The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 10, 2023HIGH INCOME TRENDS AND EFFECTIVE TAX RATES, 2021 Statistics Canada has released the latest data for high income earners as well as effective income tax (Federal income, Provincial income, Federal payroll) and cash transfer rates (Federal and Provincial cash transfers). The latest data are from the 2021 taxation year, which does include some extraordinary effects (lower employment, higher cash transfers) as a result of the pandemic.

High income earners

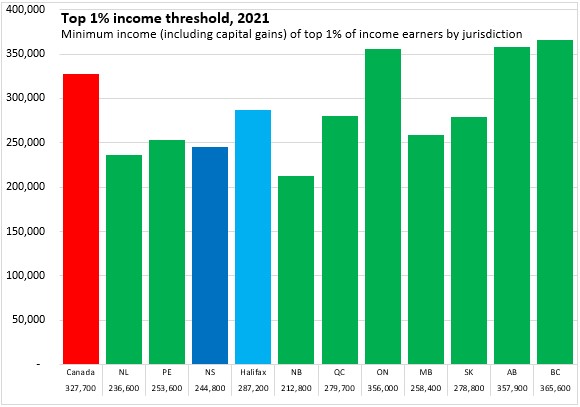

The threshold for the top 1 per cent of tax filers varies from Province to Province and from City to City. In Canada, those reporting total income (including capital gains) over $327,700 in 2021 represented the top 1 per cent of taxfilers.

In Nova Scotia, there are fewer individuals with higher incomes and the threshold of the top 1 per cent was $244,800. In Halifax, the threshold of the top 1 per cent of earners was $287,200.

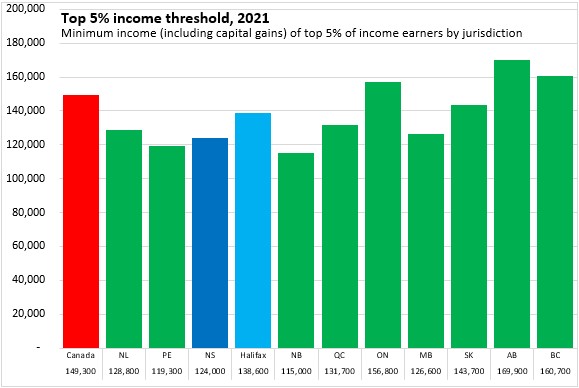

The top 5% of Canadian taxfilers had total income (including capital gains) of $149,300. In Nova Scotia, the top 5% of taxfilers had income of at least $124,000. Halifax's top 5% of taxfilers had incomes of at least $138,600.

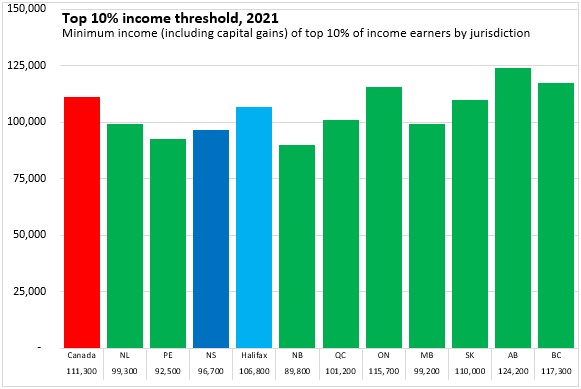

The top 10% of taxfilers in Canada had total income (including capital gains) of $111,300. For Nova Scotia, the top 10% of taxfilers had income of $96,700 or more; for Halifax the top 10% of taxfilers had income of $106,800.

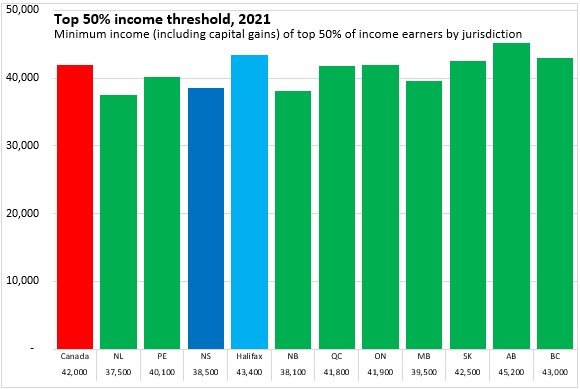

The upper threshold of income for the bottom 50% of taxfilers was $42,000 in Canada. It was $38,500 in Nova Scotia and $43,400 in Halifax.

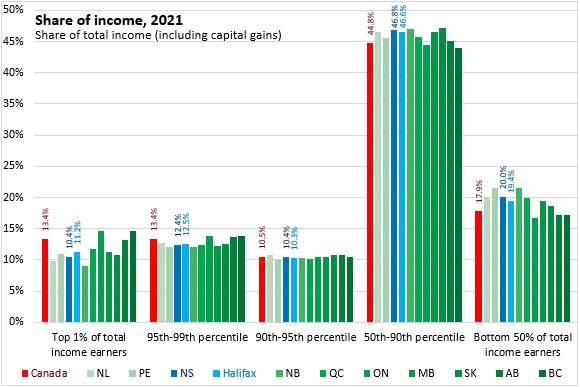

In Nova Scotia, the top 1% of earners reported 10.4% of the income and paid 16.9% of the income taxes. The top 1% of earners in Canada reported 13.4% of the total income (including capital gains) in 2021 and paid 23.5% of Federal and Provincial income taxes.

The 95th to 99th percentiles of Nova Scotia taxfilers reported 12.4% of the total income and paid 18.3% of the income taxes.

The 90th to 95th percentile of Nova Scotia taxfilers reported 10.4% of the total income and paid 13.6% of the income taxes.

The 50th to 90th percentiles of Nova Scotia taxfilers reported 46.8% of total income, but paid 44.6% of the income taxes.

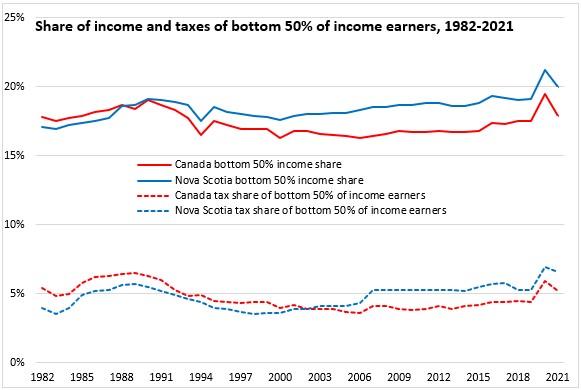

The bottom 50% of Nova Scotia taxfilers reported 20.0% of the income and paid just 6.6% of the income taxes.

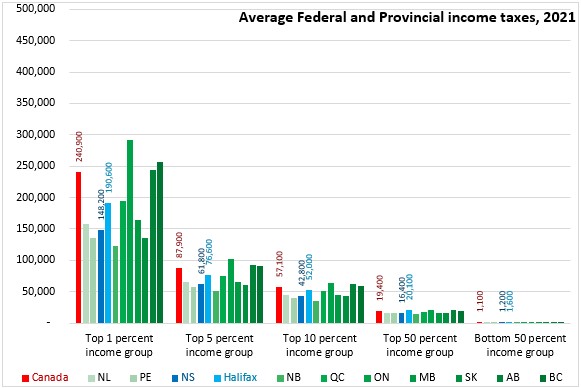

The average income of those among the top 1% of earners in Nova Scotia was $537,200 in total income (including capital gains), while their average income tax was $148,200 (Federal and Provincial).

The average income of those among the top 5% of earners in Nova Scotia was $235,300 in total income, while their average income tax was $61,800.

The average income of those among the top 10% of earners in Nova Scotia was $171,700 in total income, while their average income tax was $42,800.

The average income of those among the top 50% of earners in Nova Scotia was $82,700 in total income, while their average income tax was $16,400.

The average income of those among the bottom 50% of earners in Nova Scotia was $20,700 in total income, while their average income tax was $1,200.

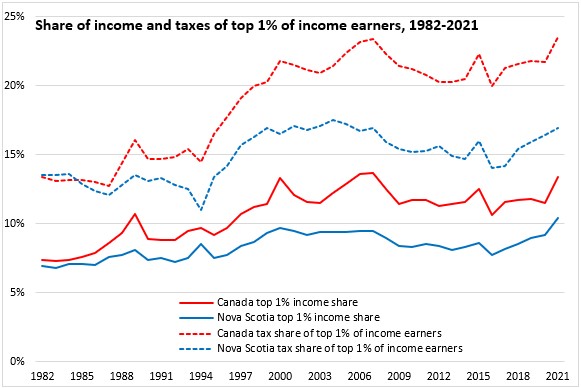

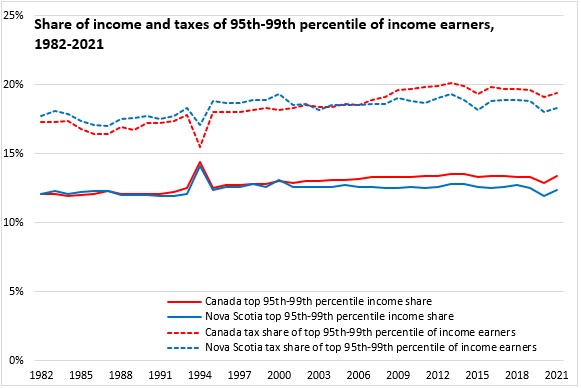

Over the period 1982-2021, the share of income accruing to the highest earners (top 1%, 95-99th percentile) has risen, though the portion of Federal and Provincial income taxes paid by these groups has risen even faster.

The share of income earned by those in the 95-99th percentiles rebounded in 2021.

Before 2021, the share of incomes for those in the 90th to 95th percentiles was declining. However, this reversed in 2021 (though the share of taxes paid by these earners was steady).

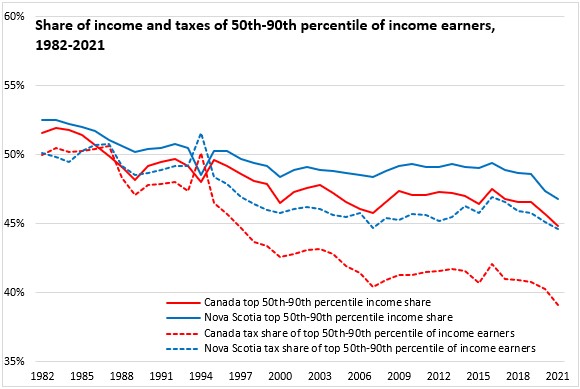

The share of incomes for the 50-90th percentiles has declined over the 1982-2021 period, particularly in the last two years. The share of taxes paid by these groups has also fallen.

In Nova Scotia, the share of income earned by the bottom 50% of taxfilers has risen over the last 20 years, before growing sharply in 2020 with the extraordinary government transfer income. Although the share of incomes earned by those at the bottom 50% of the income distribution has fallen, it remains above pre-pandemic levels.

Note: Total income consists of income from earnings, investments, pensions, spousal support payments and other taxable income plus government transfers and refundable tax credits. Federal Income taxes are derived from line 420 of the federal income tax return and exclude the Quebec abatement.

Effective tax and transfer rates

Statistics Canada's review of income trends also provides effective tax rates and transfer rates.

Effective tax rates measure the sum of Federal income tax, Provincial income tax and Federal payroll taxes as a share of modified total income.

Effective transfer rates measure the sum of Federal cash transfers plus Provincial cash transfers as a share of modified total income.

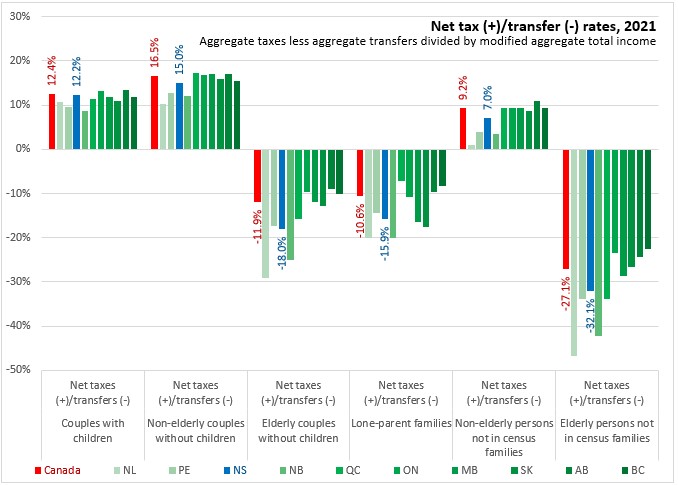

In the analysis below, those that report taxes in excess of transfers pay a positive net tax rate while those whose transfers exceed their taxes report a negative net tax rate.

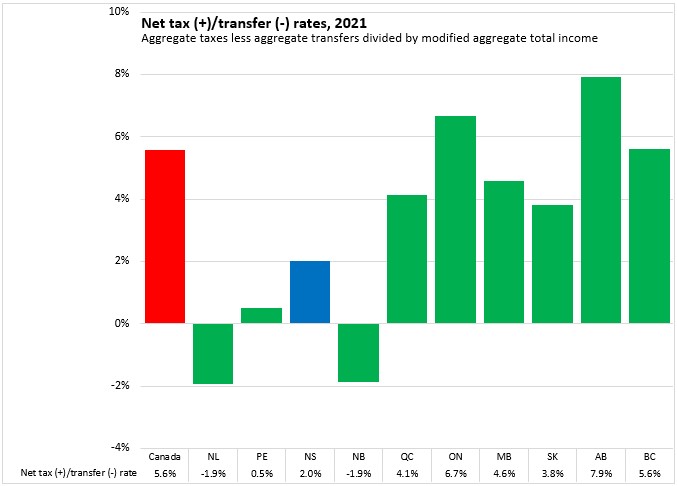

Across Canada, the effective tax rate was 19.6% in 2021. Nova Scotia's effective tax rate was just above this at 19.8%. The highest effective tax rates were reported in Québec while the lowest were reported in Saskatchewan, New Brunswick and British Columbia.

Transfer rates were highest in Newfoundland and Labrador and Labrador while the lowest rate of transfers was reported in Alberta. Nova Scotia's transfer rate was 17.7% of modified total income while the national average was 14.0%.

Nova Scotia's net effective rate (taxes less transfers) was a net tax of 2.0% of total income. Nationally, the net effective tax rate was 5.6%. The only negative net tax rates (taxes<transfers) were reported in Newfoundland and Labrador and New Brunswick. Atlantic Canada reported substantially lower or negative net tax rates.

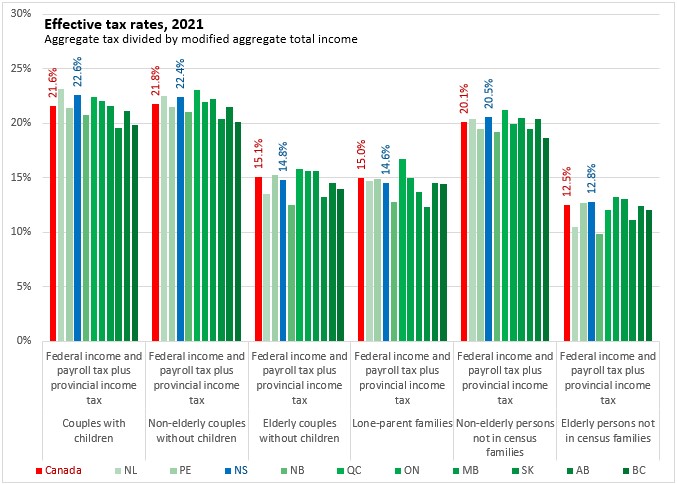

Canada's system of taxes and transfers make different provisions for certain family types and age cohorts. Tax rates were higher for non-elderly couple families and non-elderly persons not in a census family. There were lower effective tax rates for lone-parent families and elderly persons (whether in couples or not in census families).

Transfers were notably higher for elderly persons (reflecting public pension systems) as well as for lone-parent families. Other parents and non-elderly persons received much lower transfers as a share of income.

With higher transfer rates and lower tax rates, transfers exceeded taxes for the elderly as well as for lone parents. The highest net taxes were paid by non-elderly couples without children.

Source: Statistics Canada. Table 11-10-0054-01 Federal and provincial individual effective tax rates; Table 11-10-0056-01 High income tax filers in Canada, specific geographic area thresholds

<--- Return to Archive