As of July 1, 2010, HST in Nova Scotia will change from 13% to 15%, due to an increase of the provincial portion of the HST from 8% to 10%.

On this page you will find links to documents that you can download and print for use within your business.

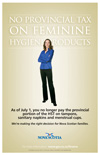

Point-of-Sale Rebate Signs:If you sell any of the newly rebated items – children’s clothing, children’s footwear, children’s diapers or feminine hygiene products – you may wish to inform consumers about the new point-of-sale rebate. The following signs are available for you to print and use within your store.

CRA is available to businesses for more information about the HST rate increase and providing the point-of-sale rebate. The number to contact is: 1-800-959-5525

CRA information about the point-of-sale rebate.

Download Full Colour:

HST Posters En. (6.3MB PDF)

HST Posters Fr. (6.3MB PDF)

HST Talkers (2 up) En. (2.7MB PDF)

HST Talkers (2 up) Fr. (2.7MB PDF)

HST Talkers (4 up) En. (2.3MB PDF)

HST Talkers (4 up) Fr. (2.3MB PDF)

Download Black & White:

HST Posters En. (3.4MB PDF)

HST Posters Fr. (3.0MB PDF)

HST Talkers (2 up) En. (1.8MB PDF)

HST Talkers (2 up) Fr. (1.4MB PDF)

HST Talkers (4 up) En. (1.7MB PDF)

HST Talkers (4 up) Fr. (1.7MB PDF)

Additional Documnents

Rebates Summary (20k PDF)

Backgrounder on HST (24k PDF)