For additional information relating to this article, please contact:

December 18, 2025BUSINESS OPENING AND CLOSING, SEPTEMBER 2025 Monthly (September 2025 vs August 2025, seasonally adjusted)

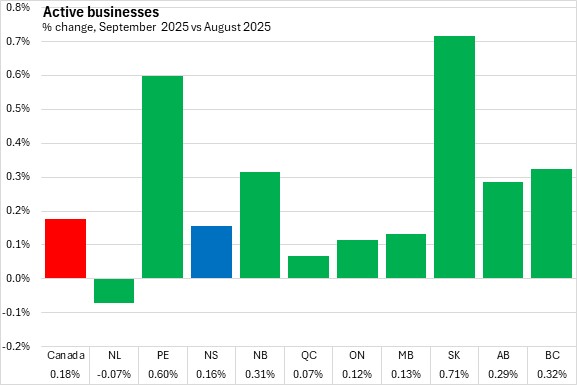

The number of active businesses in Nova Scotia grew by 0.16% from August 2025 to September 2025, rising by 33 to 21,219 active businesses.

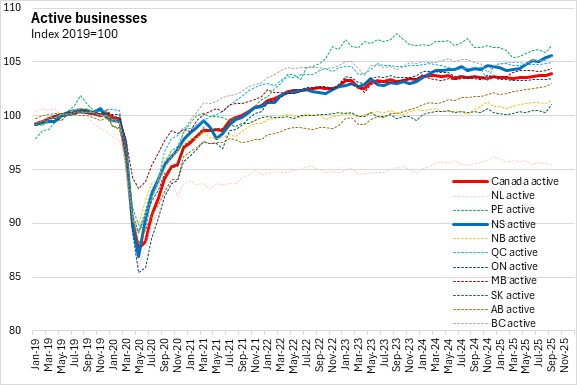

Nationally, active businesses were up 0.18%, with gains in all provinces except Newfoundland and Labrador. Saskatchewan and Prince Edward Island reported the largest gains in active businesses.

A business will be classified as 'opening' if it had no employment in the previous month and then has employment in the next month. A business is 'closing' if it had employment in the previous month and no employment in the current month. For opening and closing, the reason could be a permanent change (i.e. business exit) or temporary for reasons such as seasonal operations, capital maintenance or restructuring. Continuing business are those that had employment in both the current and previous month. Active businesses are the sum of continuing and opening business in the current month.

The rate at which business either opened, continued or closed can be examined to see how the number of active businesses has changed. The calculation for the opening, continuing and closure rates are based on the number of active businesses in the previous month.

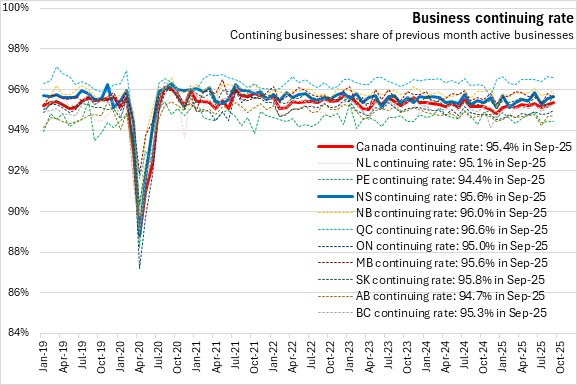

Most businesses continue operating each month. In September 2025, Nova Scotia's business continuing rate was 95.6%, slightly above the national average (95.4%). Québec reported the highest business continuing rate (96.6%) while Prince Edward Island reported the lowest continuing rate (94.4%).

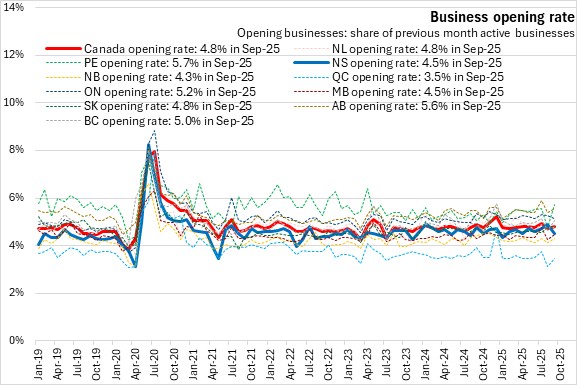

Nova Scotia's business opening rate was 4.5% in September 2025, below the national average of 4.8% and down from the previous month. Prince Edward Island had the highest business opening rate (5.7%) while Québec had the lowest (3.5%).

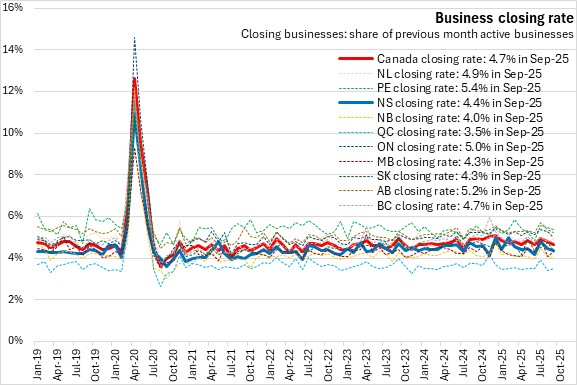

Nova Scotia's business closing rate was 4.4% in September 2025, below the national average of 4.7%. Prince Edward Island reported the highest business closing rate (5.4%), while Québec had the lowest business closing rate (3.5%).

Year-over-year (September 2025 vs September 2024)

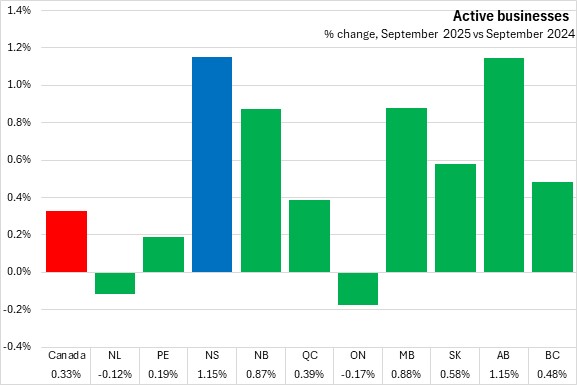

Compared with September 2024, the number of active businesses was up 1.15% for Nova Scotia, tied with Alberta for the largest increase among provinces. Nationally, active businesses were up 0.33% compared to September 2024. Ontario and Newfoundland and Labrador reported the only year-over-year declines in active businesses.

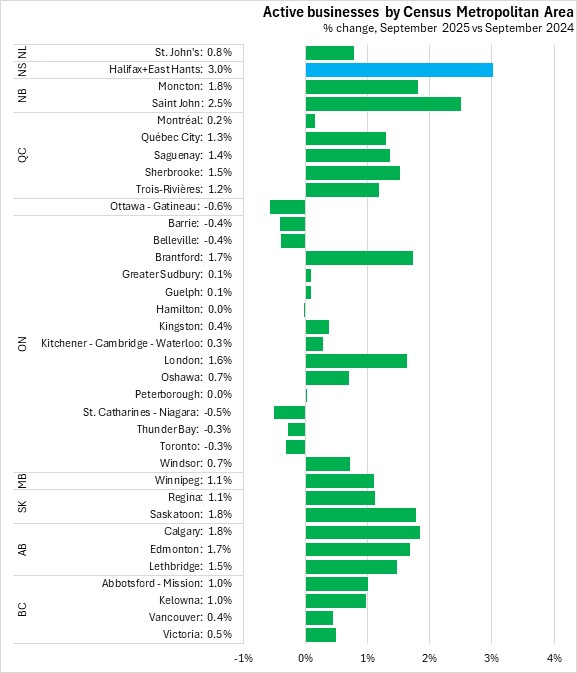

The number of active businesses in the Halifax and East Hants Census Metropolitan Area was up 3.0% from September 2024 to September 2025, the fastest rise among Census Metropolitax Areas (CMA).

Out of 35 CMAs, 28 reported growth in active businesses over the past 12 months. Ottawa/Gatineau and St. Catharines-Niagara reported the largest declines.

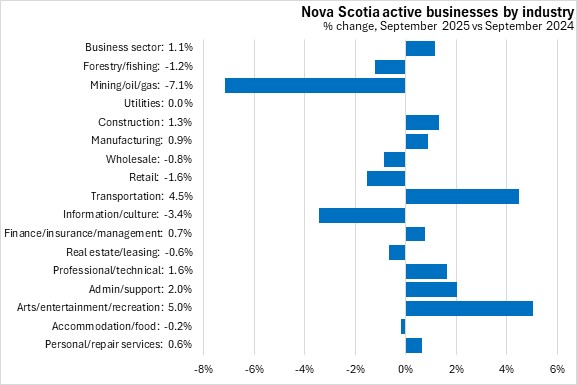

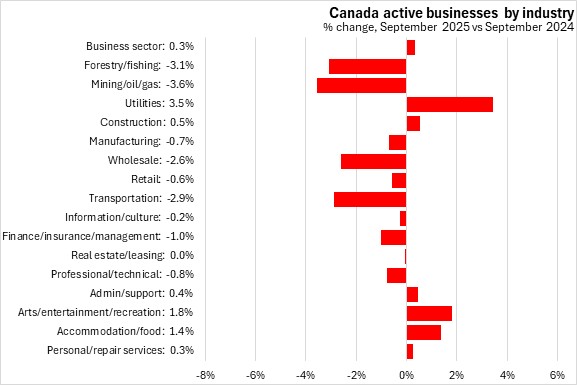

Compared with September 2024, eight sectors saw an increase in active businesses in Nova Scotia in September 2025 with the largest percentage increase in arts/recreation. The steepest decline was in mining/oil/gas.

Nationally, the number of active businesses was down for ten of sixteen business sectors. The largest gain was in utilities, while the largest decline was in mining/oil/gas.

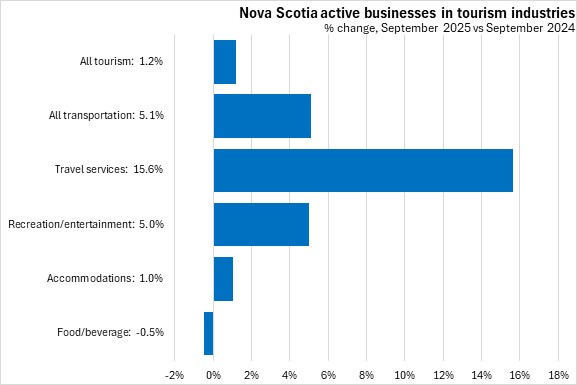

Statistics Canada has broken out specific data for tourism-related industries. Compared with September 2024, the number of active tourism-related businesses remained increased 1.2% in Nova Scotia as of September 2025, with a decline in food/beverage offset by gains in all other subsectors (especially travel services).

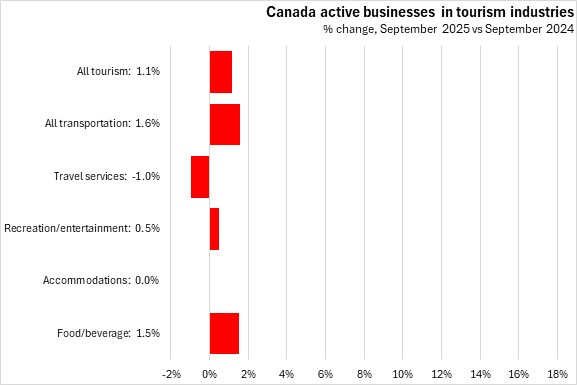

Nationally the number of tourism-related businesses was up 1.1% from September 2024 to September 2025. All transportation, recreation/entertainment, and food/beverage gains offsetting a decline in travel services.

Trends

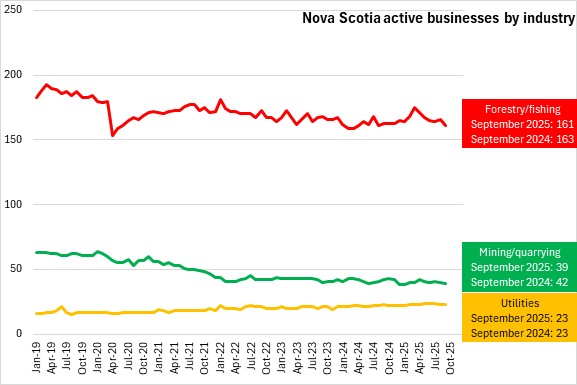

There has been a downward trend in forestry/fishing active businesses, but in the three months prior to April there was a substantial rise in active businesses. Active businesses in forestry/fishing subsequently declined up to September from their recent peak in March 2025. Mining/quarrying has been steadily declining. Utilities had been slowly growing but reported little change in recent months.

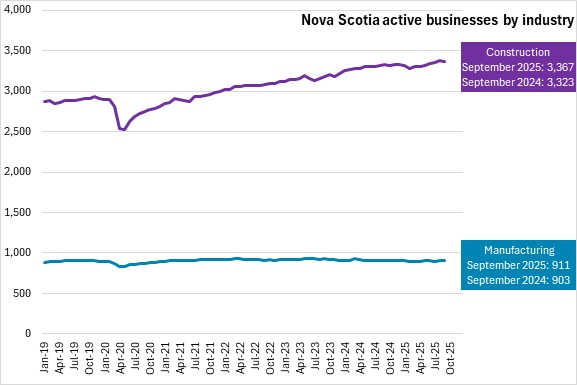

From 2020-2025, the number of active businesses in construction grew at a steady pace with a slight dip in the end of 2024 and in September 2025. Manufacturing businesses have remained stable for the past 3 years.

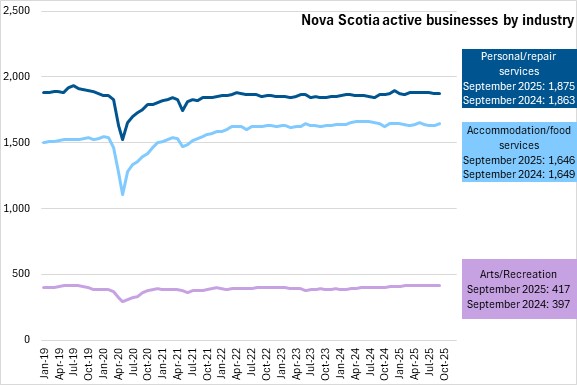

There have been small decline in active businesses for personal/repair businesses in the recent months, and small gains in accommodation/food services. Arts/recreation business counts have changed little in recent months.

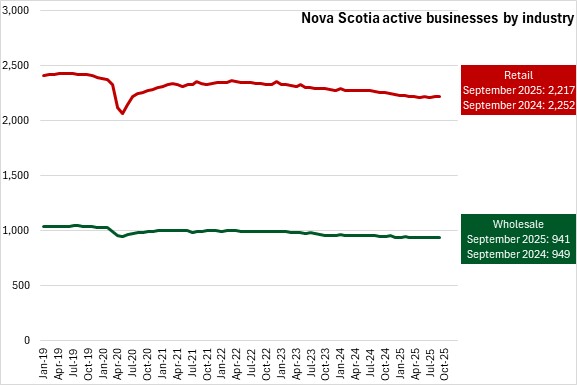

Retail and wholesale businesses have declined in the past two years, but have stabilized in recent months.

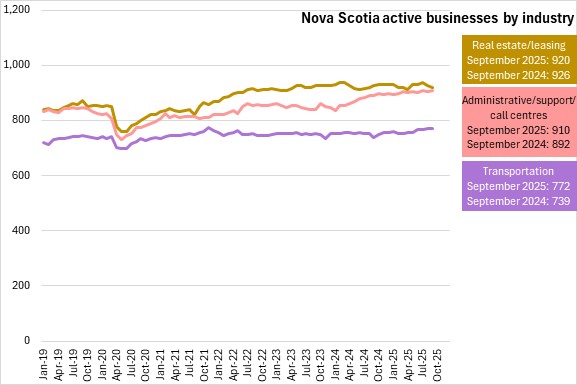

Active businesses in transportation have been rising slowly since early 2025. The number of active businesses in real estate/leasing have declined again after recent growth. Active businesses in administrative/support/call centers have grown since 2024.

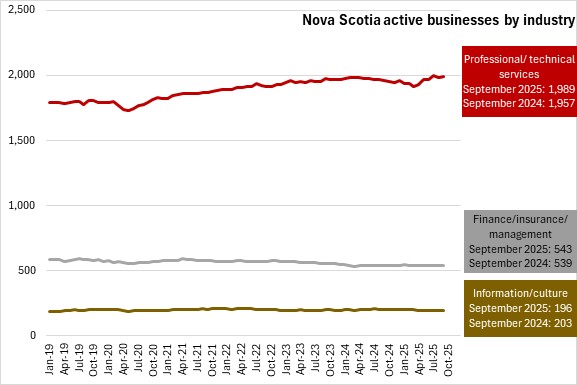

Professional/technical services active businesses have grown in 2025, but this growth tapered off in the most recent months. Finance/insurance/management businesses as well as businesses in information/culture have been stable.

The source data is seasonally adjusted. The data may not aggregate due to firms being classified into multiple industry or geography.

Source: Statistics Canada. Table 33-10-0270-01 Experimental estimates for business openings and closures for Canada, provinces and territories, census metropolitan areas; Methodology: Business Opening and Closing