For additional information relating to this article, please contact:

June 26, 2020ANNUAL HOUSEHOLD WEALTH, 2019 Statistics Canada has released the 2019 results for wealth of Canadian households. These results are consistent with the Canadian System of Macroeconomic Accounts, but provide greater details than are available through the National Balance Sheet Accounts.

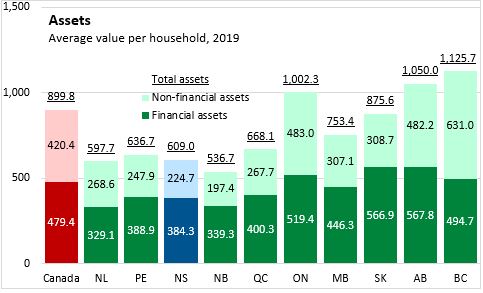

Across Canada, household assets had an average value of $899,785 per household in 2019 (all figures reported in charts are $000s of dollars at current prices).

Nova Scotia's average total asset values were lower at $608,973 per household. Average per household assets were highest in British Columbia, Ontario and Alberta. The lowest household assets were reported in Atlantic Canada.

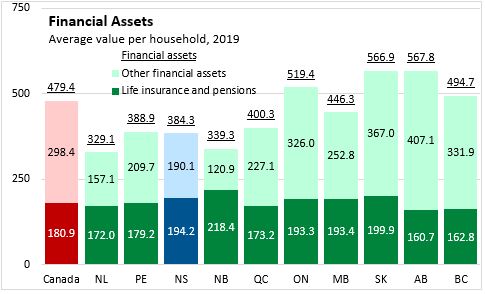

Financial assets were $479,363 per Canadian household in 2019 (53 per cent of total assets). Nova Scotian household had average financial assets of $384,312 in 2019 (61 per cent of total assets). Financial assets were more than half of asset values in all provinces except British Columbia. Saskatchewan and Alberta had the highest average value of financial assets while British Columbia reported the highest average value of non-financial assets (particularly for real estate). The lowest values of financial assets were observed in Newfoundland and Labrador while the lowest value of non-financial assets were reported in New Brunswick.

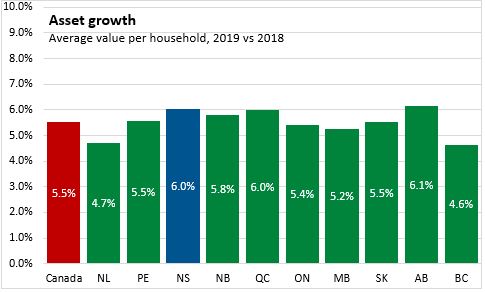

From 2018 to 2019, average household asset values increased by 5.5 per cent nationally, with growth in every province. The fastest increase in the value of assets were reported in Alberta, Quebec and Nova Scotia. Asset values per household grew somewhat more slowly in Newfoundland and Labrador and British Columbia.

Financial assets are categorized into life insurance/pension assets and other financial assets. Life insurance and pension assets averaged $180,925 per household in Canada during 2019. Nova Scotia's household life insurance and pension assets averaged $194,216. Life insurance/pension asset values per household are higher in New Brunswick and lower in Alberta and British Columbia.

The average household amount of other financial assets varies more widely, with higher amounts in Alberta and Saskatchewan and lower amounts in New Brunswick and Newfoundland and Labrador. The value of other financial assets averaged $298,438 per household in Canada during 2019 and $190,097 in Nova Scotia.

The value of financial assets per household declined in every province in 2018 (-1.6 per cent nationally and -1.5 per cent in Nova Scotia). In 2019, there was a strong rebound in financial asset values per household, rising by 8.3 per cent nationally (8.2 per cent in Nova Scotia). Increasing asset values ranged from a low of 7.6 per cent in Manitoba, Saskatchewan and Newfoundland and Labrador to 8.9 per cent in Alberta.

Real estate makes up the bulk of non-financial asset values in every province. National real estate assets amounted to $371,223 per household in 2019. Nova Scotia real estate assets averaged $181,295 per household in 2019. The highest real estate asset values were reported in British Columbia, Ontario and Alberta. The lowest average real estate assets were reported in New Brunswick.

Growth in the value of non-financial assets was much slower than the growth in the value of financial assets in 2019. National non-financial assets per household grew by 2.5 per cent in 2019. Nova Scotia non-financial assets grew at the same pace. Growth in the value of non-financial assets was faster in Alberta and slower in Newfoundland and Labrador.

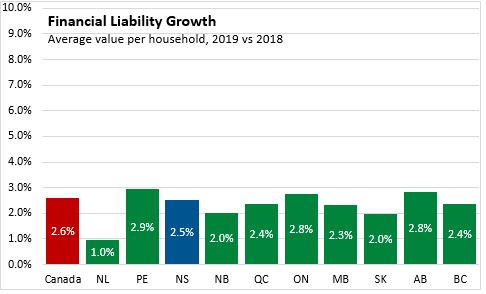

Statistics Canada' estimates that total financial liabilities averaged $149,612 per household in Canada during 2019. Nova Scotian households averaged $93,103 of financial liabilities in 2019. The lowest liabilities were reported in the Maritimes, particularly as mortgage liabilities were lower (consistent with lower real estate asset values). The highest financial liabilities were observed in Alberta, British Columbia and Ontario.

From 2018 to 2019, total financial liabilities per household increased by 2.6 per cent nationally (2.5 per cent in Nova Scotia). Growth in liabilities was notably slower in Newfoundland and Labrador and faster for Prince Edward Island, Ontario and Alberta.

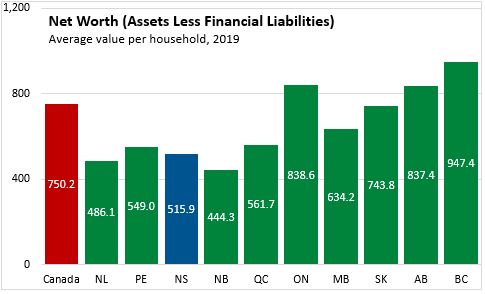

Net worth represents the difference in value between total assets and financial liabilities. National net worth amounted to $750,173 per household in 2019 with the highest net worth in British Columbia, Ontario and Alberta. Net worth was lower in Quebec and all Atlantic Provinces. Nova Scotia's net worth averaged $515,870 per household in 2019.

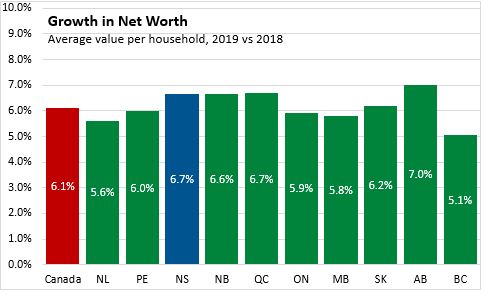

From 2018 to 2019, net worth per household increased in every province, particularly because of growth in the average financial asset value. National net worth grew by 6.1 per cent and all provinces reported a gain. Nova Scotia's new worth per household grew faster than the national average at 6.7 per cent in 2019. Net worth grew fastest in Alberta and slowest in British Columbia.

Statistics Canada: Table 36-10-0586-01 Distributions of household economic accounts, wealth, Canada, regions and provinces, annual (x 1,000,000)