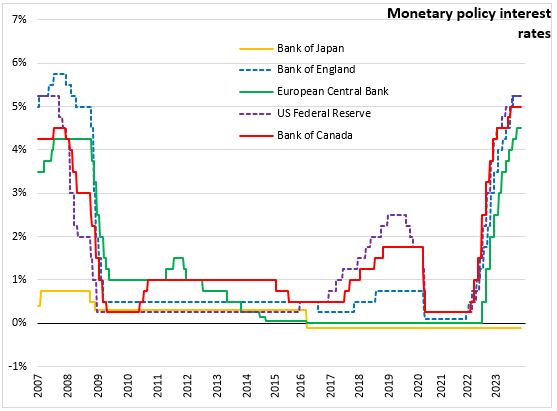

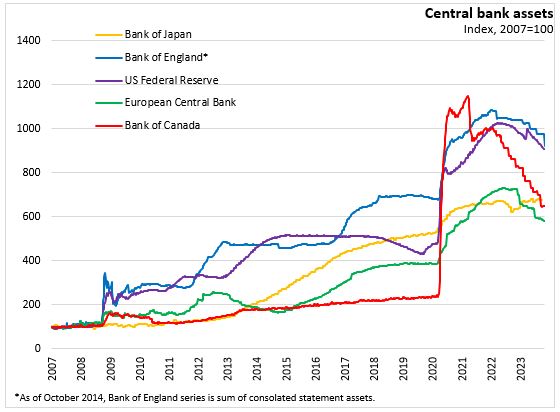

November 02, 2023BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%. The Committee also decided to reduce the stock of UK government bond purchases held for monetary policy purposes in September meeting, and financed by the issuance of central bank reserves, by £100 billion over the next twelve months, to a total of £751 billion as of November 1, 2023.

Global economic activity has evolved in line with the Committee's August projections through there were some differences across the regions. In the United States, GDP has increased by 4.9% (seasonally adjusted annualized rate) in the third quarter of 2023 reflecting gains in consumer spending, state/local spending, defence spending, and residential investment. Euro-area GDP had increased by 0.6% in 2023 Q2 but contracted 0.4% in Q3, weaker than expected in the August Report.

According to the revised quarterly estimates, real Gross Domestic Product (seasonally adjusted annualized rate) grew 0.8% in the second quarter of 2023. UK GDP is expected to have been flat in 2023 Q3, weaker than projected in the August Report.

The Labour Force Survey (LFS) unemployment rate increased to 4.3% in the three months to July 2023. The UK unemployment rate is rising because employment declined faster than a decline in the labour force (comparing May-Jul against Apr-Jun).

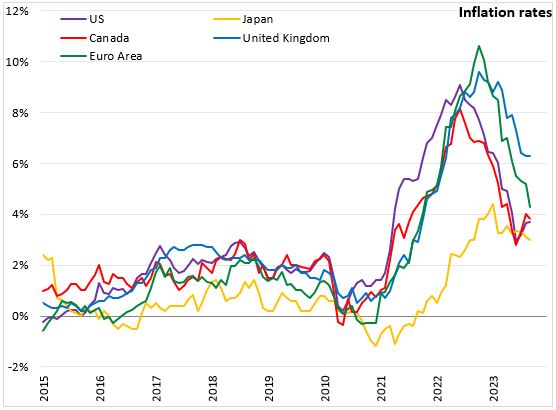

CPI inflation was 6.7% in September 2023 and Q3 2023, down from the 11.1% peak in October 2022, and lower than the projections in the August Monetary Policy Report. The decline is expected to continue in Q4 2023. It is mostly attributed to lower energy prices, core goods and food price inflation, and beyond January, by some fall in services inflation.

The MPC will continue to monitor for persistent inflationary pressures, including tightness of labour market conditions, behaviour of wage growth and services inflation. The Bank notes that further tightening in monetary policy would be required should the economy feel more persistent inflationary pressures.

The next scheduled monetary policy meeting will be on December 14, 2023.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report - November2023

<--- Return to Archive