For additional information relating to this article, please contact:

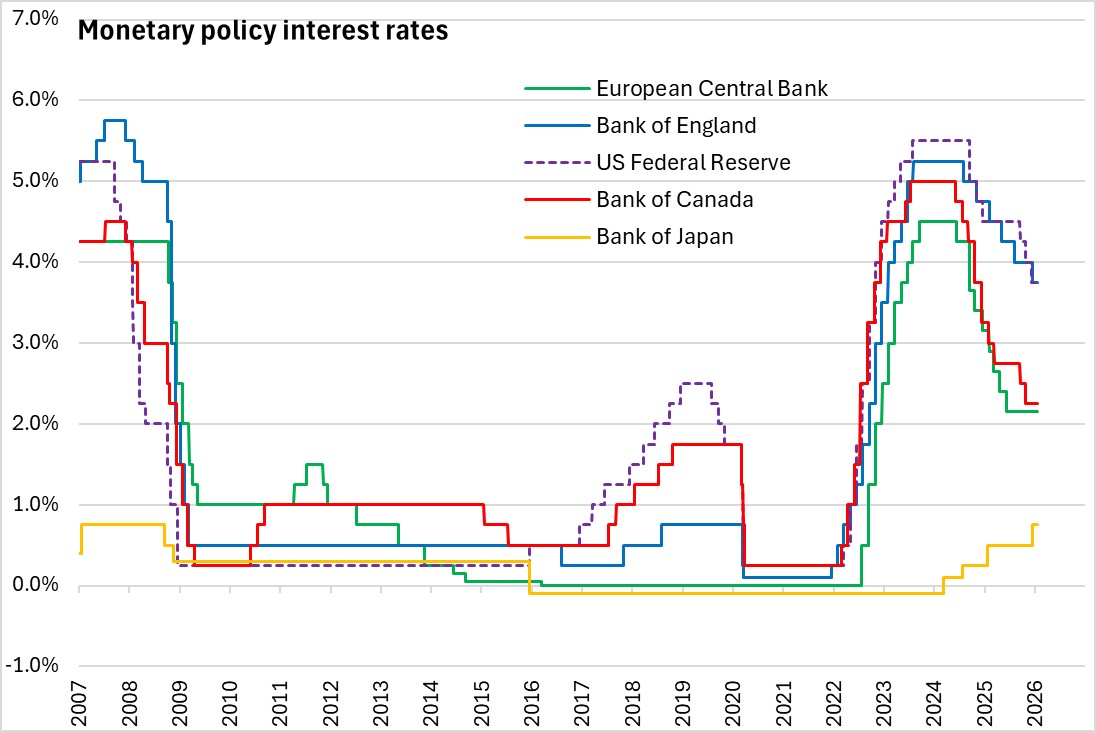

January 23, 2026BANK OF JAPAN MONETARY POLICY Today, the Policy Board of the Bank of Japan decided to maintain their uncollateralized overnight call rate around 0.75%.

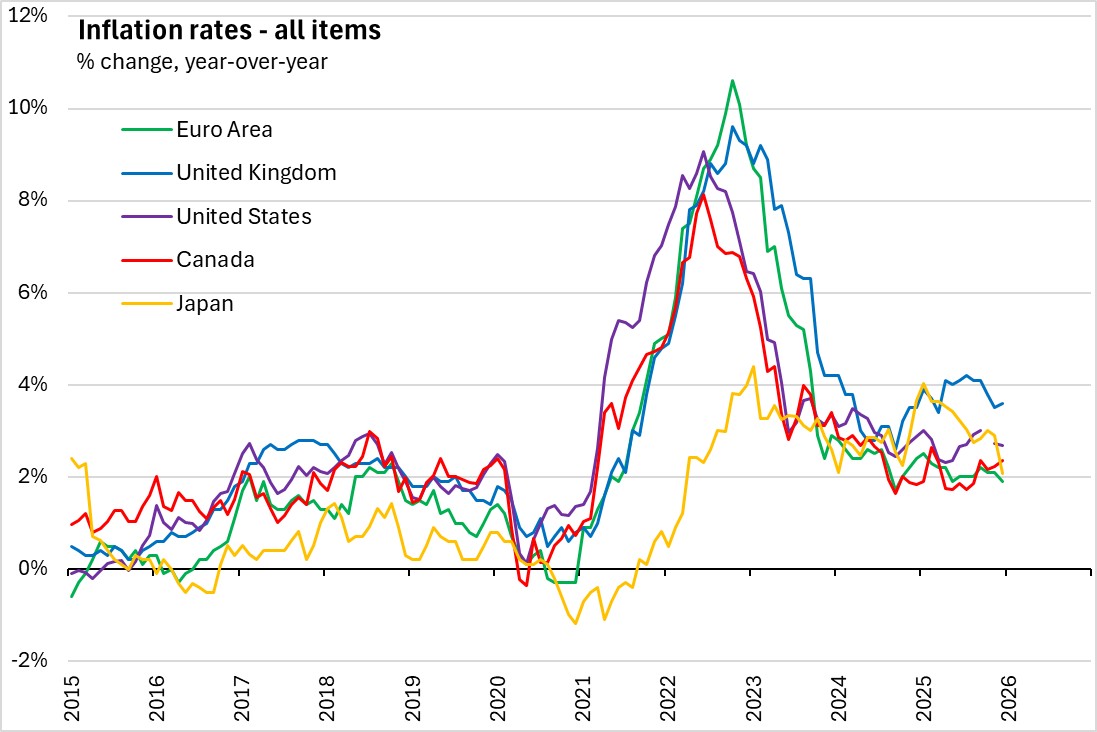

Japan's economy has recovered moderately, with some weakness in exports and industrial production as a result of US tariffs. Bank of Japan expects GDP to grow between 0.8% and 1.0% in 2026 and between 0.8% and 1.0% in 2027. Labour market conditions are likely to tighten further with improving economic conditions and growth in wages across a wide range of firms. Despite the current tariff environment, corporate profits are expected to remain high, with a downward pressure on the manufacturing sector. CPI inflation is expected to decelerate below 2.0% in the first half of the year. The Policy Board members forecast CPI to range between 1.9% and 2.0% in 2026 and 1.9% and 2.2% in 2027. Uncertainty regarding the US economy remains a risk to the outlook, but the degree of uncertainty has declined.

The Bank of Japan will continue to raise the policy interest rate and adjust the degree of monetary accommodation. The Bank will respond to developments in economic activity and prices, as well as financial conditions, to sustainably achieve the price stability (2 per cent) target.

The Bank will release their next monetary policy statement on March 19, 2026.

Source: Bank of Japan, Statement on Monetary Policy; Outlook for Economic Activity and Prices (January 2026)