For additional information relating to this article, please contact:

July 05, 2023STUDY: THE IMPORTANCE OF SHORT-TERM RENTALS IN THE ACCOMMODATION SERVICES SUBSECTOR, 2017 TO 2021 Statistics Canada recently released a study examining the expansion of private short-term rentals (STRs) in the accommodation services subsector, 2017 to 2021. This study defined private short-term rentals as privately owned units made available for rent via online platforms in short-term intervals, typically between 1 and 28 days. These short timelines have these rentals competing with traditional commercial accommodations for travellers and differ with the rental and leasing of real estate that operates on monthly and yearly intervals. The study uses data from AirDNA and Statistics Canada’s accommodation services survey data. This article provides a summary of the findings of the study.

In Nova Scotia, the share of revenue of private short-term rentals in accommodations services subsector grew from 7.2% in 2017 to 19.9% in 2021. Nationally the share of revenue of private short-term rentals increased from 7.0% in 2017 to 15.2% in 2021. In 2021, the largest share was in Prince Edward Island and the smallest share was in Nunavut territory.

In Halifax, the share of revenue of private short-term rentals in accommodations services subsector grew from 9.2% in 2017 to 17.5% in 2020 and decreased to 14.3% in 2021. The growth across census metropolitan areas was uneven. All census metropolitan areas revenue share grew from 2017 to 2021 except Montreal. In 2021, the largest share was in Montreal and the smallest share was in Edmonton.

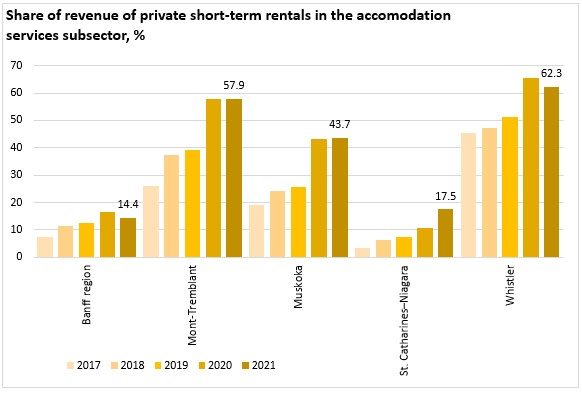

The share of revenue of private short-term rentals in accommodations services subsector grew in all selected tourist regions from 2017 to 2021. In 2021, the largest share was in Whistler (62.3% of accommodation revenue with private short-term rentals) and the smallest share was in Banff region.

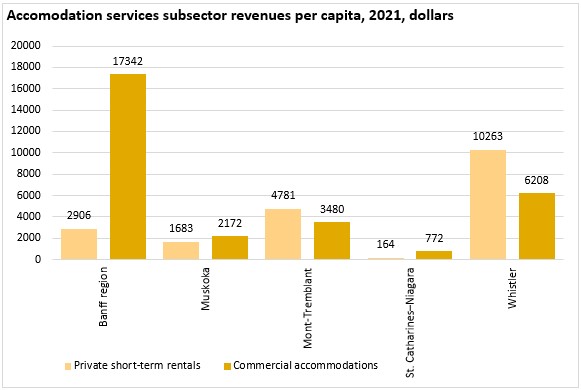

Private short-term rentals revenues per capita were largest in Whistler and smallest in St. Catherines-Niagara in 2021.

Looking at the share of revenue that goes to commercial and private short-term rentals across different geographies (CMAs, tourist markets, and rest of Canada). Commercial accommodations - in 11 census metropolitan areas share of revenue in accommodations services subsector declined from 43.4% in 2017 to 32.8% in 2021. Private short-term rentals in the 11 census metropolitan areas share of revenue in accommodations services subsector grew from 2017 to 2019 and declined in 2020 and 2021.

Commercial accommodations in tourist markets (Banff region, Mont-Tremblant, Muskoka, St. Catharines–Niagara and Whistler) share of revenue in accommodations services subsector declined from 6.6% in 2017 to 5.6% in 2021. Private short-term rentals in the tourist markets (Banff region, Mont-Tremblant, Muskoka, St. Catharines–Niagara and Whistler) share of revenue in accommodations services subsector grew from 0.9% in 2017 to 2.5% in 2021.

Commercial accommodations in the rest of Canada share of revenue in accommodations services subsector grew from 42.8% in 2017 to 46.4% in 2021. Private short-term rentals in the rest of Canada share of revenue in accommodations services subsector grew from 2.6% in 2017 to 9.4% in 2021.

Sources: The growing share of private short-term rental revenue in the Canadian accommodation services subsector: Trends from 2017 to 2021