To view previous releases, select one from the dropdown box:

Currently displaying information released on: February, 2023

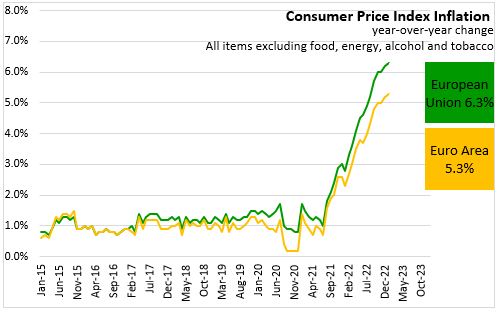

EU AND EURO AREA CONSUMER PRICE INDEX, JANUARY 2023

Year-over-year (January 2023 vs January 2022)

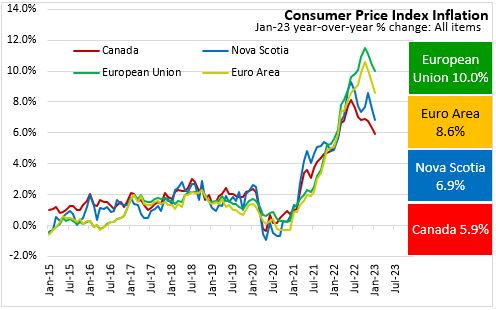

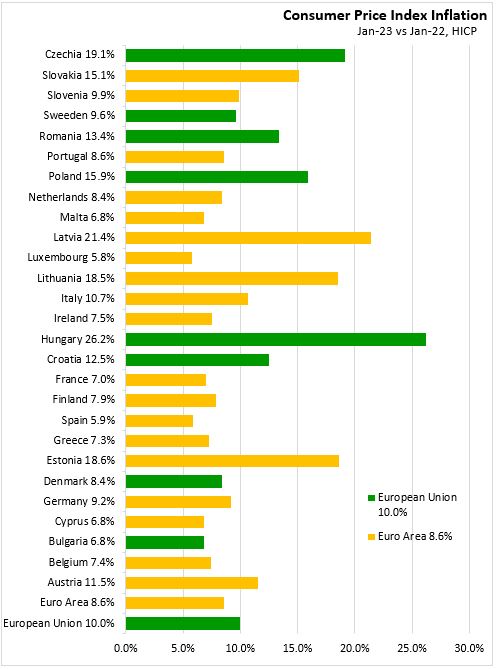

The inflation rate moved up to 10.0% in the European Union and was up to 8.6% in the Euro Area in January 2023.

The fastest inflation was reported in Hungary (+26.2%), Latvia (+21.4%), and Czechia (+19.1%) and the lowest inflation rates were in Luxembourg (+5.8%) and Spain (+5.9%).

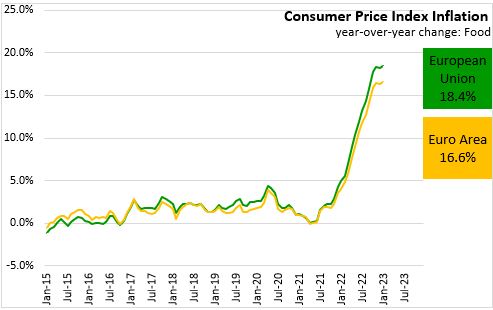

Food price inflation increased to 18.4% in the European Union and to 16.6% in the Euro Area.

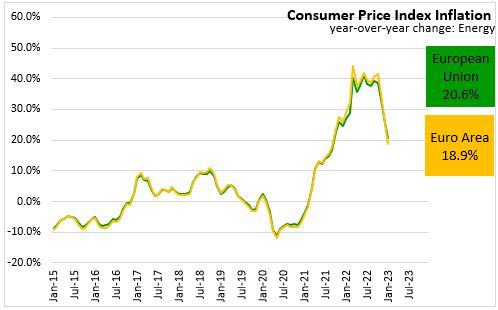

Energy inflation slowed to 20.6% in the European Union and to 18.9% in the Euro Area.

Excluding the impacts of energy, food, alcohol and tobacco prices inflation increased to 6.3% in the European Union and 5.3% in the Euro Area in January 2023.

Source: Eurostat CONSUMER PRICE INDEX, JANUARY 2023

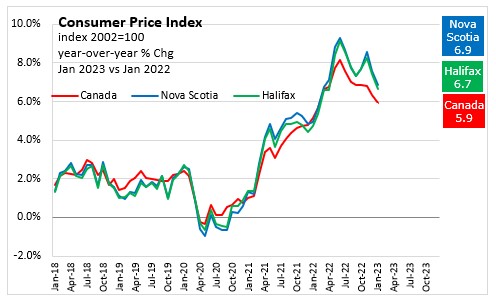

YEAR-OVER-YEAR (January 2023 vs January 2022)

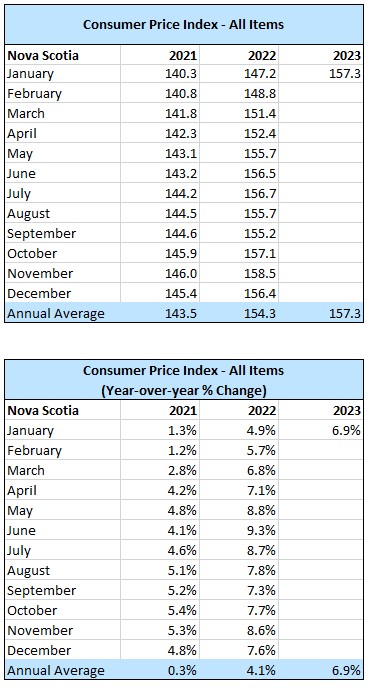

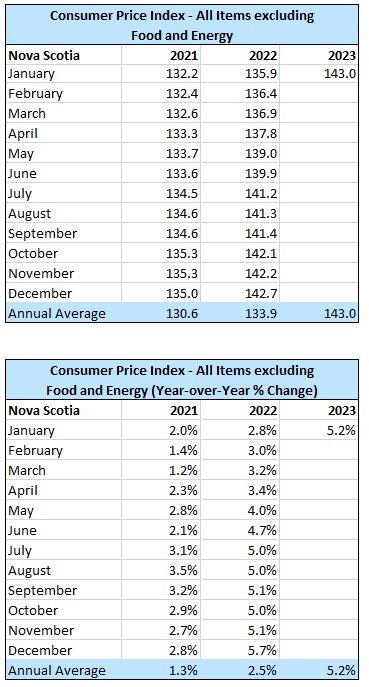

All items (index 2002=100)

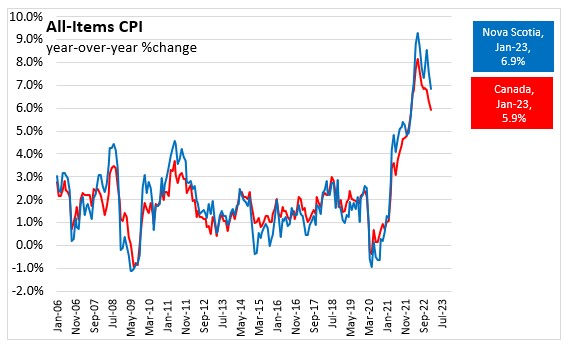

Consumer prices in Nova Scotia increased 6.9%. The national average was 5.9%. In Halifax consumer prices increased 6.7%.

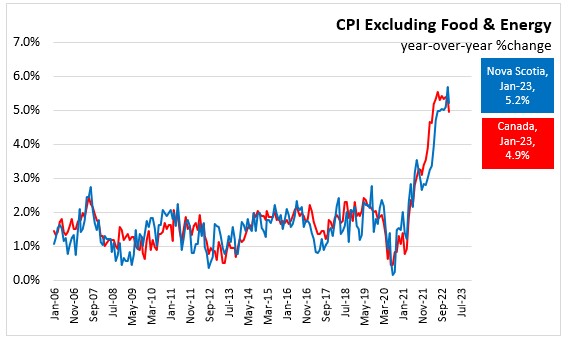

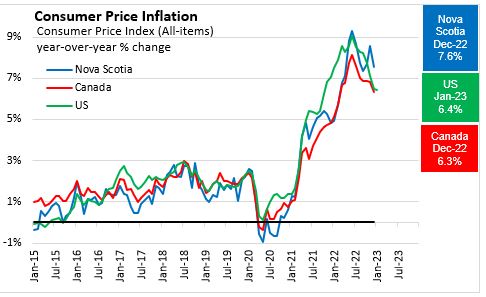

Excluding food and energy (index 2002=100)

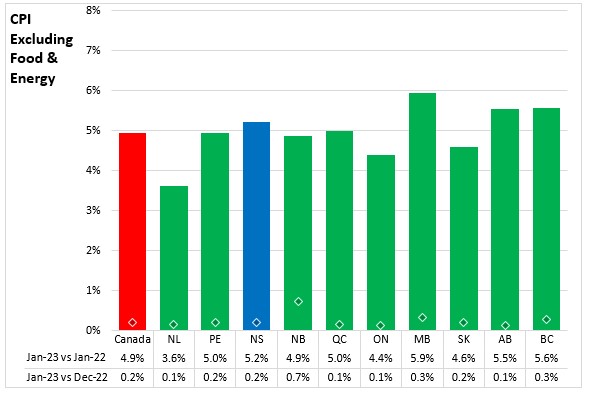

Nova Scotia consumer prices increased 5.2%. This was higher than the national average increase of 4.9%.

MONTH-OVER-MONTH (January 2023 vs December 2022)

All items (index 2002=100)

Consumer prices in Nova Scotia increased 0.6%. Nationally, consumer prices were 0.5% higher from the previous month. In Halifax consumer prices increased 0.6%.

Excluding food and energy (index 2002=100)

Nova Scotia and national consumer prices excluding food and energy increased 0.2% month over month in January 2023.

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted ANALYSIS OF NOVA SCOTIA'S CONSUMER PRICE INDEX FOR JANUARY 2023

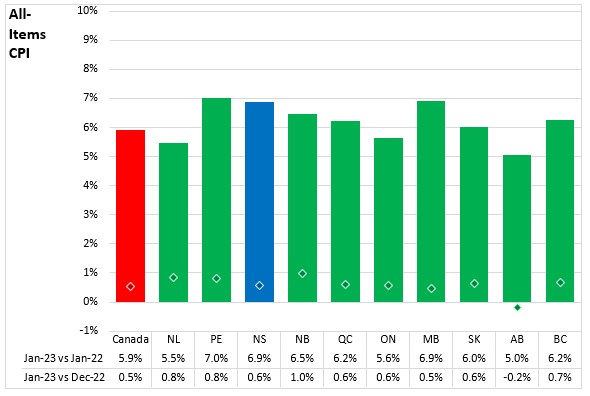

TRENDS – January 2023

Nova Scotia’s All-Items Consumer Price Index (CPI) increased 6.9% year-over-year in January 2023. Inflation rate in Nova Scotia has been declining since peaking at 9.3% in June 2022. Nationally, consumer prices increased 5.9% year over year in January 2023, following a 6.3% increase in December 2022.

Inflation was highest in Nova Scotia and Manitoba (both +6.9%) while Alberta (+5.0%) had the lowest.

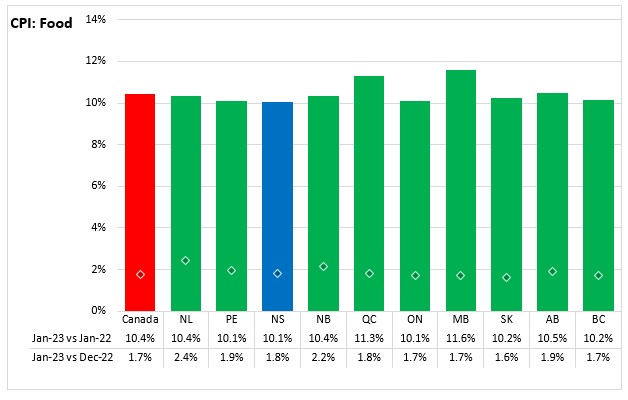

The CPI for food in Nova Scotia increased 10.1% in January, up from the 9.9% year-over-year increase recorded in December 2022. All provinces recorded year-over-year increase in food prices led by Manitoba (+11.6%). The lowest inflation was reported in Nova Scotia, Prince Edward Island and Ontario (all at 10.1%).

Nationally, food prices rose (+10.4%) in January 2023 on a year-over-year basis. Increases in grocery prices in January was partly driven by year over year growth in meat prices (+7.3%) and fresh and frozen chicken prices. Food purchased from restaurants also rose at a faster pace, rising 8.2% in January following a 7.7% increase in December. The gain was the result of higher prices for fast food and takeout.

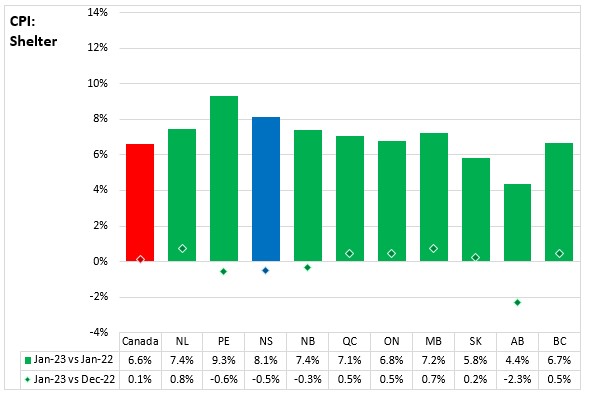

Year-over-year, shelter costs in Nova Scotia increased 8.1% in January 2023.

In January, shelter prices increased 6.6% year-over-year across Canada. Growth in other owned accommodation expenses (+1.1%) and homeowners' replacement cost (+4.3%) continued to decelerate amid the ongoing cooling of the housing market. The mortgage interest cost index continued to rise at a faster year-over-year pace and increased 21.2% in January, the largest increase since September 1982.

Compared to January 2022, shelter prices were up in all provinces with the largest increase in Prince Edward Island (+9.3%) and the smallest increase in Alberta (+4.4%).

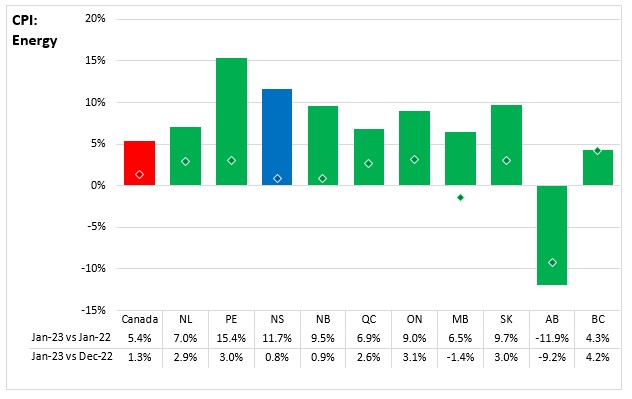

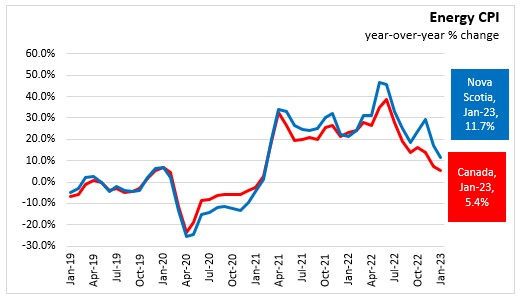

Nova Scotia's consumer price inflation (year-over-year growth in CPI) for energy was 11.7% in January, above the national average of 5.4%. Prince Edward Island (+15.4%) posted the largest year-over-year increase. Alberta (-11.9%) was the only province reporting a year over year decline in the energy index in January.

Energy prices were higher in all provinces with the exception of Manitoba and Alberta compared to December 2022. In Canada, consumers paid 4.7% more for gasoline in January compared with the previous month, mainly as a result of refinery closures in the southwestern United States following winter storm Elliot.

Nova Scotia’s consumer price inflation (year-over-year) excluding food and energy increased 5.2% in January 2023. Consumer prices excluding food and energy were up in all provinces led by Manitoba (+5.9%) and British Columbia (+5.6%). Newfoundland and Labrador had the smallest increase at 3.6%.

For Canada, consumer price inflation excluding food and energy increased 4.9% year-over-year in January.

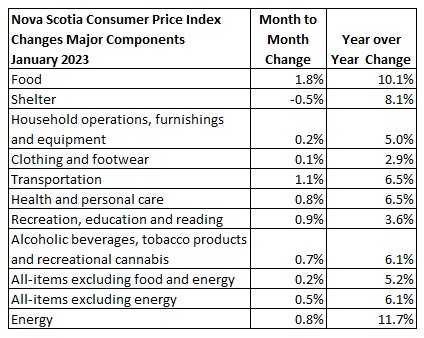

Major Components for January 2023

The following table shows the price increases specific to Nova Scotia for the major components of the CPI this month.

The main contributors to the monthly change (January 2023 vs December 2022) in Nova Scotia CPI were:

- Gasoline (+5.0%)

- Furniture(+3.7%)

- Mortgage interest cost (no % but upward pressure)

- Fuel oil and other fuels (-5.9%)

- Telephone services (-4.1%)

- Rent (-1.0%)

The main contributors to the yearly change (January 2023 vs January 2022) in Nova Scotia CPI were:

- Fuel oil and other fuels (+35.2%)

- Purchase and leasing of passenger vehicles (+6.6%)

- Food purchased from restaurants (+7.7%)

- Child care and housekeeping services (-17.0%)

- Telephone services (-3.0%)

- Home entertainment equipment, parts and services (-5.0%)

Long Run Trends

In January 2023, the all-items CPI year-over-year inflation rate for Nova Scotia was 6.9%, above the national inflation rate of 5.9%.

Nova Scotia’s CPI excluding food and energy increased 5.2%. Canada CPI excluding food and energy rose 4.9%.

Bank of Canada's preferred measures of core inflation

Compared to January 2023, CPI-Common increased 6.6%, CPI-Median increased 5.0% and CPI-Trim was up 5.1% in Canada. All-items CPI excluding eight of the most volatile components as defined by the Bank of Canada and excluding the effect of changes in indirect taxes (formerly referred to as CPIX), rose 5.0% year-over-year. The change in the core inflation measures was down 0.2 percentage points for both CPI-median and CPI-trim, and was unchanged for CPI-common from the previous 12-month period.

Appendix Tables and Charts

Basket Update - May 2022

As part of schedule update, Statistics Canada has updated the basket weights based on 2021 expenditures. A used vehicle price was introduced into the CPI Compared to the previous basket reference year of 2020 for Nova Scotia, increase weight for transportation (+2.04 percentage points) and clothing and footwear (+0.52 percentage points) were offset by lower weights for food (-0.5 percentage points), shelter (-0.53 percentage points), health and personal care (-0.65 percentage points) and recreation, education and reading (-0.5 percentage points). Statistics Canada noted that at national level the headline CPI growth rate would be the same using the previous weights. For full details on the weight update, see An Analysis of the 2022 Consumer Price Index Basket Update, Based on 2021 Expenditures.

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics - Bank of Canada definitions US CONSUMER PRICE INDEX, JANUARY 2023

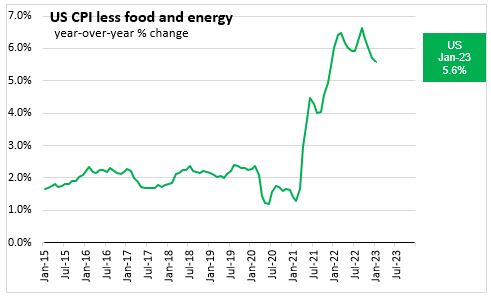

The United States Consumer Price Index for All Urban Consumers increased 6.4% year-over-year in January 2023. This was below the 6.5% increase reported in December 2022, and the smallest 12-month increase since the period ending October 2021.

The seasonally adjusted index increased by 0.5% in January following a 0.1% gain reported in December. Shelter was the largest contributor and accounted for nearly half of the increase. The food index (+0.5%) and energy index (+2.0%) also contributed to the monthly increase. The index for all items less food and energy was up 0.4% in January.

The 12-month change in the CPI - all items less food and energy was 5.6% in January 2023, down from 5.7% for December 2022 . Over the past 12 months, the energy index increased 8.7%, the food index increased 10.1% and the shelter index increased 7.9%.

Note:

Canada and Nova Scotia January 2023 CPI figures will be released on February 21, 2023.

Sources:

Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted

US Bureau of Labor Statistics, retrieved from FRED, Federal Reserve Bank of St. Louis

|