The Basics

Why do we pay taxes?

Everyone pays taxes, and every level of government levies taxes. At the provincial level, taxes pay for the programs and services the Government of Nova Scotia delivers to, and on behalf of, this province’s citizens.

Providing services like hospitals and ambulances, and schools and universities, require a great deal of funding. And delivering these services simply wouldn’t be possible without tax revenue.

Where does the province get the revenues to pay for programs and service?

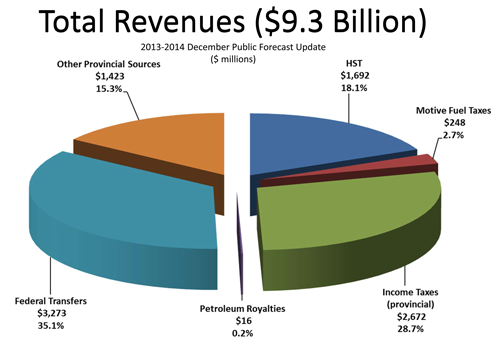

In 2013-14, the Province of Nova Scotia received $9.3 billion in revenue. Most of this comes from taxes, including the income tax individuals and businesses pay, taxes on gasoline, HST, user fees, and royalities the government receives from offshore petroleum production activities.

Where do our taxes dollars go?

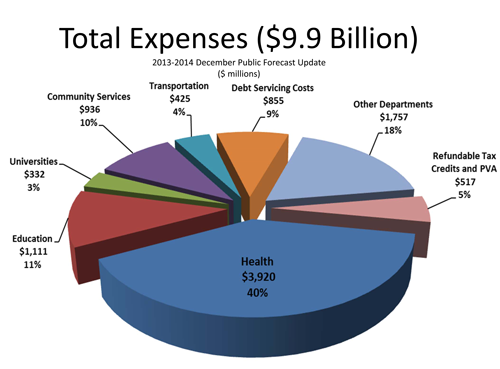

Nova Scotia spent $9.9 billion in 2013-14 delivering programs and services to Nova Scotians. The largest portions of these expenses go to funding our healthcare (40%), education (11%), and social services (10%) systems. Roads and infrastructure (4%), and our universities (3%), also represent considerable expenses. It’s also worth noting that Nova Scotia will paid $855 million, or 9% of total expenses, to service our debt.

Who pays taxes?

Each level of government levies taxes in a variety of ways.

The federal and provincial government have income tax. When you file your taxes each year, a portion of what you paid goes to the federal government and a portion goes to the provincial government. Businesses too pay a federal and a provincial corporate income tax rate.

The federal and provincial governments also levy consumption and excise taxes like the Harmonized Sales Tax (HST), Goods and Services Tax (GST), tobacco tax, and motive fuel tax. HST in Nova Scotia is 15% - a federal portion (5%) and a provincial portion (10%).

When you pay property taxes on your home, or put money in a parking metre, that revenue goes to your municipal government.

What are progressive and regressive taxes?

A progressive tax structure means that the more a person earns, the higher the rate of tax. Some taxes are regressive, meaning that the portion of income paid is higher for low income individuals and families.

Broadly speaking Nova Scotia's personal income tax bracket and rate structure is progressive, particularly in higher income ranges. The same is largely true across Canada.

The HST, motive fuel taxes, and tobacco taxes are examples of regressive taxes.