For additional information relating to this article, please contact:

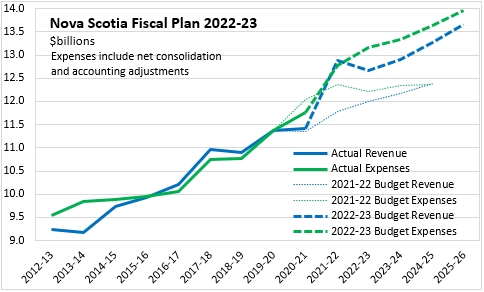

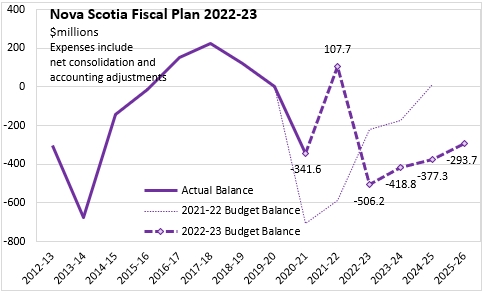

March 29, 2022NOVA SCOTIA BUDGET 2022-23 Nova Scotia has tabled its 2022-23 Budget, including a $506.2 million deficit on revenues of $12.662 billion and expenditures of $13.293 billion along with consolidation adjustments of $124.4 million. This follows from a forecast surplus of $107.7 million for the 2021-22 fiscal year. Over the course of the subsequent three fiscal years, Nova Scotia's deficit is projected to narrow, falling to $293.7 million in 2025-26. From 2022-23 through 2025-26, Nova Scotia's revenues are projected to grow at a compound annual average rate of 2.6% per year while expenditures increase by 1.6% per year.

The fiscal plan presented in the 2021-22 Nova Scotia budget anticipated a revenue decline, rising expenditures and a deficit of $585 million. Forecast revenues for 2021-22 fiscal year were $1.1 billion higher than the Budget Estimate, including adjustments for prior years revenues while expenditures were $456 million above the Budget Estimate. For 2022-23, Nova Scotia's revenues are projected to decline while expenditures are projected to rise, leading to an estimated deficit of $506 million. Over subsequent fiscal years, faster growth in revenues than in expenditures narrows projected deficits.

With stronger growth in revenues than expenditures in 2021-22, the estimated deficit of $585 million turned into a surplus of $107.7 million. In 2022-23 and subsequent fiscal years, the new fiscal plan anticipates deficits in each of the next four fiscal years.

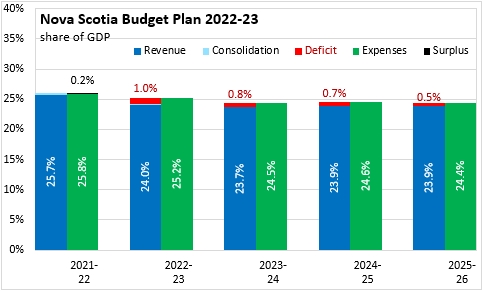

The footprint of the provincial government in the Nova Scotia economy is estimated at 25.2% of GDP in 2022-23. This is projected to shrink - falling to 24.4% of GDP by 2025-26. The deficits projected are equivalent to 1.0% of GDP in 2022-23, falling to 0.5% of GDP by 2025-26.

Nova Scotia's net debt is forecast to have declined to 33.5% of GDP in 2021-22. In 2022-23 this is projected to rise to 34.9%. In the subsequent three fiscal years, Nova Scotia's debt is projected to rise to 40.0% of GDP (including the impact of larger capital expenditures).

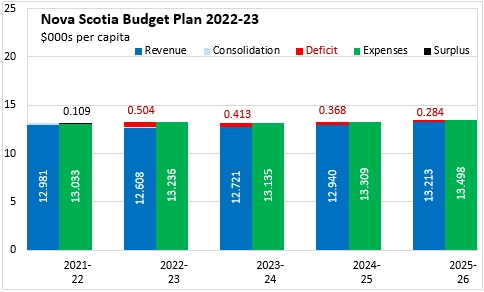

On a per capita basis, the provincial government is estimated to spend $13,236 per resident in Nova Scotia against revenues amounting to $12,608 per capita and a deficit of $504 per capita (and consolidation adjustments of $124 per capita). Per capita deficits are projected to narrow to $284 per capita by 2025-26 as revenues rise to $13,213 per capita while expenditures grow to $13,498 per capita.

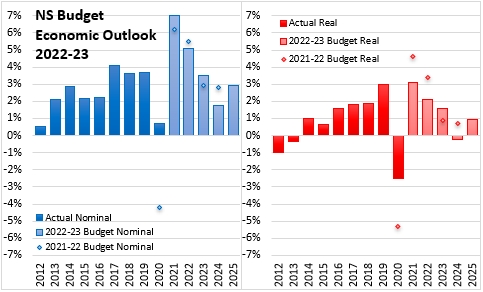

Nova Scotia's economy experienced a comparatively small decline in real GDP in 2020 (-2.5%) while nominal GDP growth remained positive (0.7%). With less of a drop, the rebound in real GDP for 2021 is also estimated to be more modest (3.1%) than previously forecast. Nominal GDP growth for 2021 is now estimated at 7.0% including the effects of higher inflation in 2021. For 2022 and 2023, Nova Scotia's economic conditions continue to normalize after the shock of COVID-19.

The Budget Estimate assumes real GDP will grow by 2.1% in 2022 while nominal GDP grows 5.1%. Growth in population, nominal household consumption spending, business and government non-residential investment and exports of goods are all expected to contribute to rising GDP. While nominal residential construction expenditures are expected to contract slightly in 2022, they remain significantly higher than pre-pandemic levels. By 2022, many key indicators are projected to be above not just pre-pandemic levels, but the trends estimated prior to the outbreak of COVID-19.

In 2023 and beyond, Nova Scotia's GDP growth is projected to converge back to pre-pandemic trends, albeit with volatility that depends on the pace of major project activities and infrastructure spending.

The Nova Scotia economic outlook is subject to risks from geopolitical events such as the Russian invasion of Ukraine and inflation associated with the shock to commodity markets. Major project activity over the medium term is also subject to possibly constraints in labour supply.

Key Measures and Initiatives

Nova Scotia's 2022-23 Budget focuses on solutions for health care as well as for the economy (workforce, businesses, housing) and the future (community and family supports, education, green/vibrant communities). The 2022-23 Budget introduces a new Non-Resident Deed Transfer Tax in the amount of 5% of the value of residential real property purchased by a non-resident of Nova Scotia, with exemptions for purchasers that move to Nova Scotia within 6 months of closing. The 2022-23 Budget also introduces a Non-Resident Property Tax in the amount of $2.00 per $100 of assessed value on residential real property owned by a non-resident, excluding multi-unit (3+) dwellings and those on 12+ month lease to a Nova Scotia resident.

Solutions for Healthcare

Laying the foundation for mental health:

- expanding mental health virtual care

- hiring 22 new clinicians for outpatient clinics

- enhancing virtual care at emergency departments

- opening the first mental health acute day hospital in Halifax

- adding 2 clinical assistants in the Eastern Zone

- adding 4 psychology residents

- increasing withdrawal management services

- supporting the Provincial Opiod Action Plan

Improving access to primary care:

- making virtual care available to everyone on the Need a Family Practice Registry

- supporting healthcare professional recruitment

- adding 200 more nursing seats

- supporting access and flow initiatives to improve timely care and efficient use of resources

- expanding operating room hours and adding beds/staffing for surgeries at the Dartmouth General Hospital

- addressing surgery backlogs at the IWK

- funding more cataract surgeries

- expanding operating room capacity in Cape Breton

- increasing cardiac and renal programs

- meeting increased demand for endoscopy and cystoscopy services

- establishing an obesity clinic in the Eastern Zone

- adding funds for hospices

- increasing funding for medications, pharmacare programs and CAR T-cell Therapy

- increasing Public Health capacity with new hiring

- delivering vaccines and boosters to protect against COVID-19

- adding funds for the Newcomer Health Clinic

- expanding the Nova Scotia Brotherhood Initiative

- collecting and analyzing race-based data to address inequities in healthcare and better serve racialized people

- funding for healthcare redevelopment projects (QEII and Cape Breton Regional Municipality) as well as construction, repair and renewal at other facilities

Investing in long term care:

- raising wages for Continuing Care Assistants

- supporting recruitment/retention in continuing care

- increasing staffing levels to at least 4.1 hours of one-on-one care per long-term resident

- adding staffing in long-term care

- extending/converting new long term care spaces

- making workplace safety investments in long term care

- making the Seniors Care Grant to help seniors stay in their homes longer

Solutions for the Economy

Strengthening workforce and businesses:

- starting the More Opportunities for Skilled Trades (MOST) program which returns provincial personal income tax paid on the first $50,000 of earnings for eligible people under 30.

- increasing skills trades in schools programs

- supporting newcomers and immigrant programs with new staffing

- expanding immigration services in communities

- continuing marketing campaigns for immigration and population growth

- refreshing the Innovation Rebate Program

- adding to Tourism Nova Scotia's visitor attraction funding

- classifying and monitoring coastal areas to support low-impact sustainable aquaculture

Taking action on housing solutions:

- increasing funding for affordable housing programs

- creating new rent supplements

- leveraging Federal funding under the National Housing Strategy

- supporting the joint planning task force on housing in Halifax Regional Municipality

- planning for new residences at NSCC campuses

- undertaking land transfer initiatives for housing related provincially-owned land

Solutions for Our Future

Supporting Nova Scotians:

- increasing Disability Support Program in residential and community-based settings

- helping transitions from adult residential centres and residential rehabilitation to community-based settings

- removing the cap on Independent Living Support program

- expanding eligibility for Direct Family Support for Children

- supporting young adults as they transition out of long-term care homes

- increasing the Disability Support Flex Program, the Supportive Care Program and the Self-Managed Care program

- introducing a Fertility and Surrogacy Rebate

- supporting post secondary students with accessibility needs

- increasing the Nova Scotia Child Benefit

- implementing an integrated health services care model for pre-school aged children with autism spectrum disorders

- increasing prevention and early intervention programs under Child and Youth Family Services

- supporting modular housing units in Halifax, funding emergency shelters and volunteer shelters in rural areas

- adding new supports for people experiencing homelessness

- redesigning the Foster Care program

- increasing funding to prevent domestic violence

- expanding victims' services supports

- supporting the Public Prosecution Service to address timeliness

- adding 13 additional cancers and heart attack coverage for firefighters receiving workers compensation

Investing in Children and Education

- lowering fees, adding subsidies and creating more spaces for childcare, including after-school care

- supporting pre-Primary enrolment growth

- implementing recommendations from the Commission on Inclusive Education

- continuing Healthy Schools Grants

- increasing public education system settlement services, including English as an Additional Language teachers

- building and renovating schools across the province

- establishing a Children's Sports and Arts Refundable Tax Credit

Investing in Green and Vibrant Communities

- funding the provincial share of green and transit projects under the Canada Infrastructure Program

- conducting energy audits of provincial buildings

- expanding electric vehicle charging stations

- establishing three regional offices (Digby, New Glasgow, Preston) for African Nova Scotian Affairs

- establishing a joint regional transportation agency

- revitalizing rinks

- redesigning and upgrading Charlotte Street in Sydney

- repairing roads, highways, bridges, including rural and gravel roads

Nova Scotia Budget 2022-23