For additional information relating to this article, please contact:

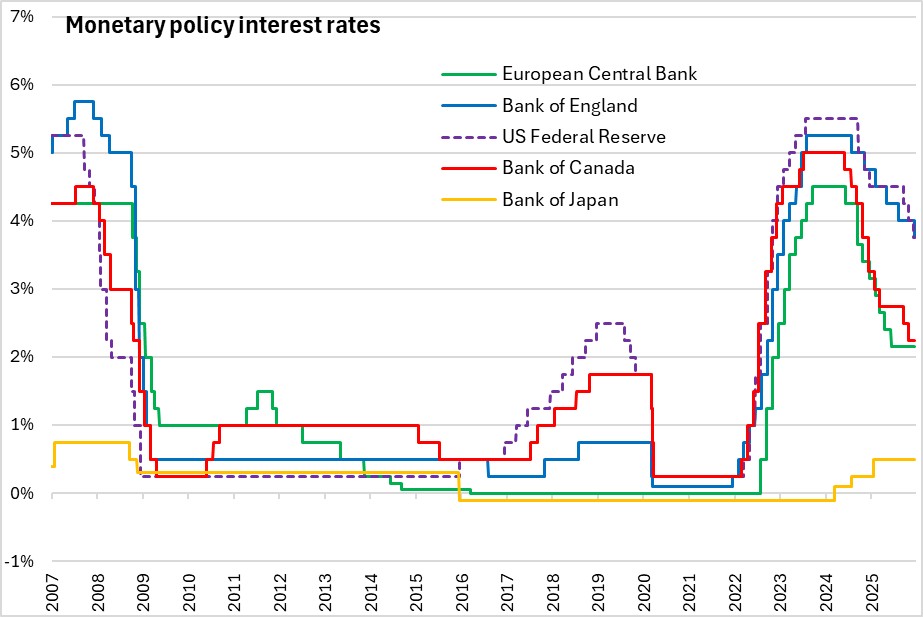

December 18, 2025BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to reduce the Bank Rate to 3.75% (-25bps) in their December meeting.

UK GDP eased to 0.1% in Q3 2025, slightly below November Report expectations. Bank staff expect headline GDP growth to be zero in Q4 2025.

Global activity has been more resilient than expected at the time of the November Report, suggesting tariffs and trade uncertainty are not weighing on global economic activity to the extent that had been expected. In addition, Chinese export prices decreased moe than expected, following a brief moderation earlier this year.

Labour force unemployment rate had risen to 5.1% in the three months to October, above expectations in the November Report. The level of job vacancies has been stable since the summer and employment growth had remained low.

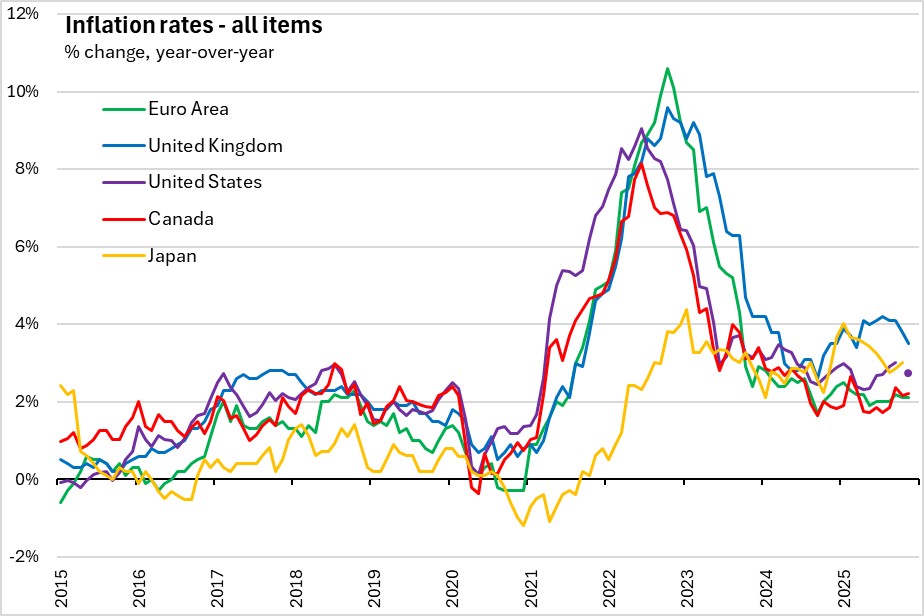

Twelve-month CPI has fallen to 3.2% in November and is now expected to return to target more quickly than previously projected. The Monetary Policy Committee has judged that underlying price and wage pressures continued to ease.

The Committee judged that a careful approach to the further withdrawal of monetary policy restraint remained appropriate. The timing and pace of future reductions in the restrictiveness of policy would depend on the extent to which underlying disinflationary pressures would continue to ease. Current evidence suggest a gradual downward path for the Bank rate, but the Committee would remain responsive to the accumulation of evidence.

The next scheduled monetary policy meeting will be on February 6, 2026.

Source: Bank of England, Monetary Policy Summary, December 2025