The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 04, 2013MONETARY POLICY: EUROPE, ENGLAND, JAPAN In today's monetary policy announcements, neither the European Central Bank nor the Bank of England announced substantial changes to key interest rates or asset purchase programs. The European Central Bank noted that inflation has moderated recently and that inflation expectations are anchored below its 2 per cent medium term target. With weak economic growth expected to continue and persistent downside risks, the European Central Bank anticipates maintaining accommodative monetary policy "for as long as needed".

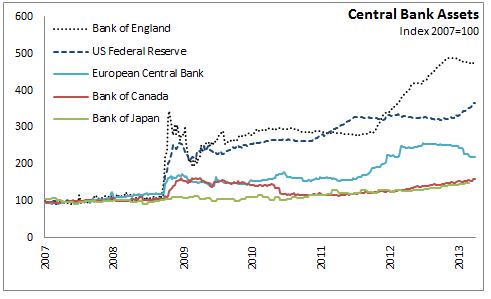

However, the Bank of Japan has introduced new quantitative and qualitative easing in its monetary policy in order to reduce deflationary pressures and achieve a price stability target of 2 per cent inflation. To achieve this inflation target within two years, the Bank of Japan intends to double the monetary base through purchases of Japanese government bonds as well as exchange traded funds. The Bank of Japan has changed its operating target for money market operations from the overnight rate to the monetary base. The Bank of Japan anticipates an annual pace of expansion of 60-70 trillion yen, doubling the monetary base to $270 trillion yen by the end of 2014.

The proposed doubling of the Japanese monetary base is not inconsistent with monetary expansion among other major central banks.

European Central BankBank of EnglandBank of England

<--- Return to Archive

European Central BankBank of EnglandBank of England

<--- Return to Archive