For additional information relating to this article, please contact:

September 10, 2024CANADIAN HOUSING SURVEY, 2022 Today, Statistics Canada released results from the 2022 Canadian Housing Survey with data on housing affordability, core housing need and its dimensions, household composition, first-time home buyers, and indicators related to moving. Data are available at the provincial level, as well as for different population centre sizes, census agglomerations, and census metropolitan areas. Collection for the 2022 Canadian Housing Survey took place from October 31, 2022 to March 31, 2023.

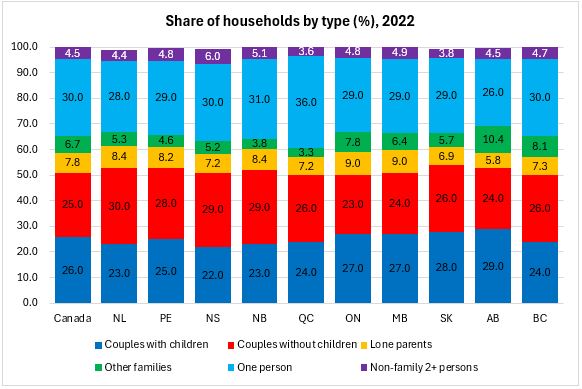

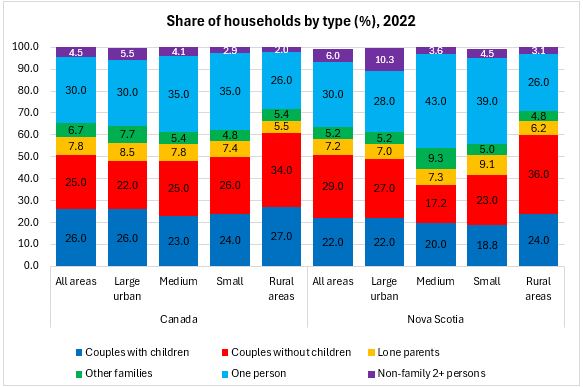

In 2022 in Nova Scotia, there were 432,200 households, of which the largest shares were single person households (30.0%) and couples without children (29.0%). Compared to the national average, Nova Scotia had a higher share of couple households without children, as well as non-family households with 2 or more people. Nova Scotia had a smaller share of couples with children, lone-parent households as well as other families compared to the national average.

The portion of couple families without children among households was notably higher in Nova Scotia's rural areas (as it was in Canada's rural areas). In Nova Scotia's small population centres, the share of one-person households and lone-parent families was higher (and the share in couple families with children was lower).

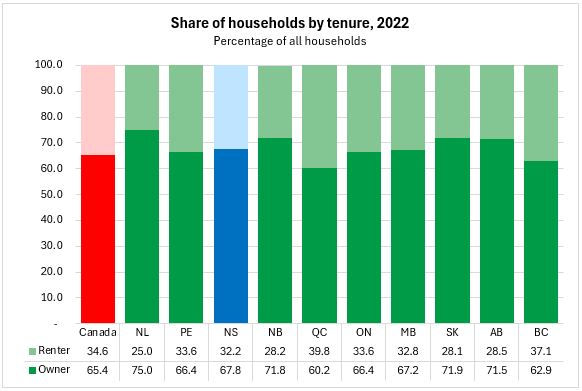

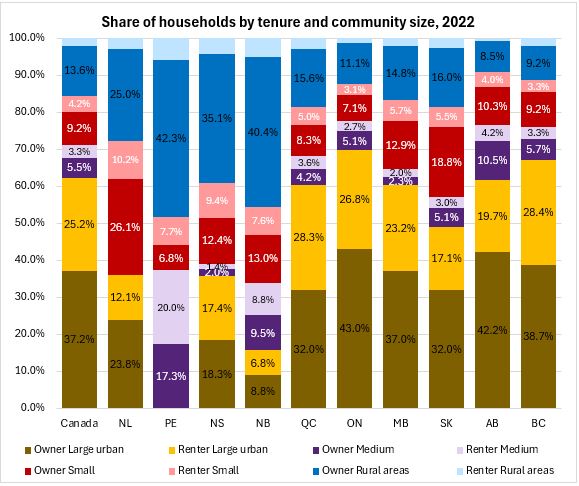

Renters made up 32.2% of Nova Scotia's households in 2022 while 67.8% were homeowners. Compared with the national average, Nova Scotia had a slightly larger share of owner households and slightly lower share of renter households.

In Atlantic Canada, a much larger share of households live in rural areas, including 39.1% in Nova Scotia (national average: 15.5%). Of Nova Scotia's rural households, the large majority were homeowners. In smaller population centres and large urban areas, the share of home ownership and rental tenure was more balanced (though ownership was still larger).

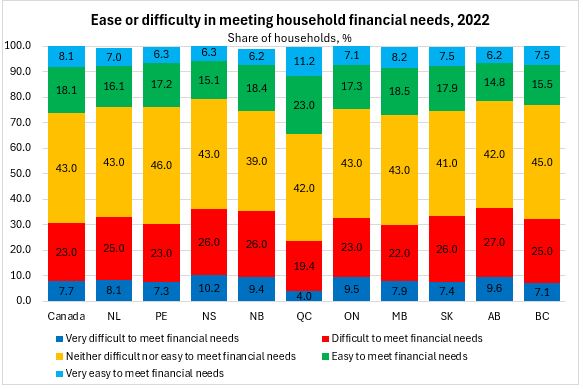

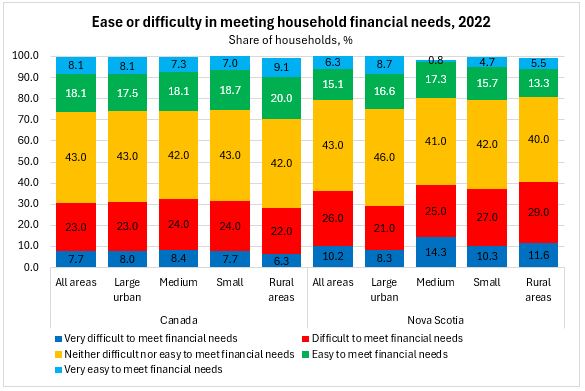

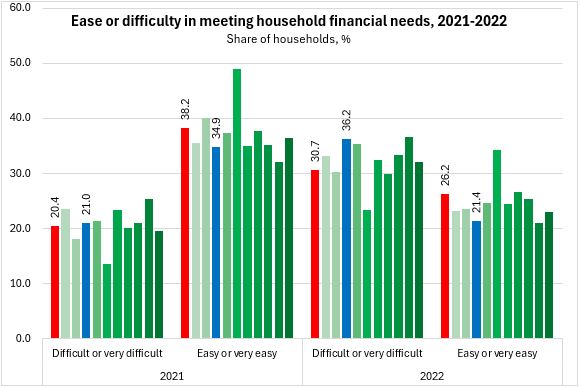

The housing survey asked respondents about their difficulty or ease in meeting financial needs. In 2022, 21.4% of Nova Scotia households reported that meeting financial needs was 'easy' or 'very easy' while 36.2% reported that meeting financial needs was 'difficult' or 'very difficult'. Across Canada, financial difficulties were lowest in Quebec and highest in Alberta. Easy financial conditions were reported most frequently in Quebec and least in Alberta and Nova Scotia.

Financial difficulties were more prevalent in Nova Scotia's rural areas, small and medium population centres, and less prevalent in large urban areas in 2022. Across Canada, rural populations reported greater financial ease than large urban populations.

More households reported difficulty in meeting household financial needs in 2022 compared to the year prior. In 2022, the share of households reporting difficulty meeting financial needs increased from 21.0% in 2021 to 36.2% in 2022 in Nova Scotia. Similarly, the share of households reporting ease in meeting financial conditions declined from 34.9% in 2021 to 21.4% in 2022. All provinces reported increases in households reporting difficulty meeting financial needs compared to 2021, as well as a decline in households reporting ease in meeting financial needs. During 2022, all provinces reported significantly higher inflation (measured by the consumer price index) compared to the year prior. In 2022, the consumer price index increased 7.5% in Nova Scotia compared to 4.1% in 2021.

Core housing need is defined as the portion of the population that experience at least one of:

- unaffordability (spending 30% or more of income on housing)

- inadequacy (requiring major repairs)

- unsuitability (insufficient bedrooms/size for family composition)

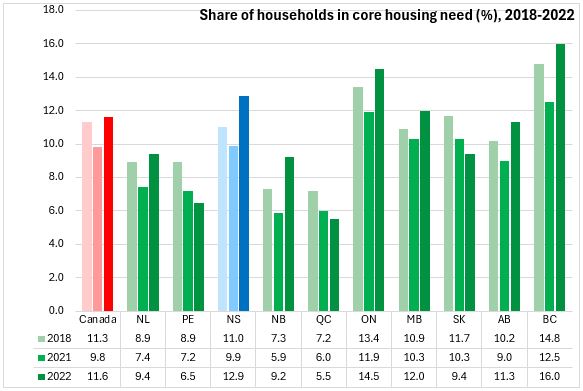

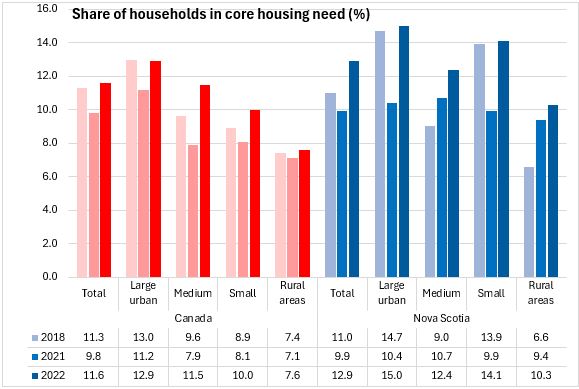

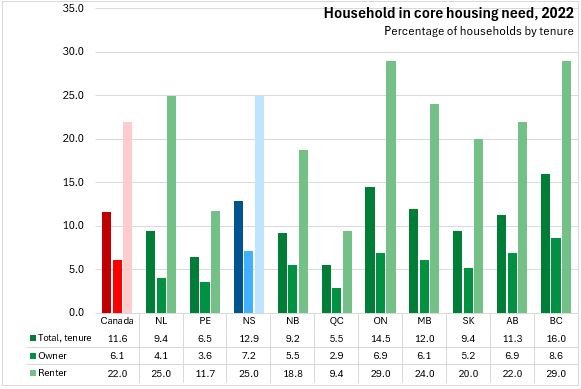

In 2022, 12.9% of Nova Scotian households were in core housing need, representing 54,000 households. Nova Scotia reported the third highest share of household in core housing need behind British Columbia and Ontario. Nationally, 11.6% of households were in core housing need with Quebec and Prince Edward Island reporting the lowest prevalence of core housing need in 2022.

With larger transfer and income support programs during COVID-19, the share of Nova Scotia's households in core housing need fell from 11.0% in 2018 to 9.9% in 2021. All provinces reported declines in core housing need in 2021 from 2018. From 2021 to 2022, core housing need increased in all provinces except Prince Edward Island, Quebec and Saskatchewan.

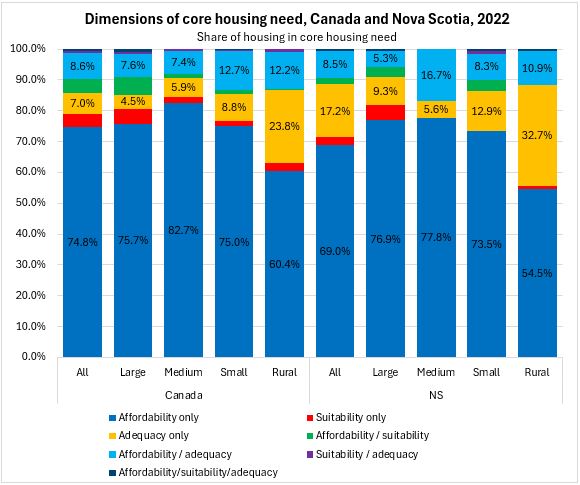

Core housing need was higher in Nova Scotia's larger urban areas and smaller population centres than in rural areas or medium population centres. Across Canada, core housing need tends to be higher in areas with a greater population. Core housing need rose in all areas from 2021 to 2022, both in Nova Scotia and on average across Canada.

Of the 54,000 Nova Scotia households in core housing need, the majority were renters. Among renters, 25% reported being in core housing need in 2022 compared to 7.2% of homeowners. Both of these shares were higher than the national averages of 22.0% of renters and 6.1% of homeowners.

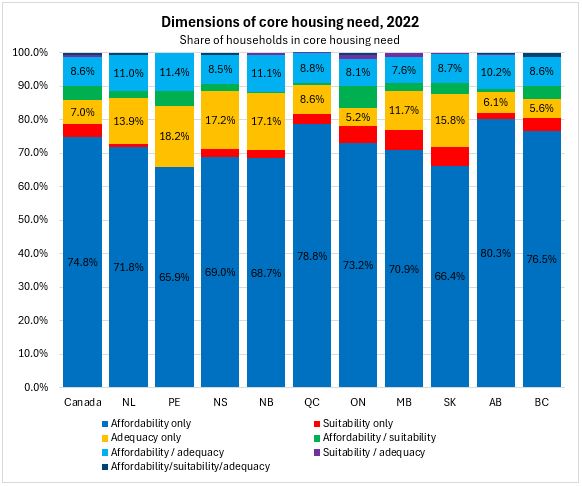

The most common reason, by far, for being in core housing need was affordability. In Nova Scotia, 69.0% of households in core housing need were there due to affordability only. The second most common reason was due to adequacy only, followed by both affordability and adequacy. The Maritime provinces had higher shares of inadequate housing compared to other provinces.

Rural areas tend to have higher instances of inadequate housing, both nationally and in Nova Scotia.

Source: