For additional information relating to this article, please contact:

February 04, 2022LABOUR MARKET TRENDS - JANUARY 2022 Labour force survey results reflect the period from January 9 to 15. With the emergence of the Omicron variant in the middle of December, many provinces re-introduced new restrictions (such as capacity limits and closures) after the December reference week (December 5 to 11).

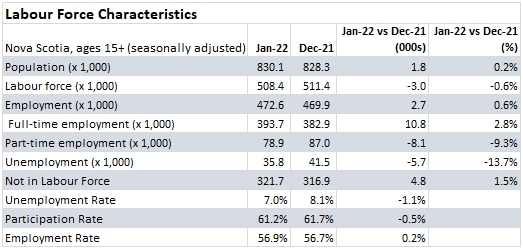

Ages 15+ (January 2022 vs December 2021, seasonally adjusted)

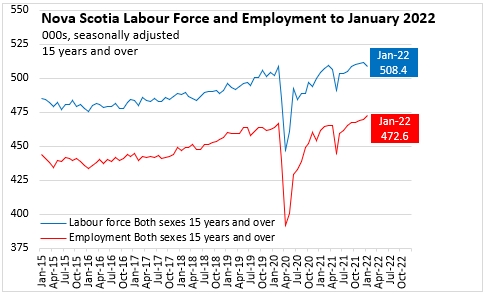

Nova Scotia's seasonally adjusted employment increased by 2,700 (+0.6%) from December 2021 to January 2022, rising to 472,600. This is the third consecutive month of modest employment gains in Nova Scotia.

Rising employment was attributable to a significant increase (+10,800) in full time employment offset by a drop (-8,100) in part time employment. These changes include variations in hours within the same job.

Nova Scotia’s labour force decreased 3,000 (-0.6%), falling to 508,400 after five consecutive months of increases.

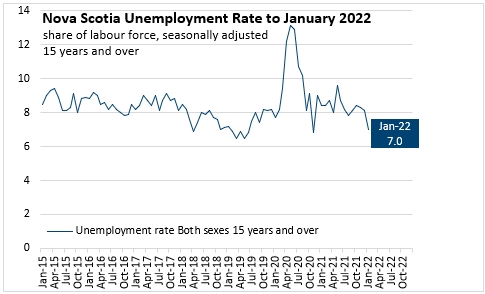

With a falling labour force and rising employment, Nova Scotia's unemployment rate declined from 8.1% in December 2021 to 7.0% in January 2022.

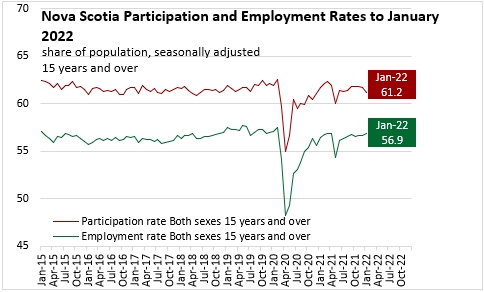

Nova Scotia's labour force participation rate declined 0.5 percentage points to 61.2% in January 2022. The employment rate increased 0.2 percentage points to 56.9% in January 2022. Although employment levels and employment rates have returned to pre-COVID benchmarks, the participation rate remains below the level observed in February 2020 (62.6%).

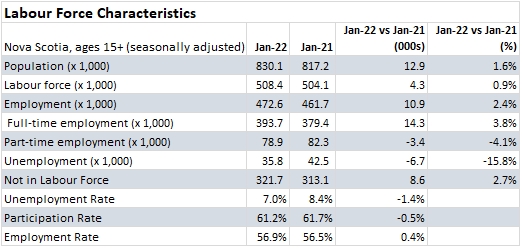

Ages 15+ (January 2022 vs January 2021, seasonally adjusted)

Compared with the same month last year, Nova Scotia's population increased by 12,900 while the labour force grew by 4,300 and employment increased by 10,900. The unemployment rate decreased by 1.4 percentage points while the participation rate declined by 0.5 percentage points. The employment rate increased by 0.4 percentage points.

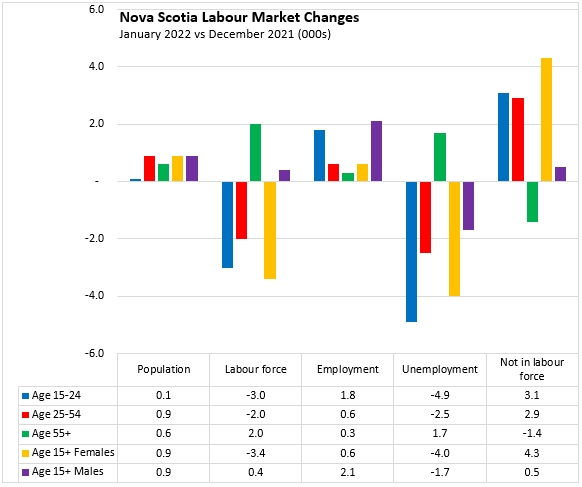

Age Cohorts (January 2022 vs December 2021, seasonally adjusted)

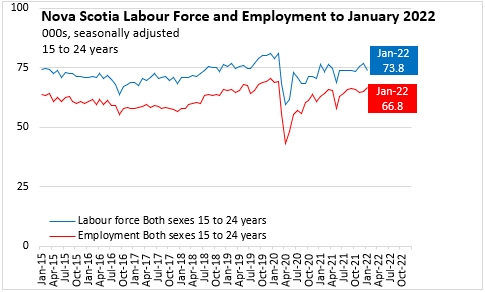

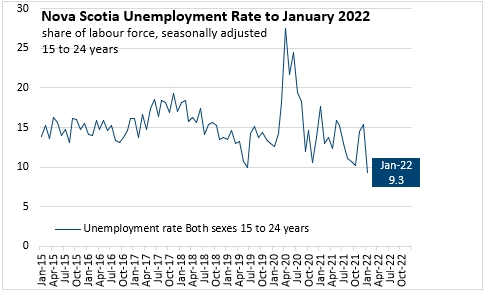

Among youth (ages 15-24), employment increased 1,800 (+2.8%) while the labour force declined by 3,000 (-3.9%). The decline in labour force reduced the youth participation rate down to 67.6%. The combination of rising employment and falling labour force pushed the youth unemployment rate down to 9.3%, which is the lowest youth unemployment rate in the monthly Labour Force Survey that started in 1976.

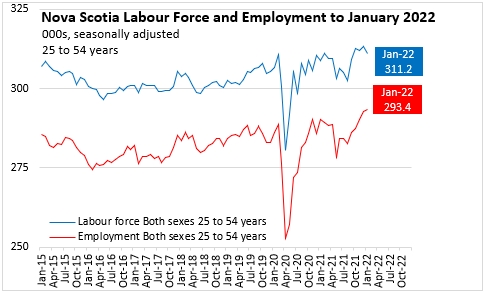

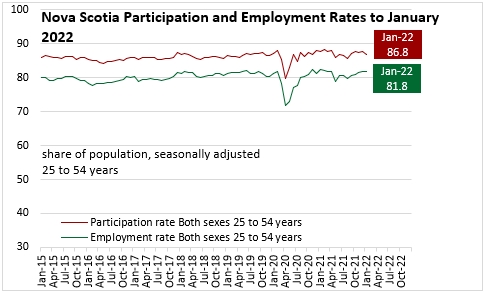

The population aged 25-54 makes up the largest part of the labour force. In this core age group, employment edged up by 600 (+0.2%) while the labour force contracted by 2,000 (-0.6%). As with youth, the combination of a lower participation rate (86.8%, down 0.8 percentage points) along with higher employment drove the core aged unemployment rate down by 0.7 percentage points to 5.8%.

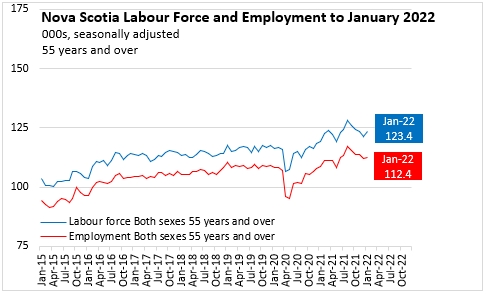

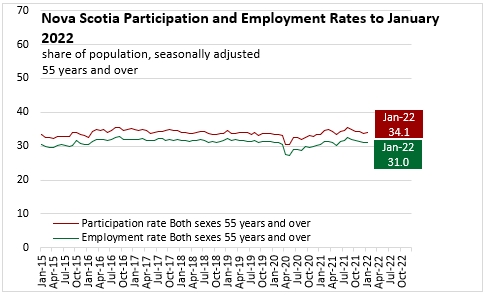

Older workers (aged 55+) reported increases in both labour force (+2,000 or 1.6%) and employment (+300 or 0.3%). Since the gain in employment was slower than the rise in labour force (the participation rate increased to 34.1%), the unemployment rate for older workers increased by 1.2 percentage points to 8.9%.

Males and Females (Ages 15+, January 2022 vs December 2021, seasonally adjusted)

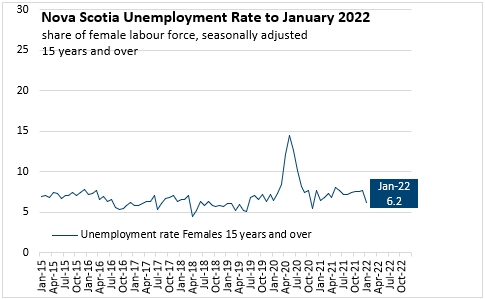

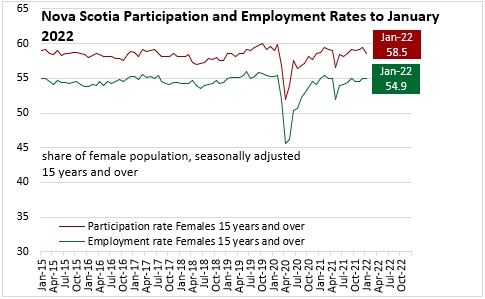

The female labour force declined by 3,400 (-1.3%) while female employment edged up by 600 (+0.3%). With the female participation rate falling 0.9 percentage points to 58.5% and the employment rate little changed at 54.9%, the female unemployment rate dropped by 1.5 percentage points to 6.2%.

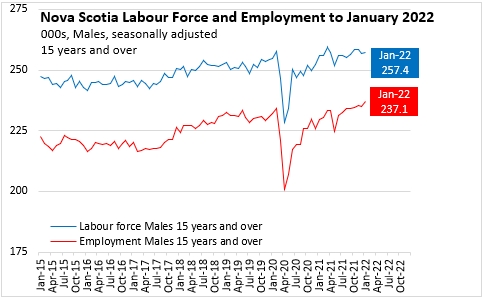

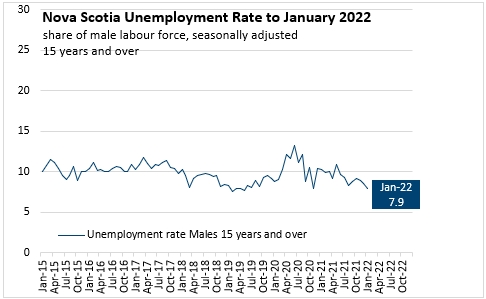

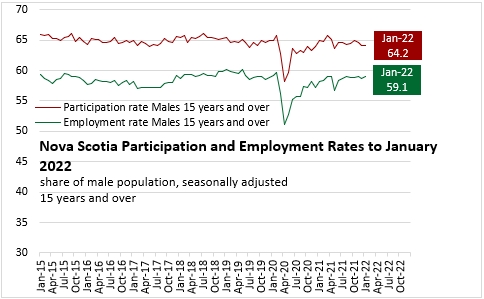

Male employment increased 2,100 (+0.9%) while male labour force edged up by 400 (+0.2%). The rise in employment pushed the male unemployment rate down by 0.7 percentage points to 7.9% while the male participation rate was little changed at 64.2%. The male employment rate edged up to 59.1%.

Overall, last month's decline in labour force was concentrated among youth and females while the rise in employment was concentrated among youth and males.

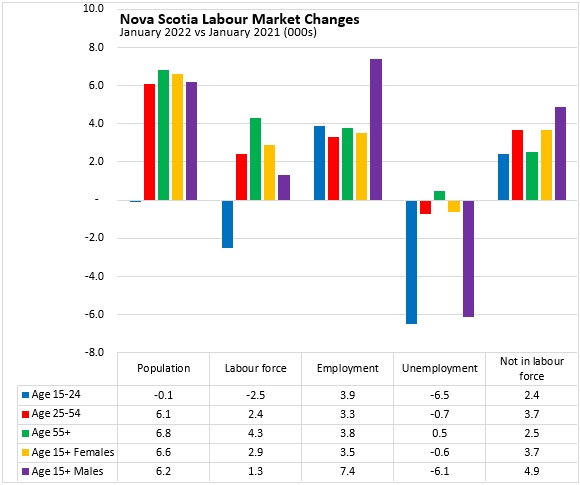

Age and sex cohorts (January 2022 vs January 2021, seasonally adjusted)

Since January 2021, employment gains were reported in each age cohort and the growth in male employment was notably faster than for females. The Labour force increased for all cohorts except youth and male labour force growth was slower than female labour force growth. Males and youth reported larger decreases in unemployment.

Class of Worker (January 2022 vs December 2021, seasonally adjusted)

Last month's employment gain was concentrated among private sector employees (+5,400 or +1.9%), offset by declines in public sector (-2,300 or -1.9%) and self-employment (-500 or -0.8%).

Class of Worker (January 2022 vs January 2021, seasonally adjusted)

Compared with January 2021, there were substantial gains in employment for private sector workers (+6,700 or +2.3%) and the self-employed (+6,800 or +12.6%) while public sector employment contracted (-2,600 or -2.1%).

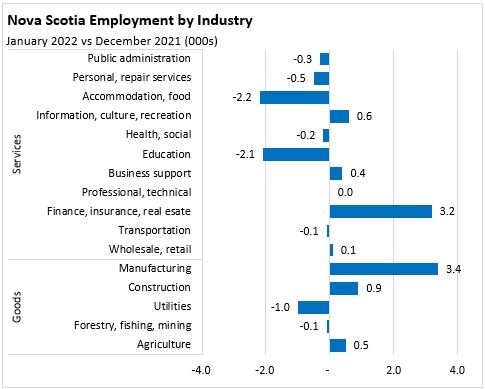

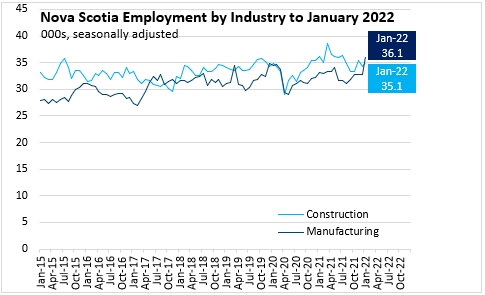

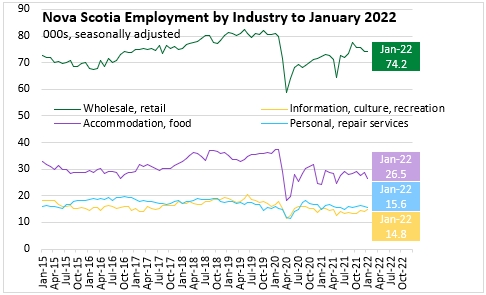

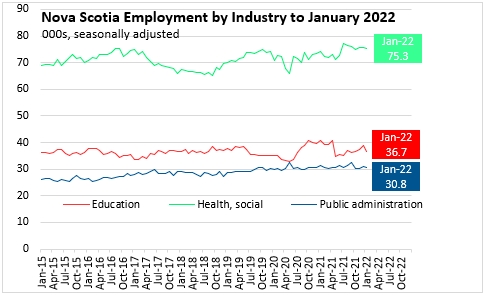

Industry of Employment (January 2022 vs December 2021, seasonally adjusted)

The employment gain from December to January is primarily attributable to rising employment in manufacturing, finance/insurance/real estate/leasing, construction and information/culture/recreation. These gains were offset by substantial declines in employment for workers in accommodation/food, education, utilities and personal/repair services.

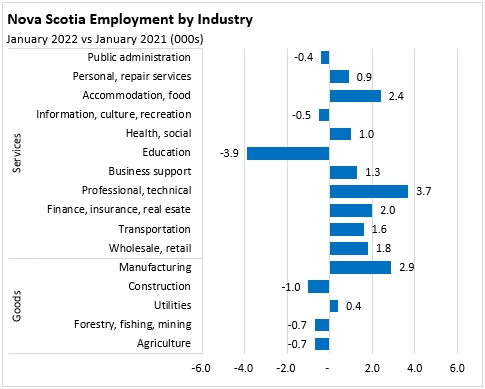

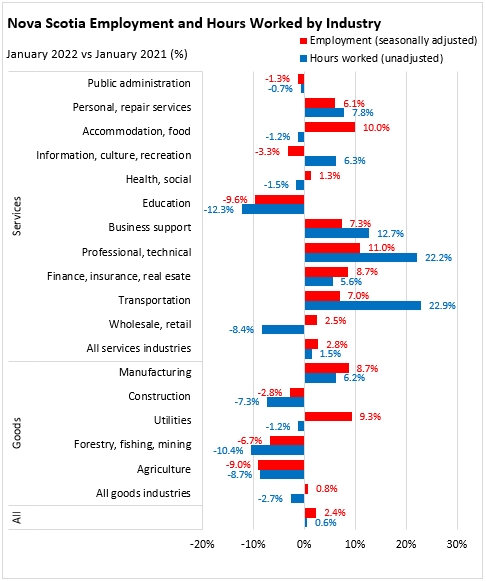

Industry of Employment (January 2022 vs January 2021, seasonally adjusted)

Over the last 12 months, employment has declined in education, construction, information/culture/recreation, resources, agriculture and public administration. However, these declines were more than offset by rising employment in other industries - notably professional/technical services, manufacturing, finance/insurance/real estate/leasing, accommodation/food, wholesale/retail, transportation/warehousing, business support (including call centres) and health/social.

Hours worked (January 2022 vs January 2021, unadjusted)

Unadjusted results for hours worked generally follow the changes in employment since January 2021. However, there are exceptions. Hours worked in transportation and warehousing increased by 22.9% even though employment only increased by 7.0%. Professional and technical services hours worked increased by 22.2% despite a 11.0% rise in employment. Wholesale and retail trade hours worked declined by 8.4% even as employment grew by 2.5%. Although information, culture and recreation employment was down 3.3%, total hours worked increased by 6.3%. Utility hours worked declined by 1.2% while employment grew by 9.3%.

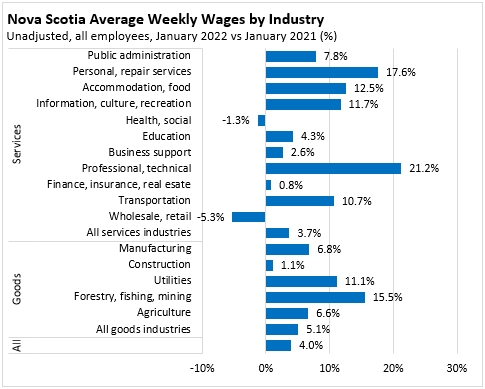

Average weekly earnings (unadjusted, both full time and part time, January 2022 vs January 2021)

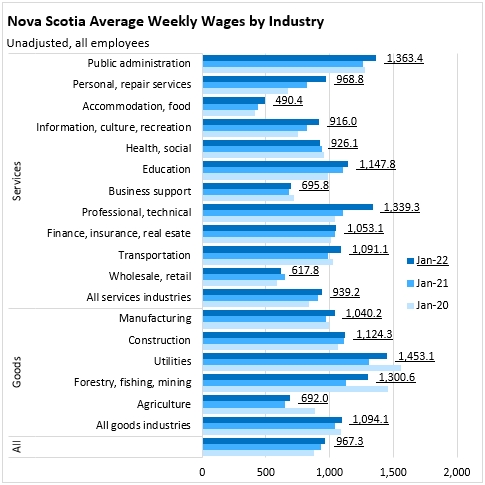

Average weekly earnings increased by 4.0% from January 2021 to January 2022. Earnings were up by double digits across several industries: personal/repair services, accommodation/food, information/culture/recreation, professional/technical services, transportation/warehousing, utilities and forestry/fishing/mining. Only wholesale/retail and health/social reported lower average weekly earnings.

Average weekly earnings (including both full time and part time employees) across all industries were $967.26 in January 2022. Earnings were highest in utilities, public administration, professional/technical services, forestry/fishing/mining, education and construction. Average weekly earnings were lowest in accommodation/food, wholesale/retail, agriculture and business support (including call centres).

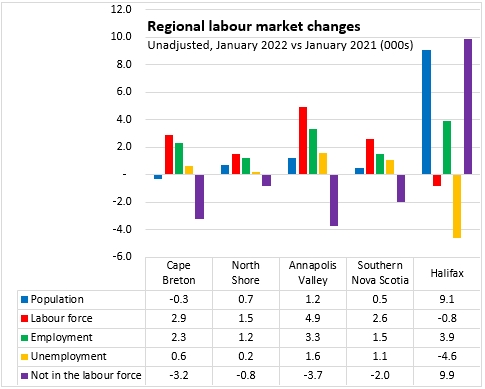

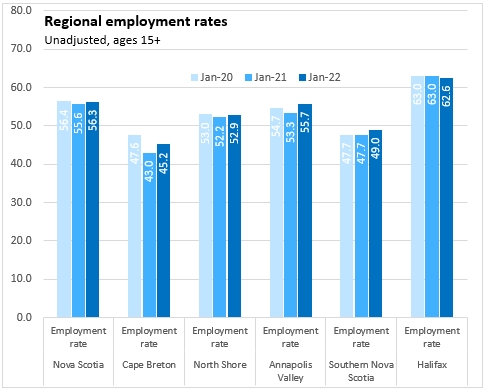

Regions (January 2022 vs January 2021, unadjusted 3 month moving average)

Regional results for January are three month moving averages from the period November-January. As restrictions were changing over this period, results do not reflect the full extent of labour market volatility observed in monthly results for the province as a whole.

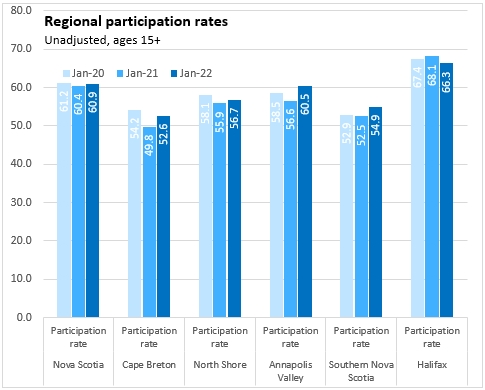

Compared with January 2021, both labour force and employment increased for all regions outside of Halifax. However, labour force growth was faster than employment growth in all regions outside Halifax, boosting participation rates and raising unemployment rates for all regions outside Halifax (Cape Breton, the North Shore, the Annapolis Valley and Southern Nova Scotia). In Halifax, labour force declined reducing the participation rate while employment grew, pushing the unemployment rate down.

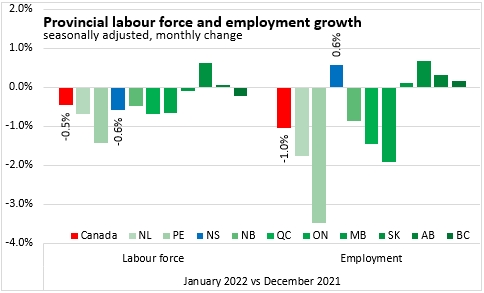

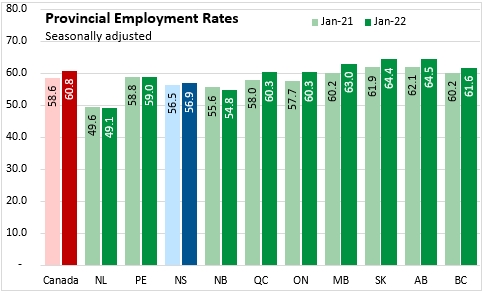

Provincial Comparisons (January 2022 vs December 2021, seasonally adjusted)

Canada's employment declined by just over 200,000 (-1.0%) from December to January, reflecting the impact of newly-implemented restrictions to contain the Omicron variant of COVID-19. Employmeent was down by 1.0% nationally with the largest declines in Prince Edward Island, Ontario and Newfoundland and Labrador. Saskatchewan reported the largest employment increase. The labour force was down 0.5% nationally with declines in 8 of 10 provinces (only Saskatchewan and Alberta reported gains). The largest contraction in labour force was reported in Prince Edward Island.

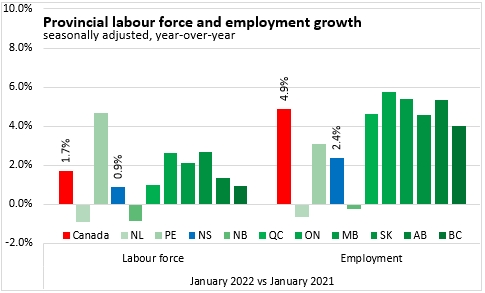

Provincial Comparisons (January 2022 vs January 2021, seasonally adjusted)

Compared with January 2021, national employment was up 2.4% while labour force increased by 1.7%. Only Newfoundland and Labrador and New Brunswick reported declining labour force and employment. All other provinces reported rising labour force and employment. The fastest gains in employment were reported in Quebec and the largest increases in labour force were in Prince Edward Island.

The national unemployment rate was 6.5% in January 2022, down from 9.4% in January 2021. Newfoundland and Labrador reported the highest unemployment rate while the lowest unemployment rates were reported in Manitoba and British Columbia.

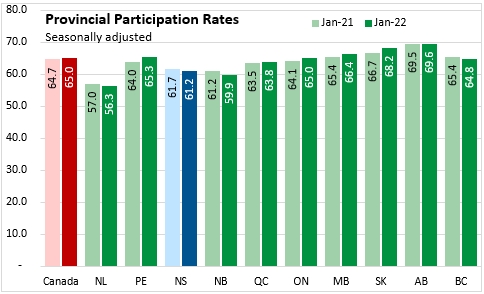

The national participation rate was 65.0% in January 2022. The highest participation rates were in Alberta and Saskatchewan while the lowest were in Newfoundland and Labrador.

The national employment rate was 60.8% in January 2022. Alberta and Saskatchewan reported the highest employment rates while Newfoundland and Labrador reported the lowest.

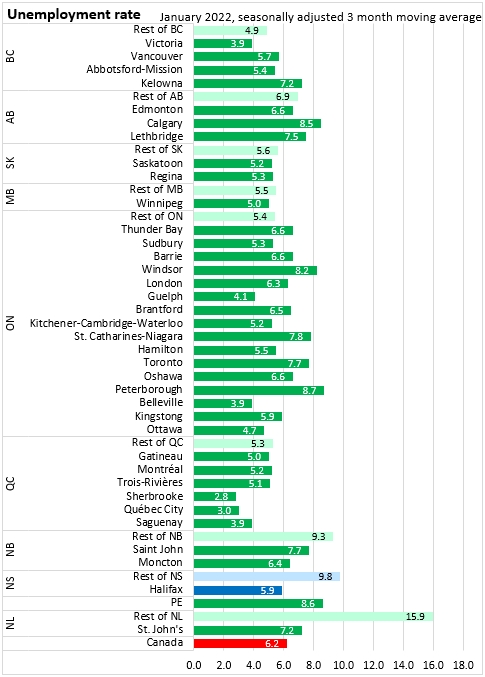

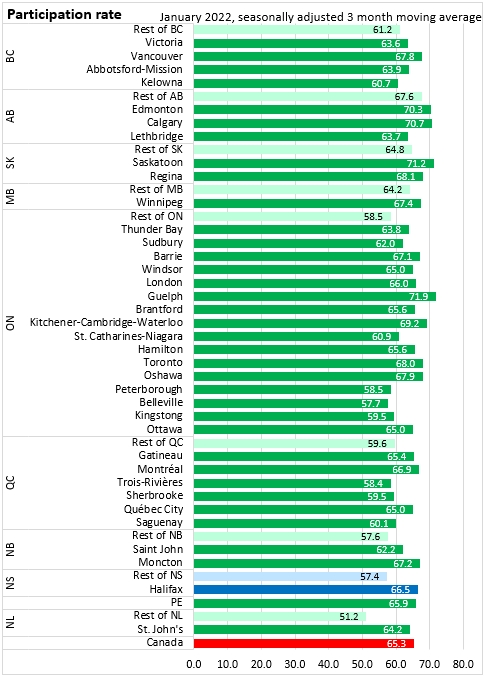

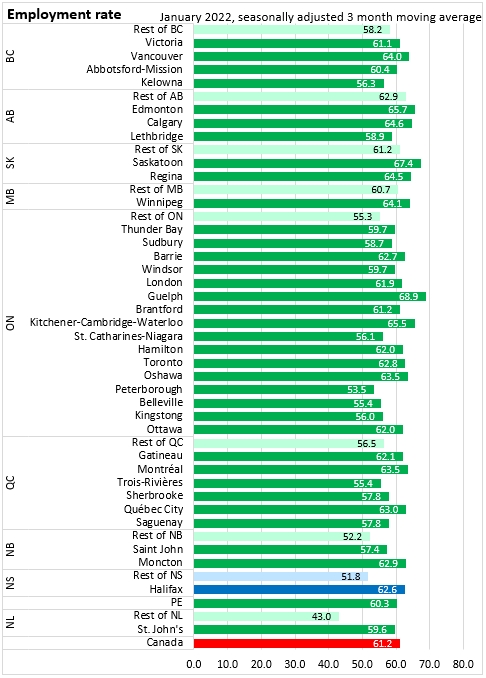

Census Metropolitan Areas (January 2022, seasonally adjusted 3 month moving average)

Data for Census Metropolitan Areas are three month moving averages from November 2021 to January 2022. As restrictions changed over these months, the three month moving averages may not reflect the volatility observed from month to month.

The Halifax unemployment rate was 5.9% in the January 2022 three month moving average. This was similar to other Census Metropolitan Areas, but lower than in the rest of Nova Scotia. Generally, unemployment rates in Census Metropolitan Areas are similar to unemployment rates outside CMAs; the Atlantic Provinces are the exception with substantially higher unemployment rates outside CMAs.

Halifax's participation rate was 66.5% in the January 2022 three month moving average.

Halifax reported an employment rate of 62.6% in the January 2022 three month moving average.

Sources: Statistics Canada. Table 14-10-0036-01 Actual hours worked by industry, monthly, unadjusted for seasonality; Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality; Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle, last 5 months; Table 14-10-0294-01 Labour force characteristics by census metropolitan area, three-month moving average, seasonally adjusted and unadjusted, last 5 months; Table 14-10-0293-01 Labour force characteristics by economic region, three-month moving average, unadjusted for seasonality, last 5 months; Table 14-10-0355-01 Employment by industry, monthly, seasonally adjusted and unadjusted, and trend-cycle, last 5 months (x 1,000); Table 14-10-0288-01 Employment by class of worker, monthly, seasonally adjusted and unadjusted, last 5 months (x 1,000); Table: 14-10-0380-02 Labour force characteristics, three month moving average, seasonally adjusted (x 1,000)