The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

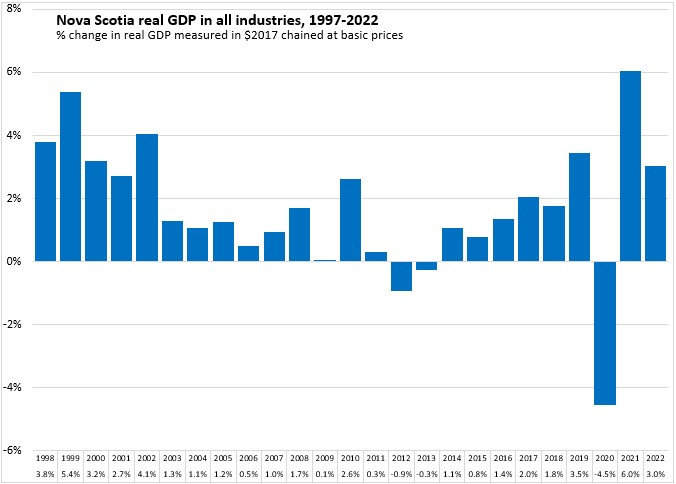

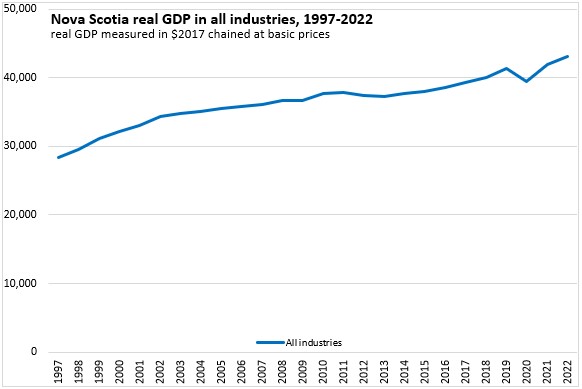

November 08, 2023PROVINCIAL GDP BY INDUSTRY 2022 [REVISED] Statistics Canada released revised estimates of real GDP by industry for the provinces and territories in 2022. Real GDP growth is measured at the industry level with chained 2017 dollars at basic prices (sellers' prices before taxes less subsidies on products) that removes the effect of price changes.

2022 vs 2021

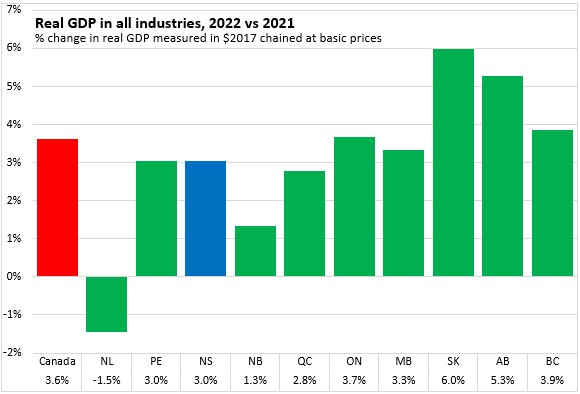

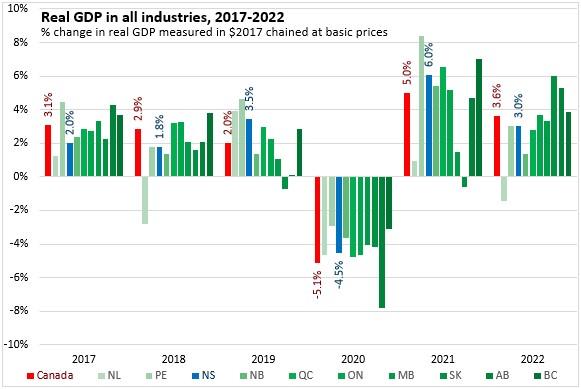

Nova Scotia's real GDP increased 3.0% in 2022, up from the preliminary estimate of 2.6%. Nationally, real GDP grew by 3.6%. All provinces reported rising real GDP in 2022 with the exception of Newfoundland and Labrador. Saskatchewan and Alberta reported the fastest gains.

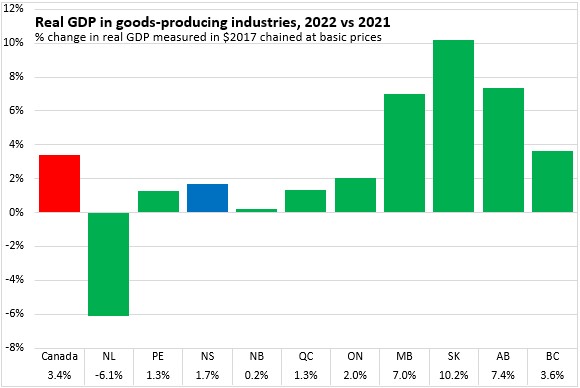

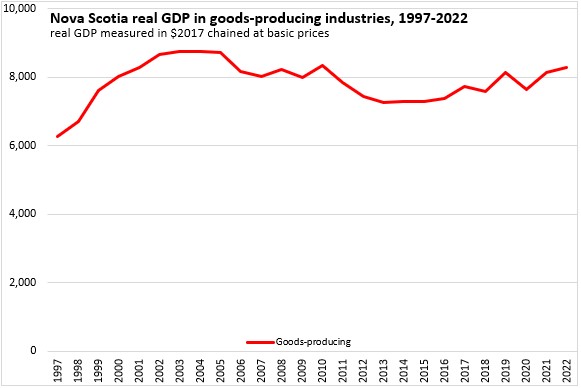

Real GDP from goods industries was up 1.7% in Nova Scotia in 2022 - about half the pace of the national average. Real GDP from goods industries was up in all provinces except Newfoundland and Labrador. The prairie provinces (notably Saskatchewan) reported the fastest increases in real GDP from goods industries in 2022.

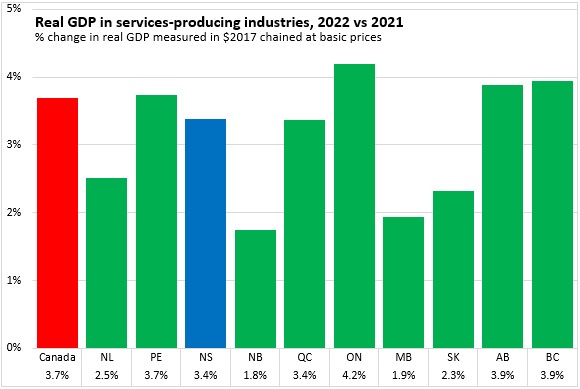

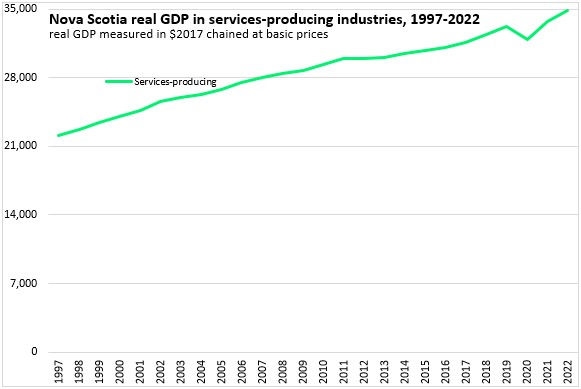

Nova Scotia's real GDP from services-producing industries was up 3.4% in 2022, just below the national pace of 3.7%. Real GDP from services-producing industries was up for every province, led by Ontario. New Brunswick and Manitoba reported the slowest real GDP growth from services-producing industries.

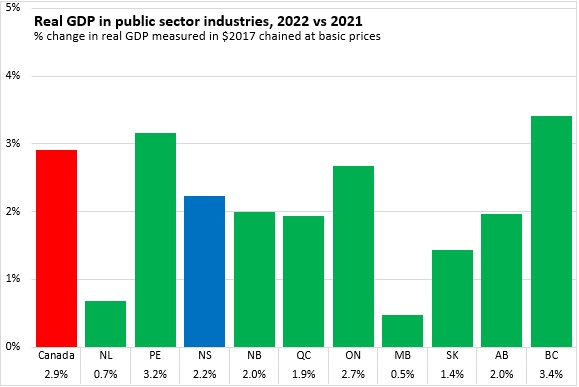

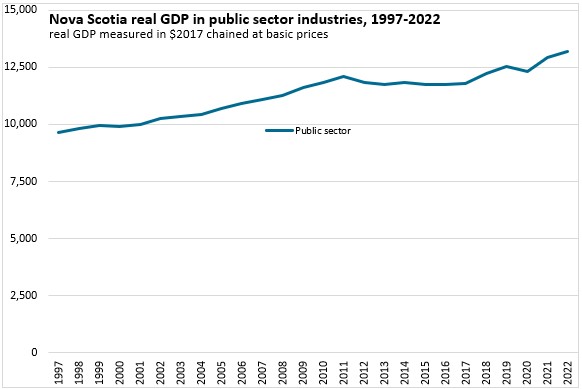

Nova Scotia's real GDP from public sector industries (which are a subcomponent of services-producing industries) was up 2.2% in 2022. Nationally, real GDP from the public sector increased by 2.9% with increases in all provinces. British Columbia and Prince Edward Island reported the fastest gains in real GDP from the public sector while Manitoba and Newfoundland and Labrador reported the slowest gains.

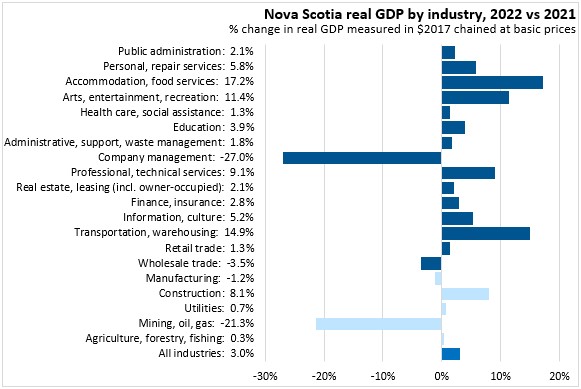

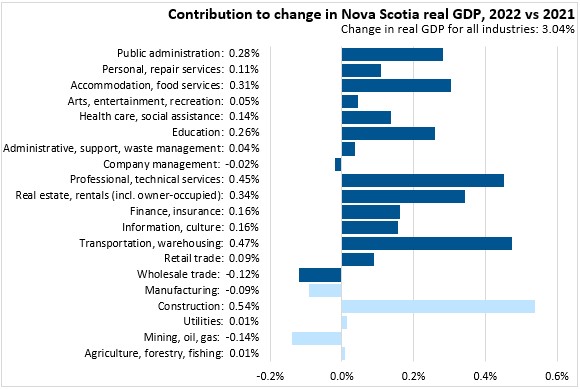

The fastest growing industries in Nova Scotia's economy in 2022 were accommodation and food services, transportation and warehousing as well as arts, entertainment and recreation. Although mining, oil and gas along with company management reported the largest declines in real GDP, these two industries are relatively small. Among larger industries, only Nova Scotia's wholesale trade and manufacturing industries reported declining real GDP in 2022.

Based on size as well as change, construction made the largest positive contribution to Nova Scotia's real GDP growth in 2022. This was followed by transportation and warehousing, professional and technical services, and real estate (which includes the imputed GDP generated by owner-occupied dwellings).

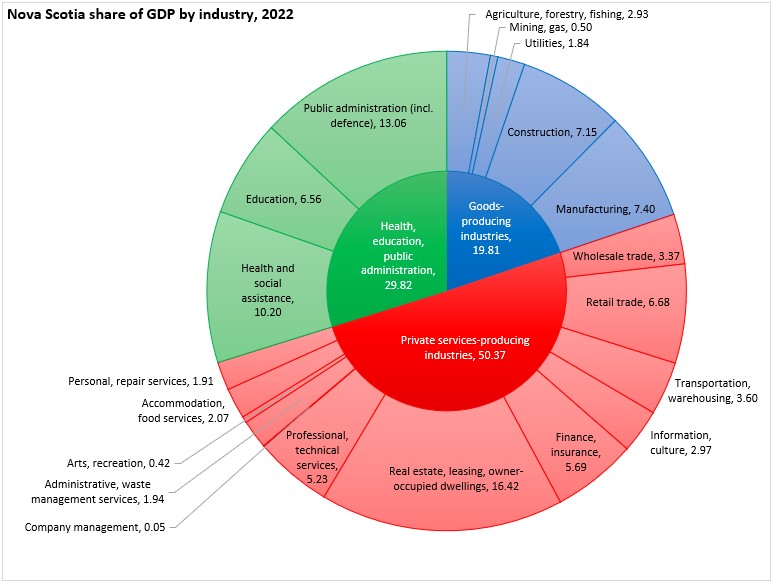

In 2022, goods production accounted for just under 20% of Nova Scotia's GDP while largely-private service producing industries accounted for just over 50% of Nova Scotia's GDP. Largely-public services (health, education, public administration) accounted for just under 30% of Nova Scotia's GDP.

Trends

Nova Scotia's real GDP growth was distorted during the pandemic and recovery periods. Recovery continued for several industries in 2022, keeping Nova Scotia's real GDP growth elevated. In 2022, Nova Scotia's real GDP growth was slower than the national average. Nova Scotia had been outperforming the Canadian average in every year (including the COVID decline) since 2018.

Nova Scotia's real GDP appears to be slowing as the effects of the pandemic recede.

Despite the severe contraction in 2020, Nova Scotia's real GDP level in 2022 was well above pre-pandemic levels.

Trends in Nova Scotia real GDP by industry

In the 26 years of data from 1997 to 2022, there have been notable changes in the real GDP generated by specific industries. These charts show the value of real GDP from 1997-2022 for most industries in the Nova Scotia economy. Real GDP is measured in 2012 (chained) dollars at basic prices. Changes in the level of real GDP for each industry indicate how its real output has changed, absent the effects of changes in output prices.

Nova Scotia's real GDP grew more rapidly from 1997-2002 as new production facilities (natural gas, supercalendered paper) were built and brought into production. Real GDP growth slowed, but remained largely positive from 2002-2011. In 2012 and 2013, Nova Scotia's real GDP contracted with industrial closures in forest products and petroleum refining as well as reductions in real GDP from the Federal government. Growth started to accelerate again from 2014 to 2019 before the contractions of the first waves of COVID-19 in 2020. Nova Scotia's real GDP rebounded quickly from the COVID recession of 2020 with stronger growth in both 2021 and 2022.

Real GDP from Nova Scotia's goods producing industries peaked in the early 2000s and trended down over the next ten years. Part of this contraction was due to slowing natural gas production as peak output on initial production is ordinary for this industry. Real GDP from Nova Scotia's goods-producing industries started to recover prior to the pandemic, but there was a contraction in 2020 (including the end of wood pulp production) before growing in the last two years.

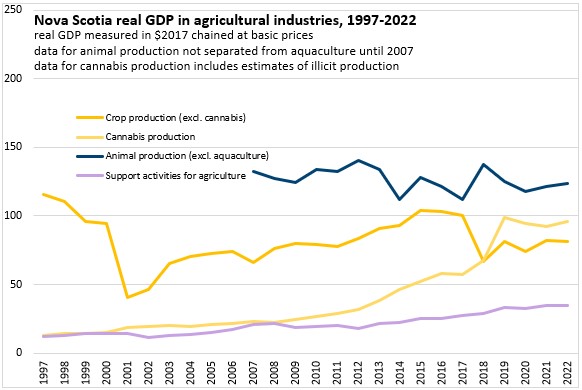

Nova Scotia's real GDP from agricultural industries has grown largely on rising cannabis production (this estimate includes illicit production). Although there are intermittent periods of faster growth and decline, real GDP from non-cannabis crops has grown slowly while real GDP from animal production has trended down.

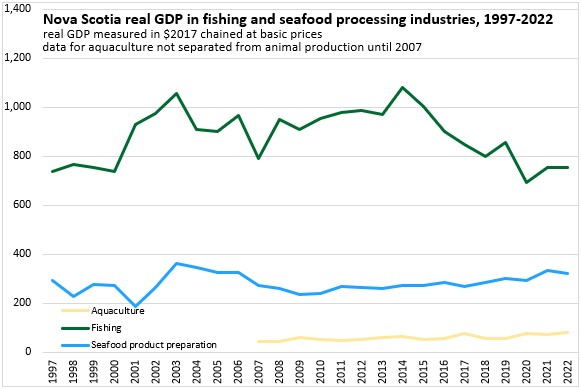

Real GDP from Nova Scotia's fishing and seafood industries has declined in recent years, despite rising export values. Although the volume of output has been lower, these industries have benefited from higher prices in more diverse markets.

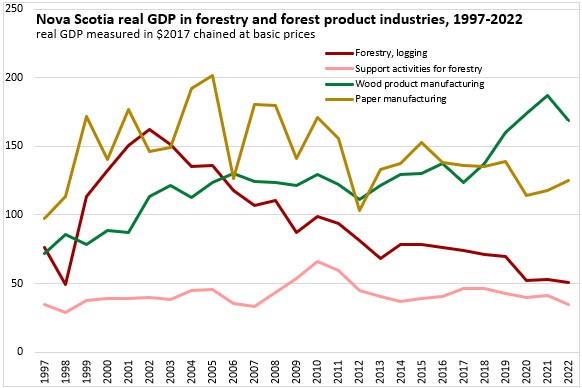

Nova Scotia's forestry and forest product industries have experienced substantial declines in recent decades, particularly with closures of paper production in 2012 and pulp production in 2020. Although real GDP from forestry declined, lumber production volumes increased from 2017 to 2021 before contracting in 2022.

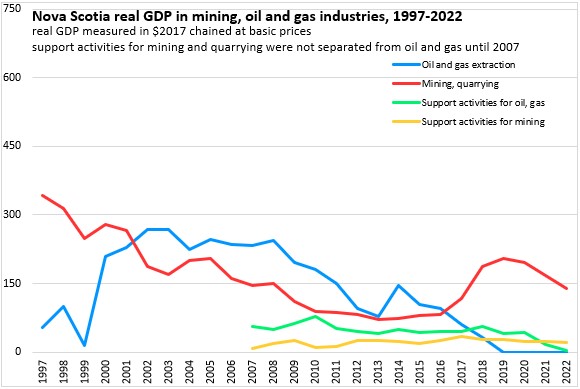

Nova Scotia's oil and gas output peaked in the early 2000s and ended by 2019. Mining and quarrying real GDP declined through 2013, but started to grow again from 2013-2020 before contracting again in the last two years.

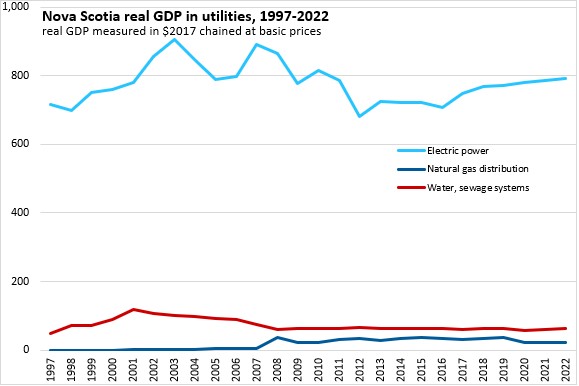

Nova Scotia's real GDP from electric power peaked in 2002 and declined over the next decade. There was a recovery in electric power real GDP before the pandemic.

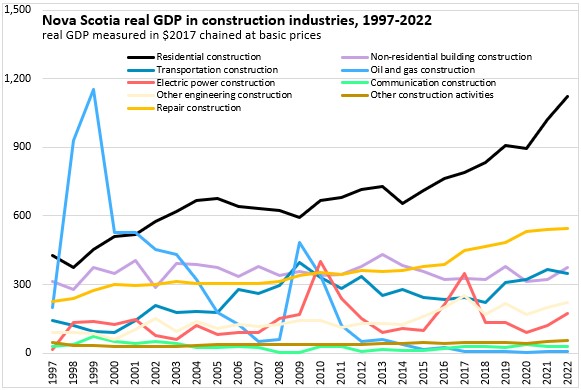

Nova Scotia's real GDP in construction industries has been led by gains in residential building, transportation construction and repair construction. Real GDP from engineering construction such as electric power, oil and gas and communications exhibit periodic spikes associated with large projects.

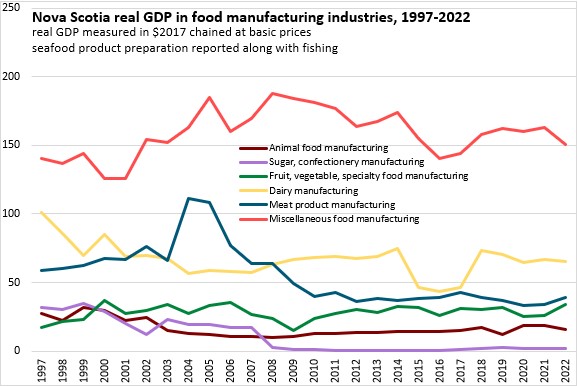

Within Nova Scotia's (non-seafood) food manufacturers, real GDP has been dominated by miscellaneous categories, which include bakeries. Most other food manufacturing industries have relatively small real GDP with a notable decline observed almost 20 years ago in meat processing.

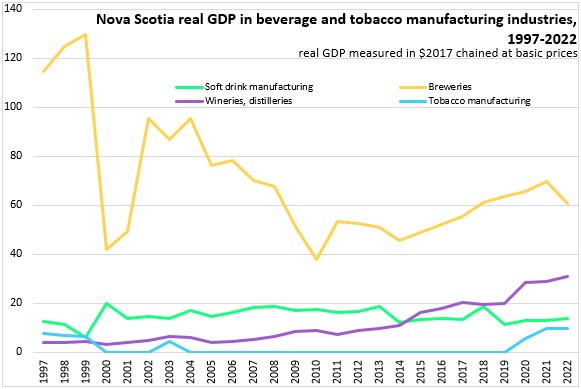

Real GDP from Nova Scotia's beverage and tobacco industries is notably smaller than from many other industries, but there has been a notable rise in real GDP from wineries and distilleries, offsetting downward trends in real GDP from breweries. There has been a recent increase in tobacco product manufacturing in Nova Scotia.

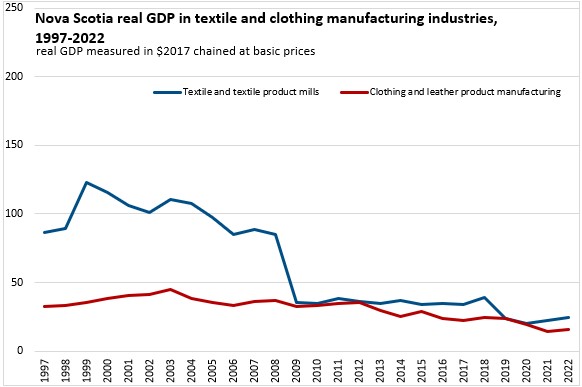

Nova Scotia's textile product mills reported a sharp decline in output in 2009. Clothing and leather product manufacturing real GDP has been trending down, but did report a gain in 2022.

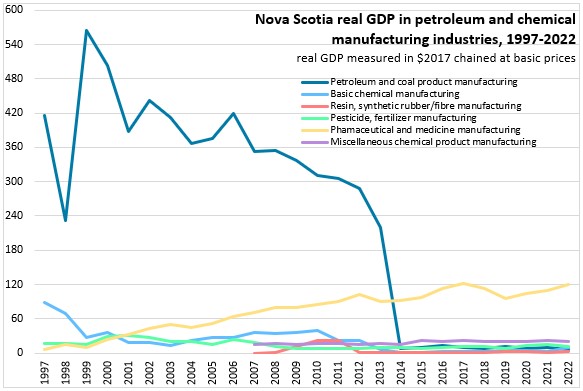

With the closure of the Dartmouth refinery in 2013, Nova Scotia's real GDP from petroleum product manufacturing fell to zero (it had been contracting for several years before that). Within chemical industries, there has been a steady increase in real GDP from Nova Scotia's pharmaceutical and medicine manufacturers.

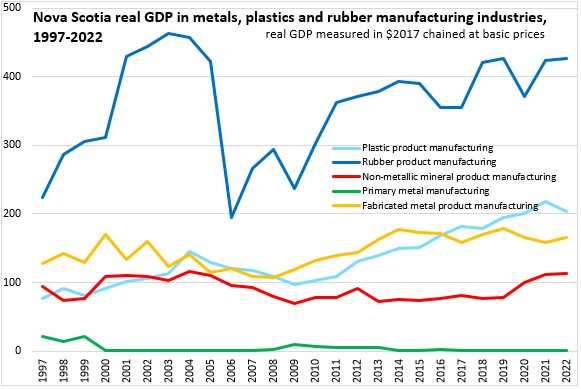

Real GDP from rubber products has exhibited significant increases and declines over the last 26 years. There has been an upward trend in GDP from rubber product manufacturing since 2006 (interrupted by declines and rebounds). In recent years, there have also been increases in real GDP from plastics manufacturers and non-metallic mineral product manufacturers (including concrete producers).

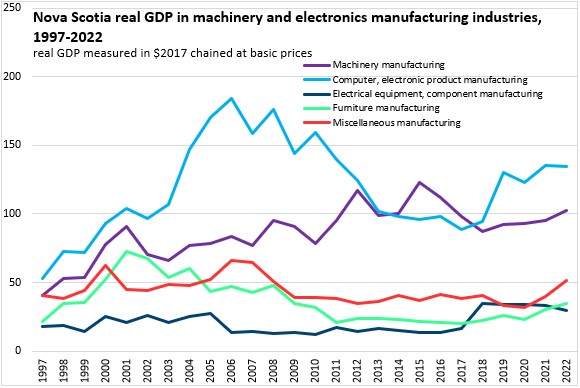

Nova Scotia's computer and electronic product manufacturers experienced declining real GDP from 2006-2017, but have rebounded in the years since then.

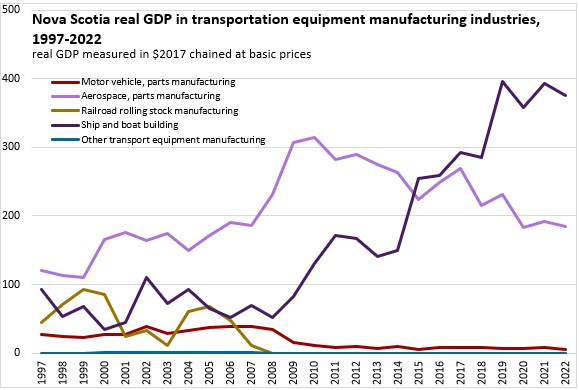

Nova Scotia's ship and boat building real GDP has grown substantially since 2008 while Nova Scotia's aerospace/parts producers have trended down since 2010.

Real GDP from Nova Scotia's services-producing industries (including public sector) has risen steadily in most years with the exception of 2020.

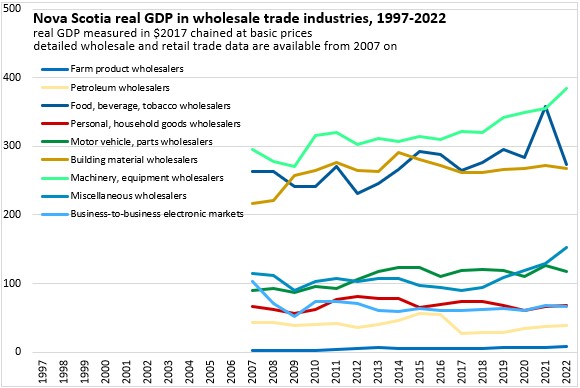

Within wholesale trade by industry (only available since 2007), real GDP has grown more rapidly in recent years for machinery/equipment wholesalers as well as miscellaneous wholesalers.

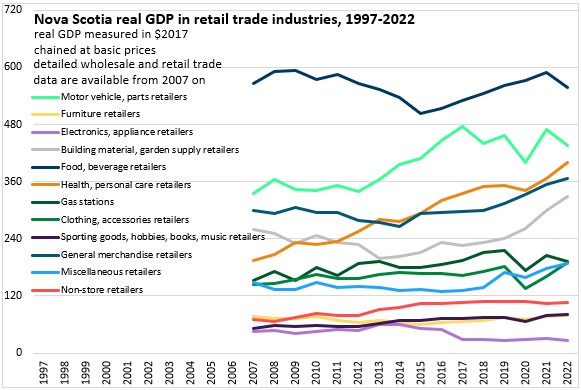

In detailed real GDP for retail trade, there has been faster growth recently for food/beverage stores (though this contracted in 2022), motor vehicles/parts dealers (up to 2017), health/personal care stores, electronics/appliance retailers and building material/garden supply centres.

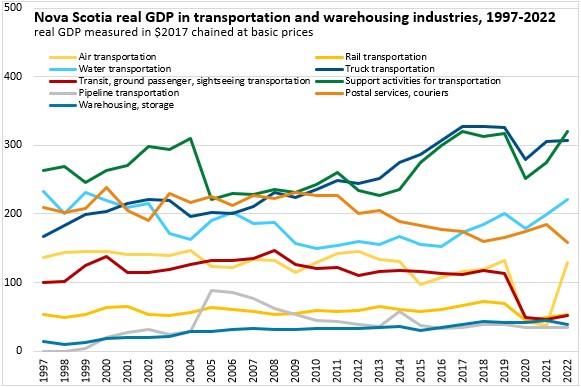

Transportation industries exhibited sharp declines during periods of pandemic-related restrictions (with the exception of postal/couriers and warehousing). This decline was particularly acute for air transportation and support activities for transportation. Real GDP from truck transportation rose substantially from 2004-2017 but has levelled off since then.

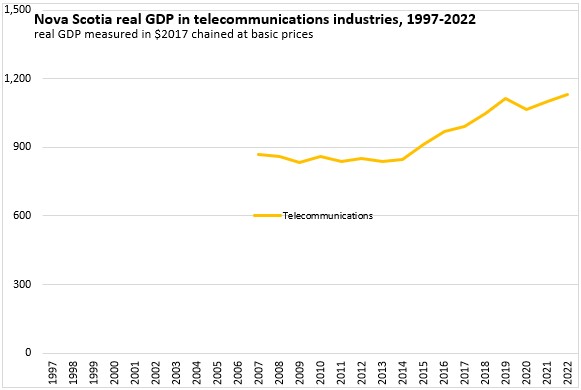

Telecommunications industries are by far the largest portion of Nova Scotia's information and cultural industries. There has been steady and substantial growth in Nova Scotia's telecommunications real GDP since 2014.

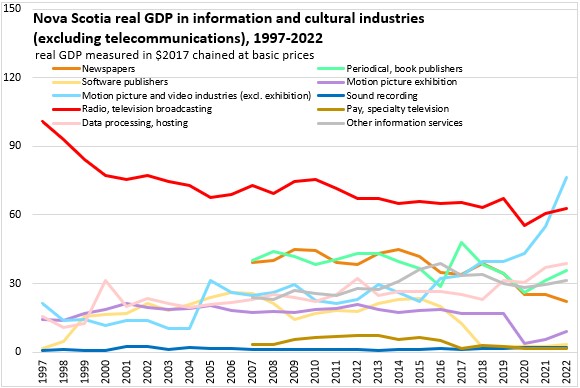

Among smaller industries in information and culture, there has been declining real GDP from radio/television broadcasting, newspapers and motion picture exhibition. There have been recent increases in real GDP from software publishers, data processing/hosting and motion picture and video industries outside of exhibition.

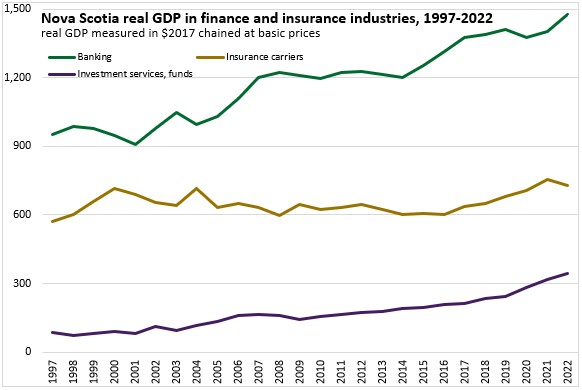

Real GDP from Nova Scotia banking and credit intermediation services has risen steadily since 2014. Real GDP from investment services and funds has growth since 2009. Real GDP from insurance carriers was flat from 2005-2017 before rising from 2018-2021 and declining in the last year.

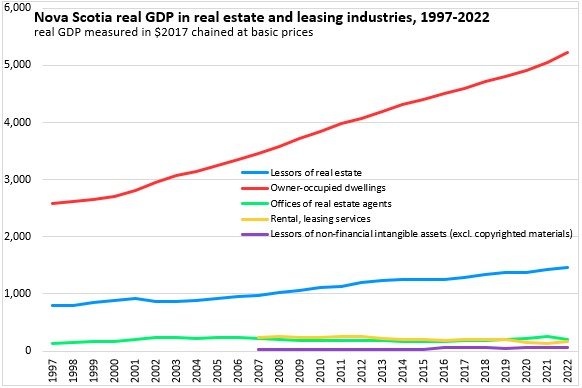

Real GDP by industry includes an imputed value for the real GDP generated by the housing services enjoyed by those who own the dwellings they occupy. This real GDP from owner-occupied dwellings has growth steadily and makes up the largest component of real GDP from real estate (even though it is never measured through an explicit housing services transaction). In contrast, the real GDP from leased real estate is measured explicitly and has also been rising steadily. Real GDP from real estate agents in Nova Scotia reported a spike in 2021.

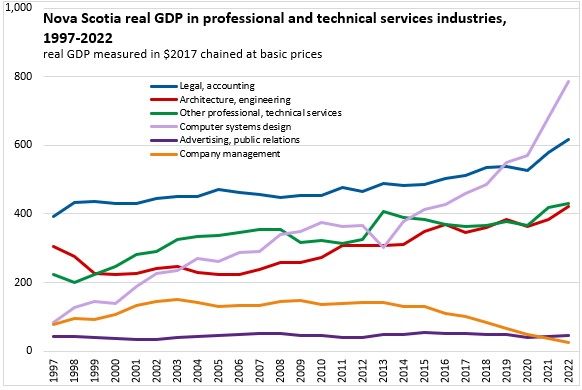

Professional and technical services in Nova Scotia accelerated during the pandemic, particularly for computer systems design. There have also been increases in real GDP for legal/accounting (except in 2022) and architecture/engineering. However, there have been steady declines in real GDP from company management in Nova Scotia (which is not categorized as part of professional/technical services).

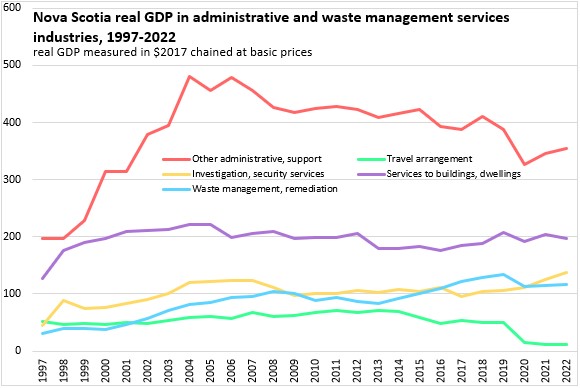

After rising rapidly from 1998-2004, there has been a protracted decline in real GDP from "other administration support" industries, which includes call centres. There have been downward trends in real GDP from services to buildings/dwellings and travel arrangement services.

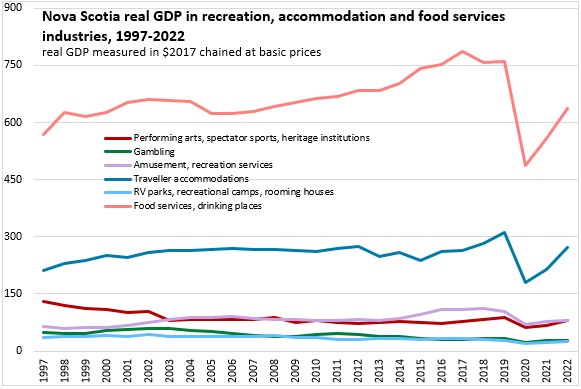

High-contact industries in arts/recreation and accommodation/food services exhibited the most severe contractions and rebounds during the COVID-19 pandemic. Neither traveller accommodations nor food services and drinking places had recovered to pre-pandemic levels of real GDP by 2022. Amusement and recreation services have returned to pre-pandemic levels of real GDP by 2022.

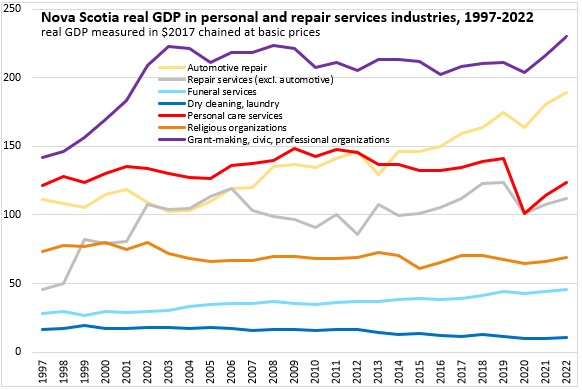

Among other services, there has been steady growth in real GDP from automotive repair. Like arts/recreation and accommodation/food, personal care services (such as hair care) reported a sharp decline and rebound in real GDP during the pandemic and have yet to recover to pre-pandemic levels.

Public sector real GDP increased steadily from 1997-2011 before contracting in the next two years and stabilizing through 2017. Since 2017, there has been a mostly steady rise in public sector real GDP in Nova Scotia, with the exception of 2020.

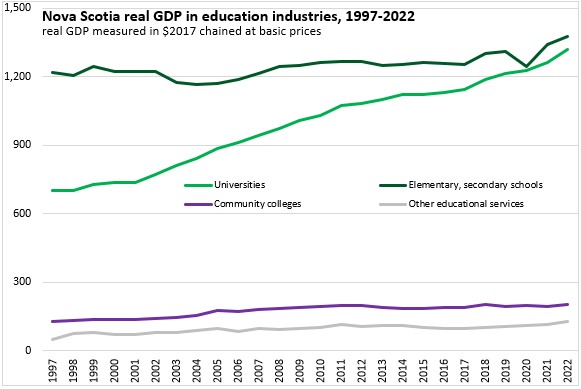

Nova Scotia's real GDP from education industries (which includes both public and private services), has increased largely on rising GDP from universities. Real GDP from elementary and secondary schools has been more stable. There was a notable contraction in real GDP from elementary and secondary schools in 2020, but this has rebounded beyond pre-pandemic levels in 2021 and 2022.

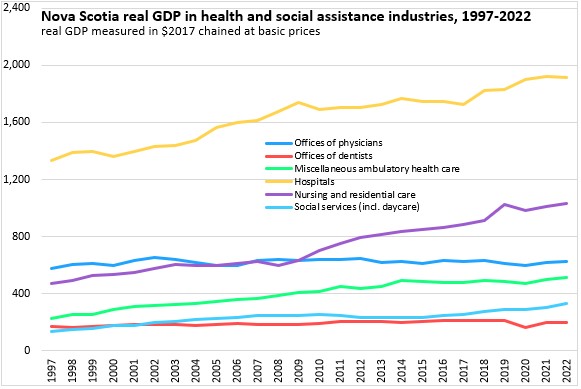

Real GDP from health care and social assistance (including both public and private industries) has been rising largely from hospitals and nursing/residential care facilities.

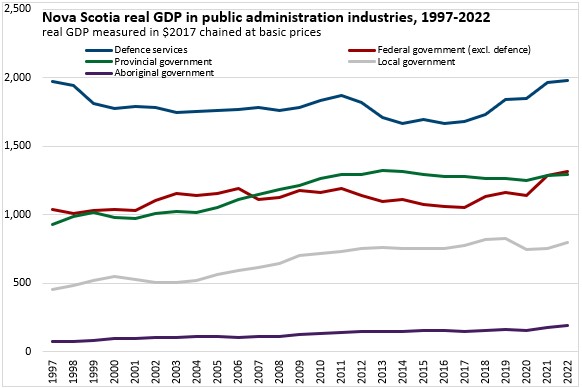

Within government services, there were notable declines in real GDP from Nova Scotia's defence services as well as the broader Federal government from 2011 through 2016 or 2017. Real GDP from provincial government services contracted from 2013 to 2017. Since 2017, real GDP from Federal government and defence services have risen faster than real GDP from other government services in Nova Scotia.

Source: Statistics Canada. Table 36-10-0402-01 Gross domestic product (GDP) at basic prices, by industry, provinces and territories (x 1,000,000); Table 36-10-0400-01 Gross domestic product (GDP) at basic prices, by industry, provinces and territories, percentage share

<--- Return to Archive