To view previous releases, select one from the dropdown box:

Currently displaying information released on: December, 2017

ANALYSIS OF NOVA SCOTIA'S CONSUMER PRICE INDEX FOR NOVEMBER 2017

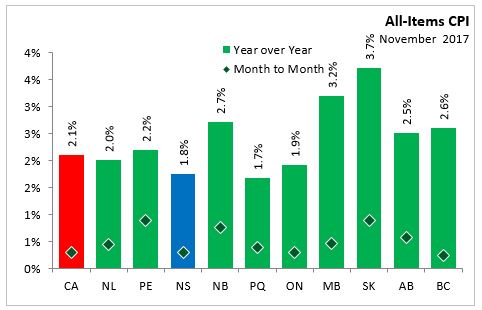

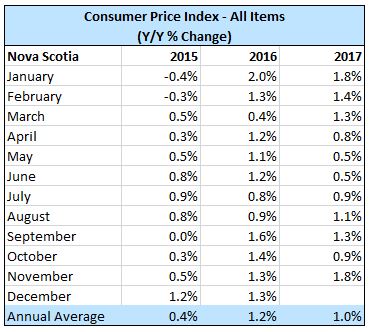

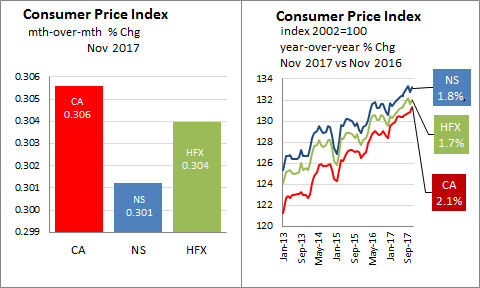

In Nova Scotia November 2017, annual consumer price inflation (year-over-year growth) was 1.8 per cent, below the national average of 2.1 per cent. Monthly consumer prices were up 0.3 per cent in Nova Scotia and up 0.3 per cent in Canada.

Within Atlantic Canada, New Brunswick (+2.7 per cent), PEI (+2.2%), and Newfoundland and Labrador (+2.0%) all had higher inflation than Nova Scotia. On July 1, 2016, the provincial component of the harmonized sales tax (HST) increased in both Newfoundland and Labrador and New Brunswick. In Prince Edward Island, the provincial component of the HST was increased effective October 1, 2016.

All other provinces experienced positive annual inflation in November.

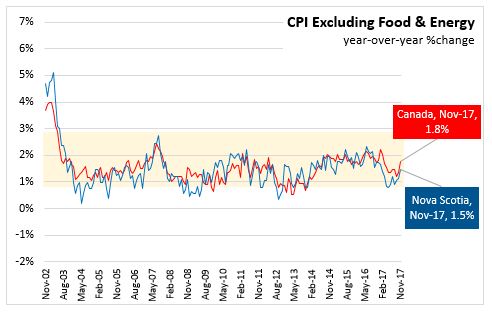

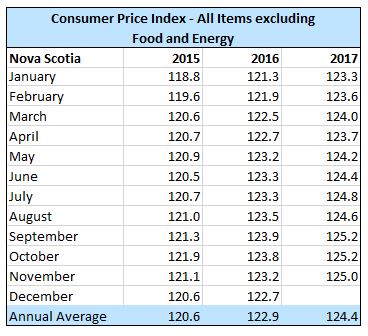

Nova Scotia's annual consumer price inflation (year over year growth in CPI) excluding food and energy rose 1.5 per cent in November, below the national rate of 1.8 per cent. Price level gains for this index were largest in New Brunswick and Saskatchewan (both +2.7 per cent), and lowest in Quebec (+1.2 per cent). On a monthly basis, Nova Scotia's index excluding food and energy was down 0.2 per cent.

The main contributors to the monthly (November 2017 vs. October 2017) NS CPI movement:

Gasoline (+8.5%)

Fresh vegetables (+5.8%)

Non-electric kitchen utensils, tableware and cookware (-11.5%)

Fresh or frozen pork (-18.2%)

The main contributors to the annual (November 2017 vs. November 2016) NS CPI movement:

Gasoline (+11.6%)

Inter-City transportation (+10.5%)

Household appliances (-6.9%)

Fresh or frozen beef (-6.9%)

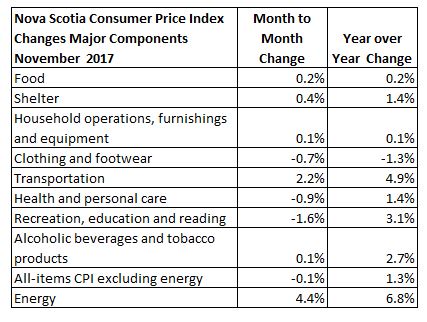

The CPI for food in Nova Scotia declined 0.2 per cent year-over-year with a 0.2 per cent decrease month-over-month. CPI growth in food (year over year) was up in all Atlantic provinces except Newfoundland and Labrador. Nationally, annual food prices increased 1.6 per cent.

The Nova Scotia energy index increased by 6.8 per cent compared to a year ago, with a sharp monthly increase from October to November 2017. Energy price growth was smallest in Ontario on a year over year basis. Nationally, the index was up 7.6 per cent. Energy prices saw the largest increase in Alberta and Saskatchewan.

Major Components for November 2017

The following table shows the price increases specific to Nova Scotia for the major components of the CPI this month:

Long Run Trends

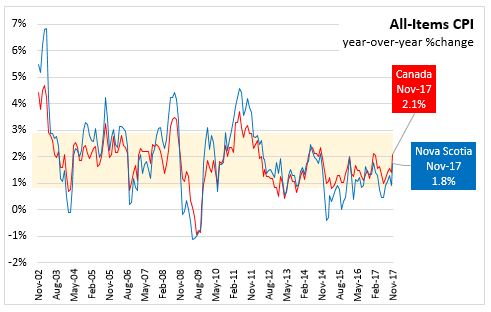

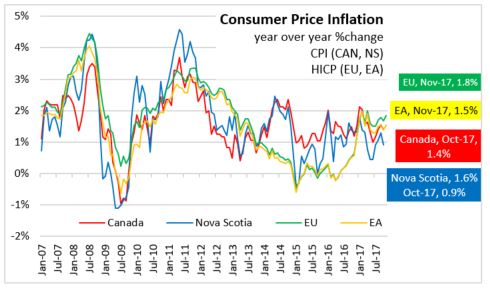

The All-Items CPI annual inflation rate for Nova Scotia was below Canada's in November 2017. Since July 2014, Nova Scotia's annual inflation has been below the Canadian average except for three months in 2016: January, September and November. While month to month movements in the indices can be different, over time they generally follow the same overall trend.

Annual inflation for the CPI excluding food and energy was lower for Nova Scotia (+1.5 per cent) than for Canada (+1.8 per cent).

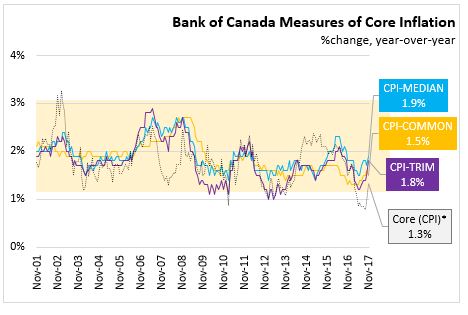

Bank of Canada's preferred measures of core inflation

Compared with November 2016, CPI-Common rose 1.5 per cent, CPI-Median rose 1.9 per cent, and CPI-Trim rose 1.8 per cent in Canada. All-items CPI excluding eight of the most volatile components as defined by the Bank of Canada and excluding the effect of changes in indirect taxes (formerly referred to as CPIX) rose 1.3 per cent year over year in November 2017.

Appendix Tables

Source: Statistics Canada CANSIM Tables 326-0020 , 326-0023 CONSUMER PRICE INDEX NOVEMBER 2017

NOVA SCOTIA

In Nova Scotia November 2017, the consumer price index (2002=100) increased 0.3% from October 2017 to 133.2 and increased 1.8% over November 2016.

The CPI, excluding food and energy, decreased 0.2% from October 2017 to 125.0, and increased 1.5% over November 2016.

CANADA

In Canada November 2017, the consumer price index (2002=100) increased 0.3% from October 2017 to 131.3 and increased 2.1% over November 2016.

The CPI, excluding food and energy, remain unchanged from October 2017 at 126.2, and increased 1.8% over November 2016.

Compared with November 2016, CPI-Common rose 1.5%, CPI-Median rose 1.9%, and CPI-Trim rose 1.8%.

HALIFAX

In Halifax November 2017, the consumer price index (2002=100) increased 0.3% from October 2017 to 132.0 and increased 1.7% over November 2016.

Statistics Canada Note: Since 2001, the Bank of Canada's main measure of core inflation has been "core" consumer price index (CPIX) inflation, which excludes eight of the most volatile components of the CPI and adjusts the remainder for the effect of changes in indirect taxes. Following a review of a wide selection of measures of core inflation in 2015, in the context of its most recent renewal of the inflation-control target, the Bank chose three preferred measures of core inflation: (i) a measure based on a trimmed mean (CPI-trim); (ii) a measure based on the weighted median (CPI-median); (iii) a measure based on the common component (CPI-common). For more information see The Daily.

Statistics Canada Cat. No. 62-001, CANSIM 326-0020 326-0023 EU AND EURO AREA CONSUMER PRICE INFLATION, NOVEMBER 2017

In November, annual inflation was 1.5 per cent in the Euro Area (up from 1.4 per cent last month) and 1.8 per cent in the European Union (up from 1.7 per cent last month). In November 2016, inflation in both the Euro Area and EU was 0.6 per cent.

The highest annual rates were recorded in Estonia (4.5 per cent), Lithuania (4.2 per cent), and the United Kingdom (3.1 per cent). The lowest rates were registered in Cyprus (0.2 per cent), Ireland (0.5%), and Finland (0.9 per cent).

The largest upward impacts to euro area annual inflation came from fuels for transport, heating oil, and milk, cheese and eggs. Telecommunication, garments and social protection showed the biggest downward impacts.

Source: Eurostat

|